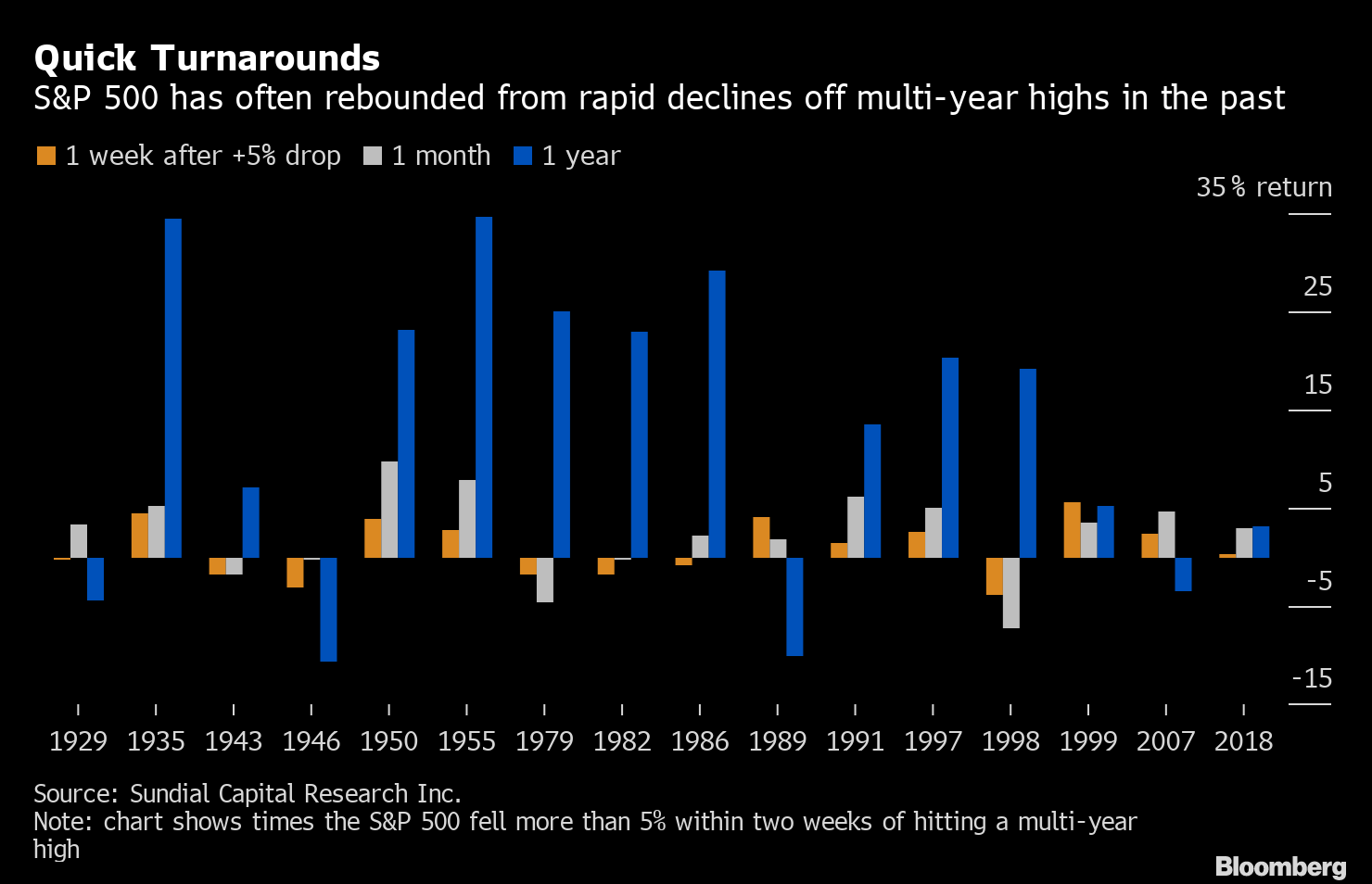

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. There's more on the U.S.-China trade war as the world's wealthiest lick their wounds from Monday's losses, the equities rout is showing signs of easing, Boris Johnson is facing a resistance and there are some large-cap earnings on the way. Here's what's moving markets. Up to 11 The Trump administration formally labeled China a currency manipulator in the latest escalation of the trade war between Washington and Beijing. But in an encouraging sign, China took steps to slow the yuan's descent after Wall Street analysts said it had taken its retaliation up to 11 by letting the yuan tumble to the weakest level in more than a decade and asking state-owned companies to suspend imports of U.S. agricultural products. Even private jet companies are bemoaning the saga. $117 Billion Not many tears will be shed, but the wealthiest 500 people on Earth lost 2.1% of their collective net worth on Monday as U.S. stocks plunged in their biggest drop this year. Twenty-one members of the Bloomberg Billionaires Index lost $1 billion or more, with Amazon.com Inc. founder Jeff Bezos's dropping the most, losing $3.4 billion as shares of his online retailer tumbled. But even after Monday's slump, the 500 individuals on the index control almost $5.4 trillion, an 11% increase from Jan. 1. Rout Eases The stocks rout eased after China announced a daily reference rate that was stronger than the psychologically important 7 per dollar level. Yet the MSCI Asia Pacific Index was still down close to 1%, bringing its selloff over the past week to about 6%, after the biggest drop of the year. Notably in the U.S., social media stocks like Twitter Inc. fell more than most amid potential greater scrutiny following the most recent mass shootings. Resistance Here comes the resistance: Opponents of Boris Johnson's threat to crash out of the European Union without a deal on Halloween are hardening their plans to stop him. Opposition Labour Party leader Jeremy Corbyn reckons he'll call a vote of no-confidence when Parliament returns next month while one rebel MP, Dominic Grieve, says a growing number of Tories will turn against Johnson if the cliff edge approaches. U.K. bond yields dived to record lows on Monday as talk of a general election increased traders' appetites for haven assets. Coming Up... Today's macroeconomic data is limited to German factory orders, and while not usually the highlight of the month, remember that a surprise plummet last time around sent ripples through markets. There's enough corporate earnings to keep us occupied this morning, including from jet engine-maker Rolls-Royce Holdings Plc and personal care product firm Beiersdorf AG, owner of the Nivea lotion brand. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morning The more optimistic among the U.S. equity trading community have no doubt just one question in their minds amid the trade-war induced stock slump -- when to buy the dip. History has a few answers. A look back at steep U.S. losses from multi-year highs does show a pattern of rapid rebounds, according to research from Sundial Capital Research Inc. Meanwhile, Bespoke Investment Group points to the tendency for Monday sell-offs to bounce back strongly. As of lunchtime trading in Asia, there was some hope the S&P 500's six-day and 6% slide was done -- futures reversed losses as China took steps to stabilize the yuan after the U.S. tagged it as a currency manipulator. Since 1929, the U.S. benchmark has experienced such a scenario -- a slump of more than 5% within two weeks of hitting a multi-year high -- 16 times, not including its current run, said Sundial. For 10 of those, the index jumped back to a fresh high, while it fell into a correction six times -- though never a bear market within the next six months. Bespoke pointed to big moves lower on Mondays being more common than any other weekday, with the market typically bouncing back the most the day after. Bulls are hoping for a Turnaround Tuesday.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment