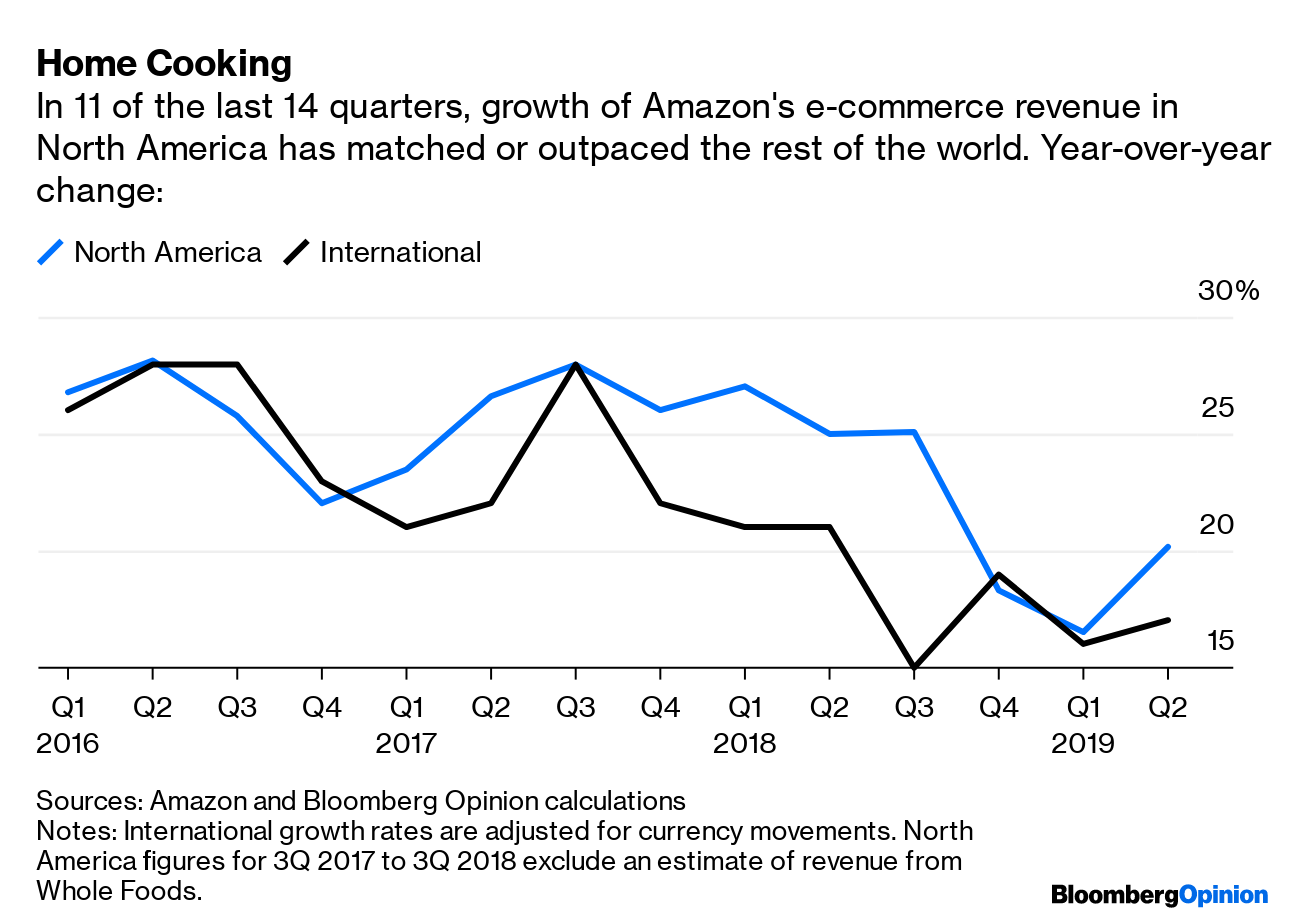

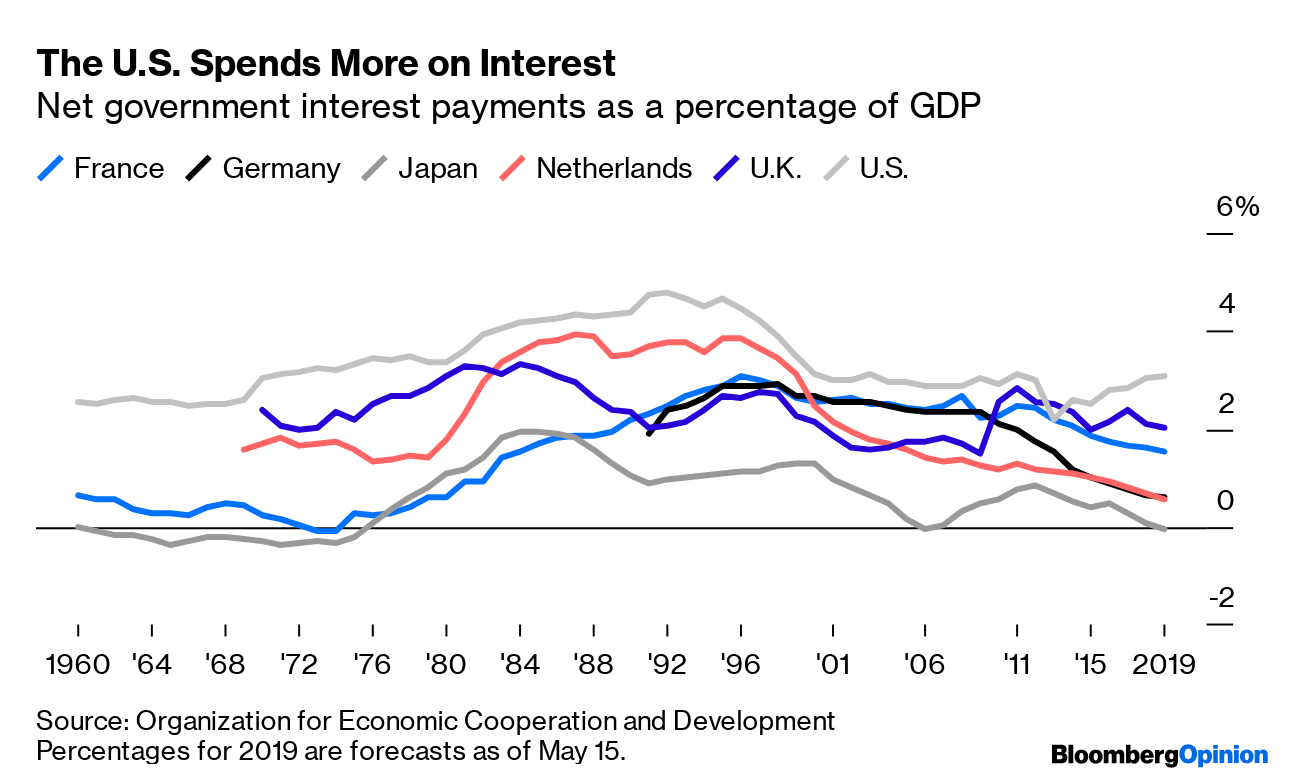

Today's Agenda  BoJo's Big Gamble For a long time, Boris Johnson's most famous moment was comically getting stuck on a zip line during the London Olympics in 2012. His latest high-wire act is much less hilarious and much more consequential. Following the U.K.'s arcane parliamentary procedures — which involve a Black Rod, various maces and a Cap of Maintenance — Johnson asked Queen Elizabeth II to suspend Parliament, whereupon she signaled her approval by beheading a robin, the national bird, with a tiny ceremonial hatchet. (Only one thing in that sentence is false.) Johnson's move, denounced by critics as a coup, or at least a "constitutional outrage," has several objectives. The most obvious is to run out the clock on opponents of a no-deal Brexit. That might make the EU believe Johnson is serious about inflicting such a disaster on his own country, which might encourage it to give a little in negotiations. Beyond this, writes Therese Raphael, Johnson's goal seems to be forcing a no-confidence vote that will trigger a general election. His aim would be to cement himself in power, neutralizing threats from Nigel Farage and Jeremy Corbyn. And it just might work, Therese writes. But he may also have unleashed a political whirlwind, and those often make high wires inhospitable. Fed vs. Trump, Day Two A day later, people are still talking about former New York Fed President Bill Dudley's call for the Fed to conscientiously object to President Donald Trump's trade war. Trump may not be aware of Dudley's column, but he did keep harping on the Fed to cut interest rates. And though his methods may be unsavory, Trump has a point, argues Ramesh Ponnuru: By being too slow to cut rates, the Fed is letting financial conditions tighten. The main thrust of Dudley's argument is that easing the pain of the trade war will only encourage more trade-warring, making the economy worse in the long run. But Karl Smith suggests the trade war is a shock to the economy, similar to an oil-price surge, and the Fed should respond as it would to any other shock, by cutting rates. But it should also make clear it's just doing its job and not endorsing trade hostilities. Of course, it's debatable how much rate cuts can help a cratering global trade regime. A recession may already be in train, and it could be a long and ugly one if China prolongs the trade war past the 2020 election, writes Michael Strain. Ultimately the economy's fate may hinge not on the Fed but on Trump recognizing his re-election depends on a face-saving China settlement. Further Central-Bank Reading: The Oil Times They Are A-Changing BP Plc might not be an oil giant if not for its 60-year involvement in Alaska's oil fields. So it was surprising yesterday when BP said it was selling all of its Alaskan assets. Oil production there has been in decline for a while, but Liam Denning writes BP's move also reflects oil's hot new trends of shoring up balance sheets and fracking, which takes less time and Herculean effort than drilling in such remote places as, say, Alaska. Oil's new paradigm has arisen partly because demand for the stuff seems irreparably damaged, at least for the duration of the trade war, and maybe much longer. Not everybody's ready to accept this: OPEC and the International Energy Agency are wildly bullish on oil demand for the rest of this year; but Liam Denning, in a second column, suggests this looks like magical thinking. Further Energy Reading: Singapore is dead serious about clamping down on car ownership, extending strict prohibitions even to Tesla Inc.'s electric cars. – Adam Minter Winners and Losers in the Opioid Wars Johnson & Johnson made a fat target for lawyers suing Big Pharma companies over America's opioid crisis — not because of the depth of its involvement in opioids but the depth of its pockets, writes Joe Nocera. But those same deep pockets could destroy these opioid cases in court, Joe writes. That's bad news not just for lawyers but also for hopes of making far-worse opioid culprits pay. Further Opioid Reading: Telltale Charts Amazon.com Inc. suggests its sluggish international growth will eventually catch up to its U.S. growth, but Shira Ovide writes that's no sure thing.  The U.S. stands out from other major economies in the way it's borrowing and spending, notes Justin Fox.  Further Reading The Japan-South Korea feud is pointless and increasingly dangerous. The U.S. should push for a settlement, which is within easy reach. – Bloomberg's editorial board China and Trump have lulled markets into a false sense of calm with measured currency moves and gentler tones. This too shall pass. – Mohamed El-Erian If any American company can thrive in China right now, it's Costco Wholesale Corp. – Nisha Gopalan Narendra Modi has no idea the damage his Kashmir crackdown is doing to India's reputation. – Pankaj Mishra The ignorance of Penn law professor Amy Wax's racial theorizing is exposed by her uninformed take on Malaysian science. – Noah Smith Humans haven't been around long, but our stain on the Earth will last. – Faye Flam ICYMI "The Big Short"'s Michael Burry sees a new bubble. Americans souring on the economy blame Trump. Tropical Storm Dorian became a hurricane, aimed at Florida. Kickers Rich families are legally separating from kids to cut college tuition. Scientists may have found a black hole so massive it shouldn't exist. Life on certain exoplanets may glow in the dark, helping us spot it. We should read more Ursula Le Guin. Note: Please send tuition and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment