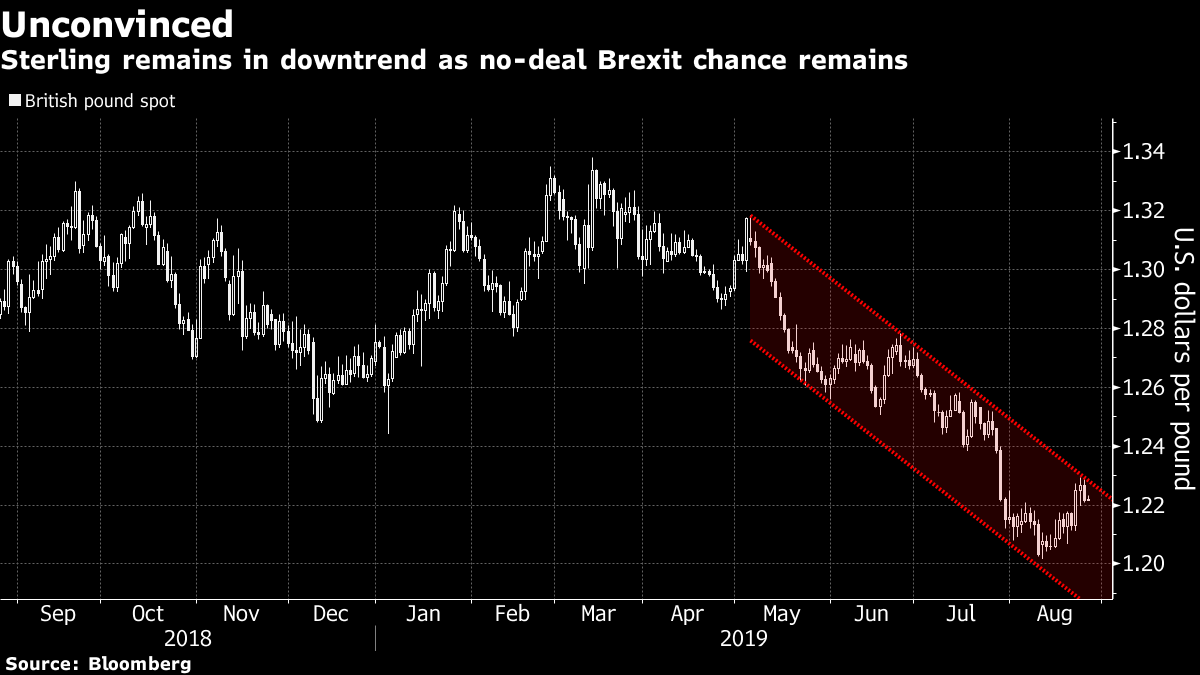

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Traders continue to consider the impact of the trade war, which is having effects all over the world, efforts to form a government roll on in Italy and there may be a meeting on the cards between the U.S. and Iran. Here's what's moving markets. No Meltdown A hearty welcome back to our U.K. readers. You actually didn't miss that much while enjoying your warm and sunny August bank holiday: Yes, Asian stocks slumped Monday as the U.S.-China trade war heated up, but Europe was flat and U.S. equities rose. Could it be that investors are becoming hardened to Donald Trump's provocative statements on trade? Or they're buying his optimistic view – disputed by China – that prospects are good for a deal? Coming into Tuesday, with a full complement of traders at their desks, Asian stocks pushed higher as the mood on the trade front turned hopeful despite no change in Trump's tactics. Trade Effects As all will know, the trade war is having an impact all over the world but a few health checks are worth taking a look at. Chinese industrial companies returned to profit in July, but primarily driven by a weak comparison from a year before and with trade-related concerns weighing heavy. Japan, a lesser-seen part of Trump's ire, has signaled it wants to lay to rest the threat of new auto tariffs before agreeing to a final trade deal. U.S. steelmakers, intended beneficiaries of the tariffs, are flummoxed by the U.S. policy and in Switzerland, trade concerns are one part of a triple whammy hitting exporters. Roman Talks Deliberations are set to continue in Rome as markets await a potential new ruling coalition for the country and hope against hope that there will be no new elections, with all the uncertainty they'll bring for a heavily indebted nation. The talks between Five Star and the Democratic Party went into the wee hours of Tuesday morning and will continue apace, with President Sergio Mattarella to hold a second round of talks with the party leaders. Watch Italian bond markets for any signals as headlines flow through on the state of the talks. Iran Meetings French President Emmanuel Macron appears to have taken the lead during the closing hours of the G-7 summit on attempting to get Donald Trump and Iran President Hassan Rouhani in a room, a bid to end the crisis that has resulted in sanctions being heaped upon the Middle Eastern nation. Macron said he is "convinced'' a deal could be found if Trump and Rouhani were able to meet. Trump himself then echoed this, saying he may be open to a meeting that could potentially lead to restrictions being eased, albeit this could be even more politically fraught than Trump's outreach to North Korea. Coming Up... It's another slowish earnings day, with five companies in the Stoxx Europe 600 Index due to report, including British wholesaler Bunzl Plc and, after the market closes, Danish beer maker Royal Unibrew A/S. Bunzl, which supplies safety gear and cleaning products to shops and businesses, is a decent proxy for the health of the business world, notably in North America, where it got 58% of its sales last year. The economic calendar is equally light, with French consumer and business confidence and U.S. consumer confidence among the highlights. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen's interested in this morning British Prime Minister Boris Johnson's Biarritz bonhomie may have gone over well with French President Emmanuel Macron and his wife, but currency traders are a tougher audience. The pound remains stuck in its summer downtrend, despite Johnson saying he was "marginally more optimistic" he could get a Brexit deal with the European Union. Sterling has risen more than 1% against the dollar since its year-to-date low in mid-August, yet remains about 2% lower from when Johnson took over as prime minister in late July. While Johnson's meeting with main Brexit antagonist European Council President Donald Tusk went without any major hiccups, the usual roadblocks remain. The EU has given no indication it's ready to give the concessions the U.K. is asking for and the contentious Irish "backstop" mechanism remains. Back at home rival political forces are gathering. As we near the two-months-to-go mark, it seems traders aren't betting on a breakthrough just yet.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. CORRECTION: Yesterday's newsletter incorrectly referred to China as the world's largest economy. It is Asia's largest economy. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment