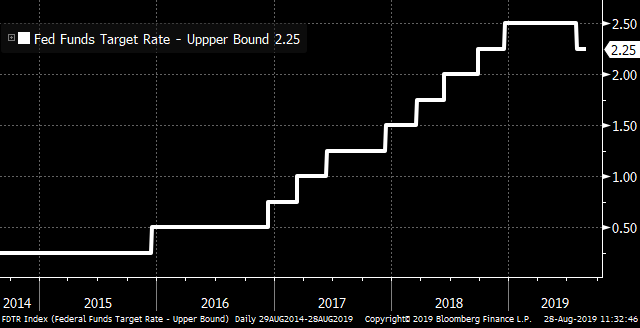

Pound plunges on Johnson's Brexit move, China prepares for the worst, and Italy almost has a new government. Brexit gambitThe British pound fell as much as 1.1%, the most in a month, after the BBC reported that U.K. Prime Minister Boris Johnson will ask Queen Elizabeth II to suspend parliament from mid-September to mid-October, a move which could severely hamper efforts by anti-Brexit lawmakers to block a no-deal exit from the European Union. While suspending parliament, known as proroguing, is not unusual, using it to strategically frustrate opposition to the government is likely to cause uproar. The decision is expected to be confirmed by the privy council – a group of senior politicians who advise the Queen – later today. Low hopesOne of the key obstacles to a breakthrough on trade talks has become President Donald Trump's credibility, according to Chinese officials familiar with the talks. His comments over the weekend that China had called looking to restart negotiations is still causing some confusion in Beijing as nobody there seems to have contacted the U.S. negotiators. All the uncertainty is having real-world effects for Chinese exporters, with toymakers there already losing out on Christmas orders in what should be their busiest quarter, while governments in the region are following monetary policy moves with fiscal stimulus of their own. Down to the wireThe anti-establishment Five Star Movement and the center-left Democratic Party in Italy continue their talks to form a new government which would avoid the need for a snap election. Both parties face a deadline this afternoon to present an agreement on a government to President Sergio Mattarella, with talks on sorting out key administration roles likely to continue until the last minute. Should the talks fail, new elections will be called. Right now, with the country's bond yields plunging, traders are betting on a successful outcome. Markets slipOvernight the MSCI Asia Pacific Index was broadly unchanged while Japan's Topix index closed slightly higher as traders awaited the next developments in the trade war. In Europe, the Stoxx 600 Index was 0.4% lower at 5:50 a.m. Eastern Time, with London's FTSE 100 Index the only major national benchmark posting a gain due to the plunge in sterling. S&P 500 futures pointed to a small gain at the open, the 10-year Treasury yield was at 1.471% and gold was flat. Coming up…The oil market will be looking for confirmation of a large draw on U.S. stockpiles when government figures are released at 10:30 a.m. this morning. There are a couple of Fed speakers on the slate for today, with Richmond Fed President Thomas Barkin and San Francisco Fed President Mary Daly both due later. The U.S. Treasury will sell $18 billion of two-year and $41 billion of five-year notes. Tiffany & Co. is among companies reporting today amid a weaker-than-usual diamond market. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningEveryone knows that President Trump has been extremely critical of his hand-picked Fed Chairman Jerome Powell. However, a recent Bloomberg Opinion op-ed from former NY Fed President Bill Dudley should remind Trump that in terms of his own purposes, Powell has been a good choice. If you haven't read the Dudley op-ed, you should. In it he argues that the Fed shouldn't be in the business of bailing out Trump's approach to the trade war by cutting rates. At the end of the column, he even suggests that if Trump himself poses an existential risk to the economy, the Fed should consider how its policies may or may not swing the 2020 election. The column was met with near universal opprobrium from economists, who recognized that such logic could seriously jeopardize the Fed's independence, which is already under threat. Fortunately for President Trump, Powell has never shown any inclination that he thinks like this. His recent speech at Jackson Hole talked about the challenges for monetary policy in the middle of the trade war, but at no point did he suggest that the Fed give up on its goals of sustaining the expansion and fulfilling its dual mandate. As Powell put it, "Our assignment is to use monetary policy to foster our statutory goals. In principle, anything that affects the outlook for employment and inflation could also affect the appropriate stance of monetary policy, and that could include uncertainty about trade policy." There's another thing that should make Trump appreciate Powell. Unlike his predecessors, the Fed chair sees scope for structural improvement in the real economy from central bank efforts to draw previously marginalized groups of workers into the labor-market fold. Trump obviously wants to see lower rates, and maybe he'll get them. But already he has a Fed chair whose approach to the job and vision for what the Fed can do is not inconsistent with Trump's own economic agenda.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment