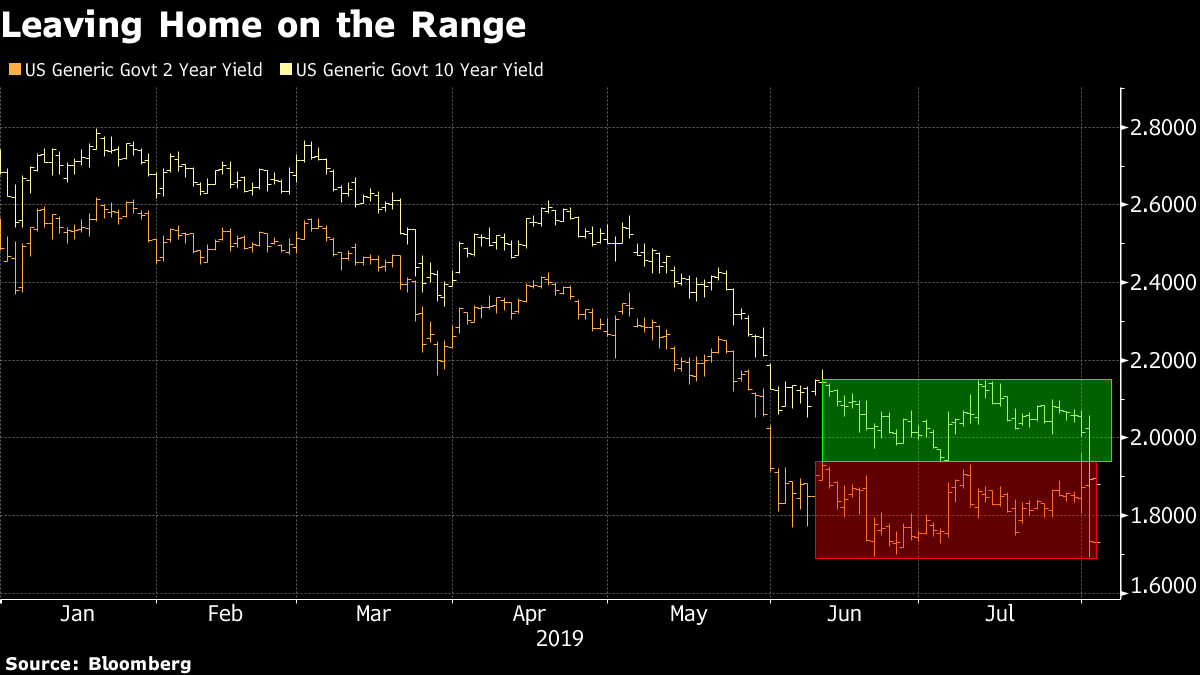

Trump's trade bomb, it's jobs day and Johnson's tiny majority just got smaller. Mr. 10%We need to start today's missive with an apology. Yesterday we may have given the impression that the trade war would not restart until September, when we should have said "later today." President Donald Trump's surprise announcement of new 10% tariffs on the $300 billion of Chinese imports currently not subject to duties sent markets into something of a tail spin yesterday. Needless to say, China has promised a response, without elaborating what measures they would take if the new tariffs are introduced on Sept. 1. Stock traders have an interesting theory about the timing of the move, with the logic suggesting that since Fed Chairman Jerome Powell used trade tensions to justify Wednesday's rate cut, it makes sense for pro-cut Trump to create more of them. Jobs dayLabor Department figures are expected to show employers in the U.S. added 165,000 positions in July, with the unemployment rate ticking lower to 3.6% and wage growth remaining solid. Normally payrolls is the biggest economic data point of the month, but this one feels like it has already been overshadowed by the Federal Reserve decision and the move on tariffs. The feeling today is that there would have to be a major surprise when the data is released at 8:30 a.m. Eastern Time for markets to turn either way on the number. And then there was oneThe anti-Brexit Liberal Democrats won a by-election in Wales, taking the seat from the Conservative Party and reducing Prime Minister Boris Johnson's parliamentary majority to just one vote. This, obviously, is not good news for the new prime minister who is facing huge amounts of uncertainty over what will happen next with Brexit. There were more signs of the damage that uncertainty is doing to the U.K. economy this morning with construction output sinking for the third month in a row in July. Markets batteredOvernight the MSCI Asia Pacific Index dropped 1.4% while Japan's Topix index closed down 2.2% for its biggest daily loss since March as trade worries hit the country on multiple fronts. In Europe, the Stoxx 600 Index was 2% lower at 5:45 a.m. with cyclical sectors including basic resources, banks and autos bearing the brunt of the sell-off. S&P futures pointed to further falls at the open, the 10-year Treasury yield was at 1.85%, the lowest level since 2016, and gold fell. Commodity slamBasic materials were dealt a serious blow by Trump's tariff announcement, with the Bloomberg Commodity Spot Index falling 2.5% yesterday. Crude was ground zero for the selloff, with a barrel of West Texas Intermediate for September delivery plunging 7.9% in the wake of the announcement. Oil is staging a small recovery today, gaining 2%, which will probably not be enough to lift sentiment ahead of earnings from Chevron Corp. and Exxon Mobil Corp. later. Also in oil news, we get the latest Baker Hughes rigcount at 1 p.m. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Luke's interested in this morningThere's some speculation that Fed Chair Jerome Powell will call Trump's bluff by declining to provide extra accommodation to absorb the escalating trade war after the president's latest plan for tariffs on Chinese imports. This is far-fetched to seasoned observers, as long as inflation expectations remain more at risk of being un-anchored to the downside than the upside. Powell doesn't control the weather, but he's the only umbrella salesman in town and storm clouds are forming on the horizon. There are puzzles for Treasury-curve traders. Does a trade war put the zero lower bound within reach? The fed funds futures curve doesn't point to policy rates sinking below 1% yet. That suggests a meaningful bull steepener -- short-term rates falling faster than long-term rates -- would require participants placing some odds on the central bank having to slash rates close to the bone. And when, if ever, will breakevens treat the trade war as inflationary? Market-based measures of inflation compensation tumbled, along with oil, as Trump's tariff tweet landed. July's nonfarm payrolls report will serve as a test of the bond market's receptivity to good or bad data in the context of heightened trade tensions. Heading into it, the market stands at a precipice: 10-year and two-year Treasury yields are flirting with dropping below their multi-month ranges.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment