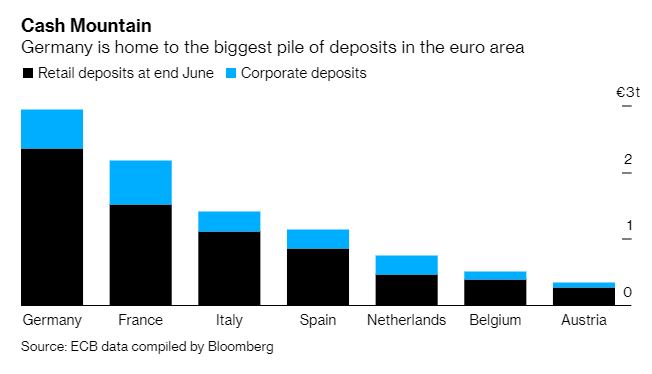

Trade optimism eases, Italy talks struggle and drugmakers face opioid reckoning. Fading trade hopesMarkets are still in thrall to the whims of President Donald Trump's latest trade threats. Yesterday's rally was driven by optimism following comments made by the president at the G-7 meeting, where he said that China called looking for a deal. That hope is fading today as it is becoming increasingly unclear whether any call from China happened over the weekend at all. The one deal that seemed secure came under doubt, with Japan insisting it wanted the U.S. to end the threat of new tariffs on autos before finalizing an agreement. Talks stumbleThe risk of snap elections in Italy is rising this morning as talks between the anti-establishment Five Star Movement and center-left Democratic Party do not seem to be going well. Both sides have until tomorrow evening to show President Sergio Mattarella that they have a solid parliamentary majority and have agreed a program for government for the next four years. Elsewhere in Europe, the second reading of German second-quarter GDP showed that a collapse in exports is weighing enough on the country's economy to push it to the brink of recession. Drug awardJohnson & Johnson shares rose as much as 5.4% in the immediate aftermath of an Oklahoma judge making a substantially smaller award against the company over the opioid crisis than had been feared by investors. While the state won only $572 million of the $17.5 billion it had sought in damages from the company for duping doctors into overprescribing its opioid-based medications, that the case was won at all risks creating a precedent for drugmakers across the country facing billions of dollars in claims. Johnson & Johnson shares gave up much of their earlier gains to trade 1.9% higher in the pre-market session. Markets riseOvernight the MSCI Asia Pacific Index added 0.5% while Japan's Topix index closed 0.8% higher, with the gauge closing well below session highs as trade optimism faded. In Europe, the Stoxx 600 Index had gained 0.1% by 5:50 a.m. Eastern Time with investors remaining wary as they await the next China-U.S. development. S&P 500 futures pointed to little change at the open, the 10-year Treasury yield was at 1.506% and gold was slightly higher. Coming up…At 9:00 a.m. the U.S. June FHFA house price index is expected to show 0.2% growth in the month. Consumer confidence and the Richmond Fed manufacturing index are released at 10:00 a.m. The Treasury Department will sell $40 billion in two-year notes at 1:00 p.m. Hewlett Packard Enterprise Co. and the Bank of Nova Scotia are among companies reporting earnings today. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningThe recent slowdown in Germany doesn't seem to have changed the thinking of Jens Weidmann, the famously hawkish head of the Bundesbank. In a new interview he said that speculation over further rate cuts or more QE "doesn't do justice to the euro area's latest economic data." Right or wrong, he probably has a point about the limits to further ECB easing. I was reading this article about the growing frustration of German savers, who save at a rate of twice the European average and who have 40 percent of their financial assets in bank deposits. It occurred to me that if that's a virtue, then saving when you actually have to pay for the privilege must be even more virtuous. After all it's not a virtue if you also are making money on it. It turns out last year a museum in Germany even had an exhibit titled "Saving – History of a German Virtue." An FT article describes how it was filled with piggy banks and other boxes for storing money. As long as the desire to hoard coins is so ingrained, there's probably going to be a limit to what you can do with monetary policy... and all the more reason to go fiscal.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment