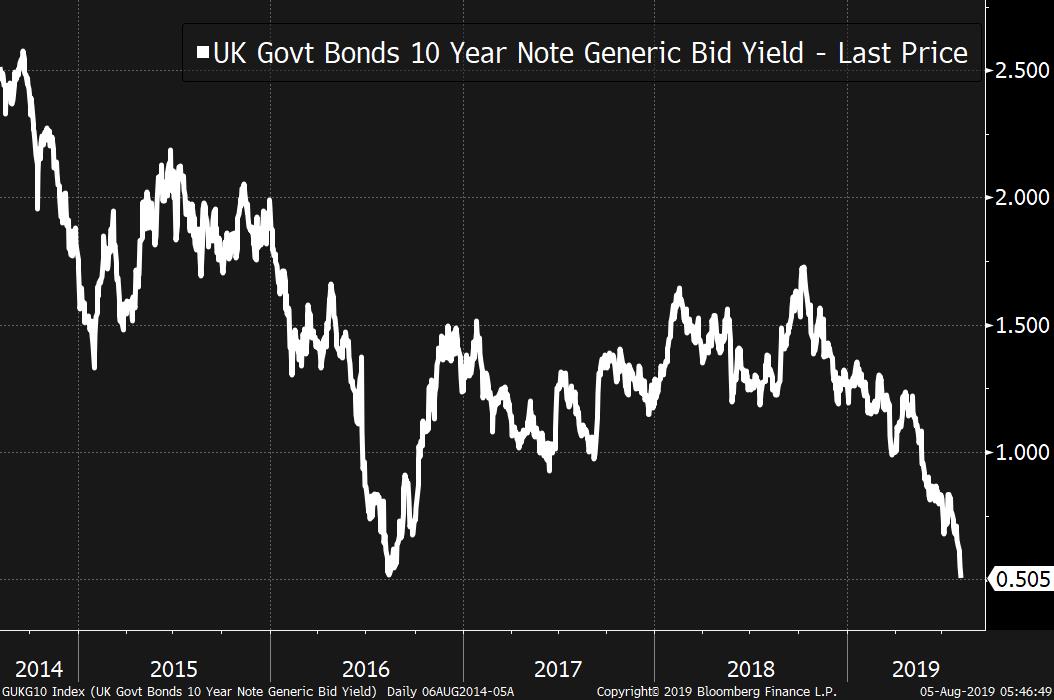

An ugly sell-off to start the week, another trade war escalation, and Berkshire Hathaway has loads of cash. Miserable startFinancial markets were roiled Monday by yet another escalation of the U.S.-China trade war. Amid the tumult the yuan tumbled to the weakest in more than a decade and crossed the 7-per-dollar mark, suggesting the level is no longer a line in the sand for policy makers in Beijing. European stocks and American futures joined the sell-off raging across Asia, and emerging-market currencies sank on concern a prolonged conflict between the world's biggest economies will weigh on economic growth. Investors turned to haven assets including the Japanese yen and gold, and bond yields sank to unprecedented lows as the worsening outlook spurred bets that central banks will need to cut rates more aggressively. Trade tempers igniteIn addition to the weakening yuan, China's state-run agricultural firms have now stopped buying American farm goods, people familiar with the matter said, in a move that looks designed to inflame President Donald Trump. China's policy on agricultural goods from the Midwest's "great patriots" has been one of Trump's loudest talking points throughout the trade spat and the news could be painful for those politically sensitive states ahead of the 2020 election. Of course, the latest tit-for-tat started with Trump, who abruptly escalated things just days after the two sides had restarted talks when he proposed adding 10% tariffs on another $300 billion in Chinese imports from Sept. 1. Bloomberg Economics puts the cost to the world economy of a full blown trade war at $1.2 trillion. Politics roundupAside from the trade war, there are a host of geopolitical headaches unfolding. U.K. politicians are increasingly taking Prime Minister Boris Johnson's public spending pledges as clues he's gearing up not just for Brexit but also a general election. Democratic front-runner Joe Biden said President Donald Trump has been a "significant contributor" to the rise of hate on display this weekend following mass shootings in Dayton, Ohio and El Paso, Texas. "Perhaps more has to be done," Trump said Sunday before returning to Washington from his golf resort in New Jersey. The president is scheduled to deliver remarks at 10 a.m. in Washington. Meanwhile, Hong Kong leader Carrie Lam warned of a "very dangerous situation" as demonstrators moved to shut down the financial hub. The Hang Seng Index slumped as much as 3.1%. The rupee fell the most since December as the Indian government revoked the special status of the Jammu and Kashmir state, risking a deepening the deteriorating security situation in the disputed region. And Iran's standoff with the West continues after the Revolutionary Guards announced it seized another foreign vessel on July 31, compounding concerns about the safety of shipping in a region crucial to oil exports. EarningsOver the weekend Berkshire Hathaway Inc. said its net income jumped 17% due to $7.9 billion in investment gains, but soft consumer demand hit some units and operating earnings dropped overall. On the plus side they still have loads of cash. HSBC Holdings Plc said it would shortly begin a buyback of up to $1 billion and announced pretax profit for the quarter of $6.2 billion, though it also dropped news that CEO John Flint's tenure has come to a sudden end. Japan's SoftBank Corp. announced gains in revenue and income at its mobile segment due to an increase in subscribers to its Ultra Giga Monster Plus plan, which separates handset payment and service fees. Tyson Foods Inc. is set to report later this morning, and look for Caesars Entertainment Corp. and Shake Shack Inc. after the close. Coming up…Markit's PMI data for the U.S. is 9:45 a.m. Eastern time, while the ISM non-manufacturing reading is at 10 a.m. It may all help shed some light on the American economy after Federal Reserve Chairman Jerome Powell whipsawed markets with mixed messages on the central bank's ``mid-cycle adjustment'' last week. Also keep an eye on whether the escalating trade mess makes it into speeches by the string of Fed policy makers slated to speak in the days ahead. Governor Lael Brainard is up first on Monday at 1:30 p.m. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningModern Monetary Theory is often caricatured as stating that governments can spend and print money like crazy without any consequences in the economy or financial markets. In reality, MMT adherents make a much narrower claim: that in advanced economies issuing their own currencies, government debt does not carry credit risk. Lots of things can of course still go bad thanks to monetary and fiscal mismanagement, but it won't show up in government bond markets in the way people would otherwise expect. The anxiety currently surrounding the prospect of a no-deal Brexit, and the impact this is having in the markets, may prove to be a nice demonstration of this. While the pound has lately been getting clobbered -- it's one of the worst performing major currencies of the last month -- U.K. government bonds have been rock solid. In fact, just today the yield on the the 10-year benchmark has fallen to its lowest level ever. Critics of MMT often say that the U.S. is a special situation, and that its government debt only has this special status due to American hegemony and the dominant role of the dollar. Well, the U.K. has neither of those attributes, and yet it hasn't mattered. Of course at this point, someone will inevitably chime in with "but Brexit hasn't happened yet!" and that's true, so it's worth watching this dynamic unfold over the coming months. Nonetheless, the MMT supposition, that risk to the market would not be seen in rising government debt costs is so far on track.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment