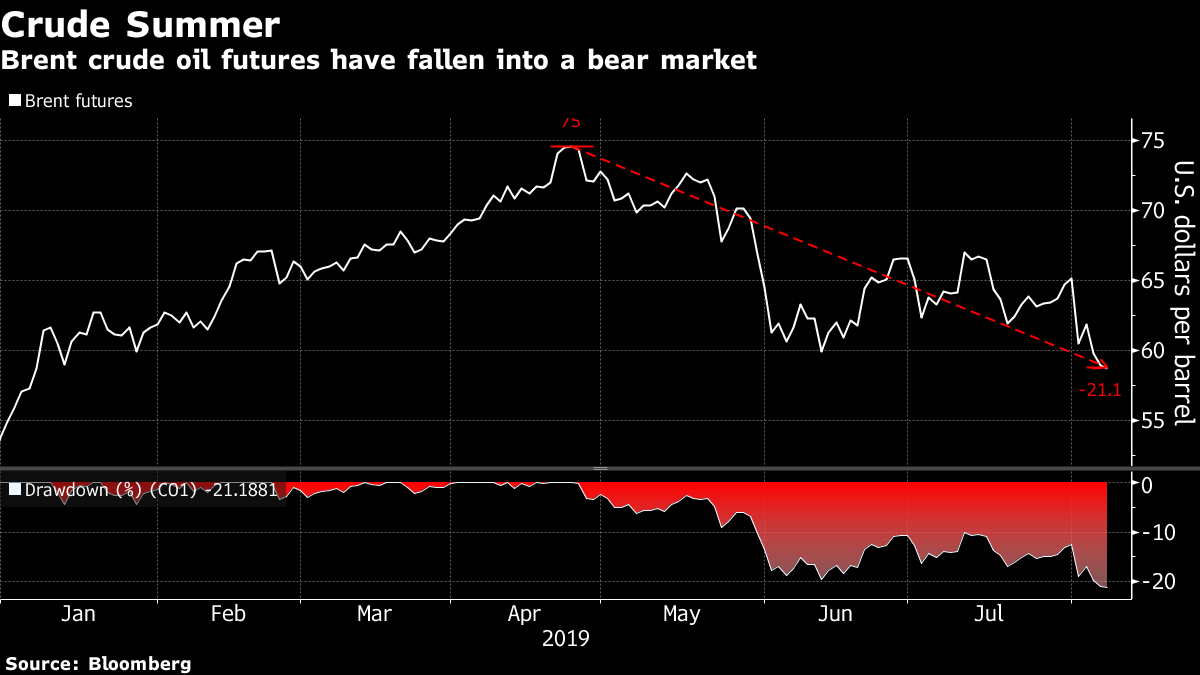

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. There was a surprise central bank decision overnight, investors are awaiting concrete trade war updates, the Brexit blame game is in full swing and a black sheep is doing better than expected. Here's what's moving markets. Kiwi Surprise There's nothing like a central bank shock to jolt markets, and New Zealand obliged. A half-percentage-point interest-rate cut overnight sent the Kiwi dollar plunging the most in more than three years, and the Aussie fell in sympathy. Just three economists surveyed by Bloomberg had forecast a 50-basis-point cut, with the other 18 predicting 25 basis points. The central bank also signaled further easing could be possible, highlighting the worsening global growth outlook and the U.S.-China trade conflict. Whirlwind Trump's top economic adviser, Larry Kudlow, said he still expects Chinese negotiators to come to Washington in September, but in the meantime, U.S. crude oil imports could become the latest target of the saga, according to traders in analysts. The yuan dipped overnight after China's move to stabilize its currency spurred a stock market recovery. With little clarity on where this is all going, here's a recap of Donald Trump and Xi Jinping's whirlwind relationship. Desperate Britain Fingers are being pointed in Brexit Land, with Michael Gove, now minister in charge of planning for a no-deal departure, blaming the European Union for failing to engage on a new agreement, deepening the political standoff less than three months before the U.K. is due to leave the bloc. Meanwhile, Downing Street might not want to bank on a trading deal with the U.S. either, according to former U.S. Treasury Secretary Lawrence Summers. "Britain has no leverage. Britain is desperate,'' he said. Black Sheep Amid all the recent gloom in markets, the black sheep of global stocks is having a its moment in the sun. Well, kind of. European equities – the world's most popular short trade -- have been outperforming U.S. peers during the latest market turmoil. Why? Investor positioning was already so bearish prior to the latest sell-off that it saved the region from an even sharper decline. Futures in the region are pointing marginally lower this morning. Coming Up... It's another mammoth earnings day in Europe, with mining and commodities giant Glencore Plc, German automaker Porsche Automobil Holding SE and the bookmaker formerly known as Paddy Power, Flutter Entertainment Plc, among those due to update. In terms of data, we'll get German industrial production, after factory orders rebounded in June, according to data on Tuesday. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning Oil traders aren't waiting around for the next escalation in the U.S.-China trade war. They have pushed Brent oil into a bear market, with futures down 5% this week alone and now more than 20% below their late-April peak. Contracts shrugged off a rebound in other risk assets to close lower Tuesday, even as U.S. stocks recovered as China moved to stabilize its currency. Investors seem to be betting that the potential hit to oil demand from a global economic slowdown will outweigh any boost from disruptions to supply. This week's decline came amid data indicating an eighth straight weekly fall in U.S. crude stockpiles, and Monday's warning from Iran that it could step up operations against tankers passing through the Strait of Hormuz. While it's fair to argue that oil prices have become a noisier indicator, they are still an important barometer for the global economy. One that is ominously pointing lower.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment