| A general strike in Hong Kong, trade tensions and another tanker seized in the Gulf. Here are some of the things people in markets are talking about. Hong Kong Strike Beijing won't sit by and let the disruption in Hong Kong go on, according to a Xinhua commentary published on Sunday. It didn't specify what steps China might take. The warning didn't immediately affect behavior in the city, where clashes continued into the evening, with police firing tear gas to disperse protesters blocking roads in Causeway Bay. There were rival pro- and anti-government protests on Saturday. Protesters look to shut down the city with a general strike today. Trade Pressure President Donald Trump said "things are going along very well with China," two days after he ratcheted up pressure on Beijing. Trump overruled advisers who opposed the levies, the WSJ reported. The People's Daily said the step "seriously breached" a truce, and Beijing's UN ambassador said the issue risks undermining North Korea talks. Iran Seizure Iran's Revolutionary Guards seized another foreign oil tanker. The vessel — the third seized by the Guards in the Persian Gulf since July 14 — is suspected of smuggling a large volume of fuel, according to Tehran. Iraq denied a report that it owned the ship. The move is likely to compound concerns about the safety of shipping in a region crucial to oil exports. Election Speculation Speculation is building that U.K. Prime Minister Boris Johnson is getting ready to call a snap election. He pledged $2.2 billion for Britain's hospitals, the sort of promise that ruling political parties tend to resort to when they're plotting for an election campaign. Meanwhile, with Johnson committed to taking the U.K. out of Europe by Oct. 31, here's the plan to avert banking chaos if there's a no-deal Brexit. Market Watch Asian stocks are set to remain under pressure Monday as investors fretted over President Donald Trump's escalation of the trade war with China. Futures pointed lower in Japan and Hong Kong, which will in focus as protesters looked to shut down the city with a general strike on Monday. China's yuan will also be closely watched after it tumbled to the weakest since November. The yen was little changed in early trading. What we've been reading: - Trump says "hate has no place" in U.S. after two mass killings.

- Australia's central bank is keeping the door open to further rate cuts.

- Mexico to announce legal actions to protect Mexicans in U.S.

- It's not just the Fed and Trump that trouble the stock market.

- The Philippines' "Iron Lady" is ready to fight Duterte's alcohol tax.

- Putin's pledge to ditch the dollar is slowly becoming a reality.

- Buffett steers clear of buying stocks; Berkshire's cash pile hits a record.

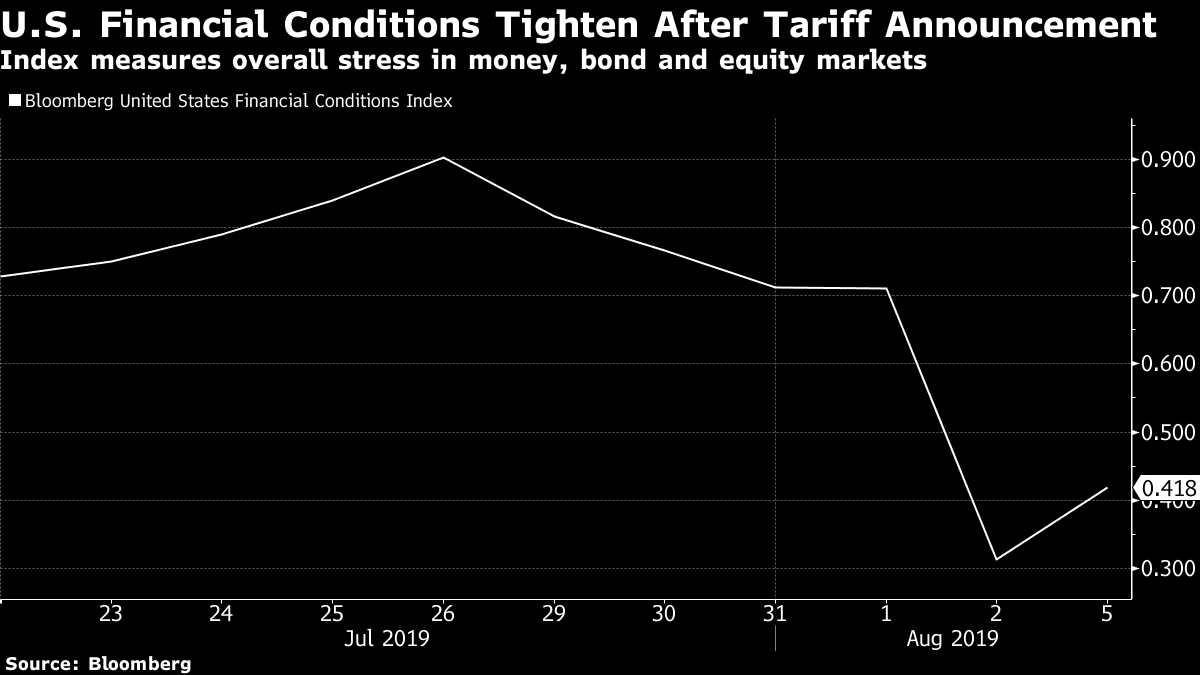

And finally, here's what Tracy's interested in this morning Why did U.S. President Donald Trump suddenly decide to impose additional tariffs? We've talked before in this space about how they might be his best chance of influencing the Fed. But Bloomberg reports people close to the administration "said the president and his advisers had grown increasingly wary of what appeared to be China's efforts to extend the talks into next year." In other words, China was dragging its feet on a trade deal, hoping Trump wouldn't get reelected in 2020.  It's an interesting theory, and one I've heard before, notably from Jefferies analyst Laban Yu. He's argued that China's trade strategy amounts to a bet on U.S. political decay. Interest groups will eventually force the U.S. to back down on tariffs, the thinking goes. Once the economic impact is clear Trump will bow to pressure from the likes of farmers, companies and consumers—before China will bow to pressure from the same interest groups. (The ability to withstand domestic pressure is, let's just say, a benefit of having a one-party political system.) I like this framing because it plays so neatly on how people tend to view the differences between China and America's political systems. If you find the theory interesting, you can catch more of Yu's thoughts on U.S.-China trade tensions on the latest episode of the Odd Lots podcast, out today. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment