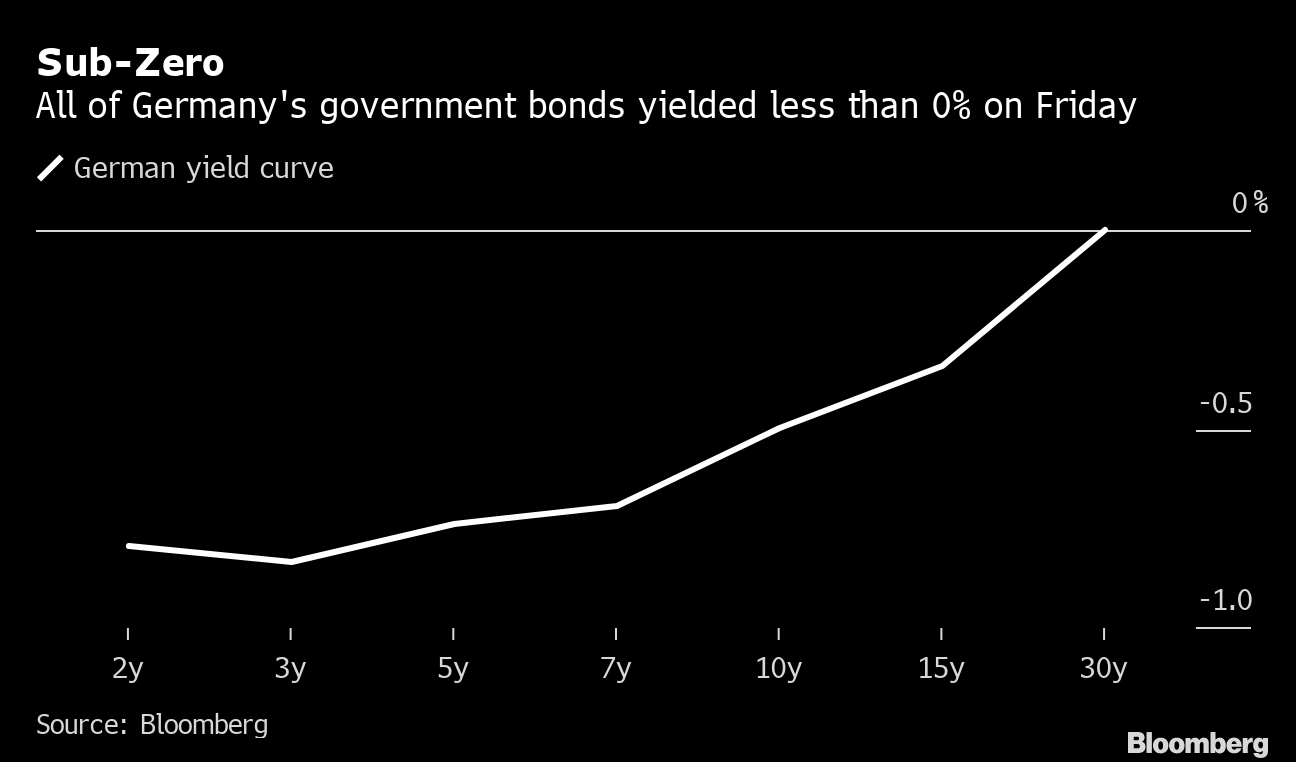

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Global stocks are set for another down day as China and the U.S. send contrasting signals on the trade war, speculation is mounting that there will be a U.K. general election, it was another weekend full of protests and there was a surprise CEO exit in the banking sector. Here's what's moving markets. Going Well? U.S. President Donald Trump said Saturday that "things are going along very well with China," just two days after his threat of tariffs on hundreds of billions of dollars in additional Chinese imports sent global stock markets tumbling. But overnight the news broke that the Chinese government had asked its state-owned enterprises to suspend imports of U.S. agricultural products, a possibly worrying sign. You might be thinking about your summer holiday, but the trade war isn't taking a break. Election Talk Boris Johnson is flashing the cash, including on health and policing, which is fueling speculation the new British prime minister is preparing for an early general election, especially after his working majority in Parliament was cut to just one in a special election last week. That could spell even more trouble for the pound, just as a Bloomberg survey of analysts suggests sterling will tumble to the lowest level since 1985 if the U.K. leaves the European Union without a deal. The U.K. currency was little changed overnight. Weekend of Protests It was a weekend of street demonstrations. Hong Kong leader Carrie Lam warned of a "very dangerous situation" as protesters moved to shut down the Asian financial hub on Monday after a ninth straight weekend of unrest in opposition to China's tightening grip. But disruption wasn't limited to Hong Kong –- in Moscow, police detained almost 700 people, including opposition leaders, at protests against the the decision to ban anti-Kremlin candidates from running for the city council. Red Screens It'll be another day of red screens for equities markets in Europe as the MSCI Asia Pacific Index heads for its biggest decline since October in reaction to the trade war turmoil and Hong Kong disruption, sending haven assets higher. Attention was on China's yuan as the currency weakened past 7 per dollar, a speculated focal point for policymakers. Here's some charts that show how global markets have been upended. Coming Up... We'll get services and composite purchasing managers index data from the U.K. and also the euro area, where economic growth is slowing, according to last week's statistics. The corporate earning schedule is much lighter today, with German chemicals giant Linde Plc the only large-cap of note to come. That's after HSBC Holdings Plc's rise in first-half profit was overshadowed by the surprise departure of the Asia-focused bank's chief executive. What We've Been Reading This is what's caught our eye over the past weekend. And finally, here's what Cormac Mullen is interested in this morning Another day, another bond market record, this time in Germany. Thanks to President Donald Trump's ratcheting up of trade tensions, yields across the whole of its government bond market dropped below 0% for the first time on Friday. The euro area's biggest economy joined Denmark and Switzerland in the region in offering negative returns to investors should the notes be held to maturity, taking the total stock of investment-grade debt yielding less than 0% to $14 trillion globally. While many will struggle to understand the allure of bonds that essentially eat your money, the move highlights the desire of many investors for relative security, liquidity and credit quality. Negative yielding bonds can still offer capital gains and traders always have the option of exploiting a steep yield curve -- buying and holding longer-dated bonds for shorter periods of time to capture differences in the pricing of different maturities. But whatever way you look at it, an entire yield curve below zero is a sign of a deeply distorted market and very uncertain economic outlook.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment