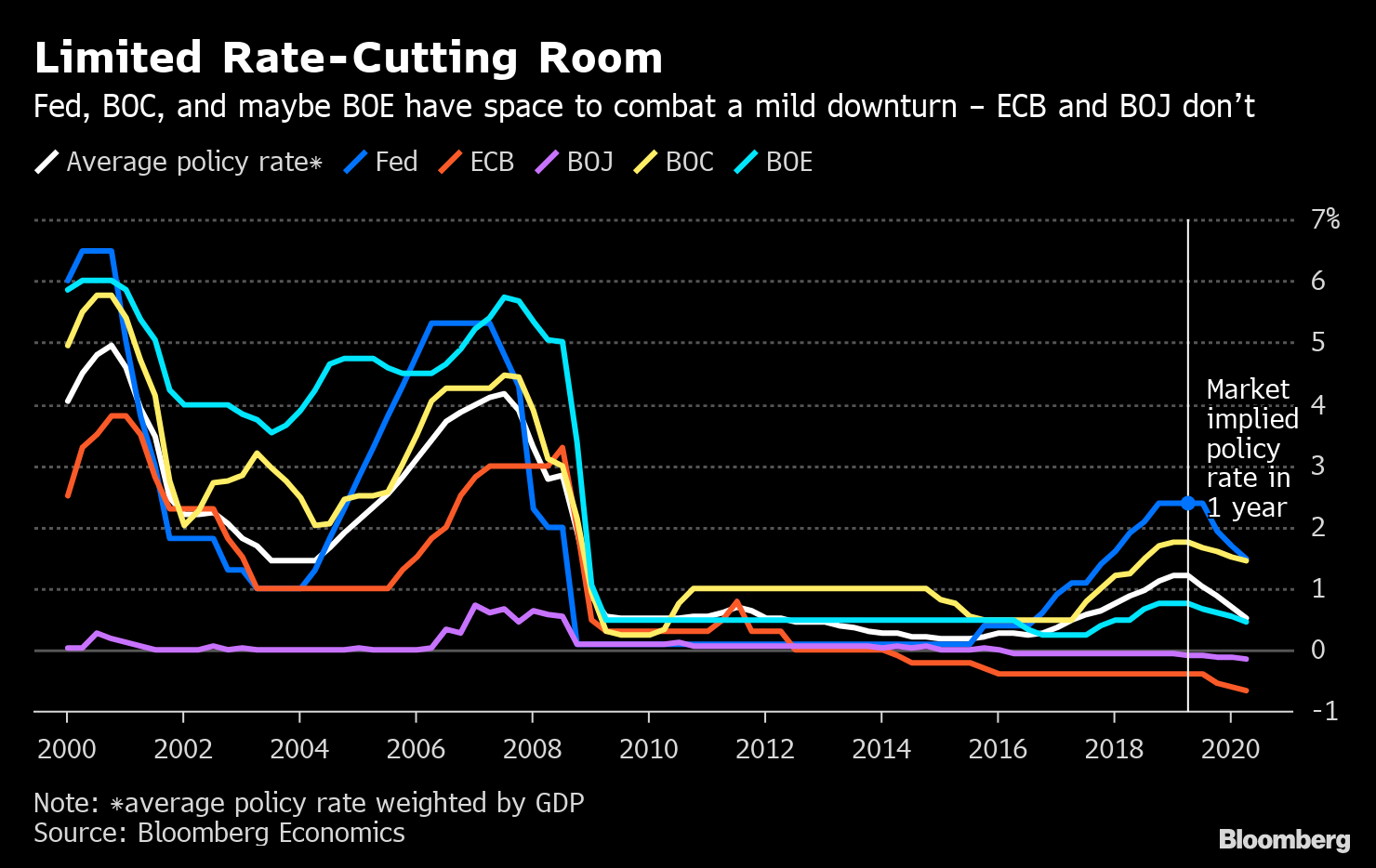

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Markets everywhere are digesting the Federal Reserve interest rate cut, the pound is still getting hit hard and the Bank of England has to figure out its next steps. Here's what's moving markets. 'Downside Risks' As widely expected, the Federal Reserve lowered interest rates by a quarter-point, the bank's first cut since 2008. But the move was accompanied by a less dovish tone than expected from Chairman Jerome Powell. He said the cut was done to insure the economy against "downside risks" and didn't signal the start of a series of reductions, in addition to saying the cut was designed to help "those left behind" in the American economy. That was seemingly not a satisfying outcome for either bond traders or President Donald Trump. The move jarred stocks, dealt a blow to emerging market assets and to gold, while leaving some countries yet further out of step with the Fed. Bruised Pound U.K. Prime Minister Boris Johnson looks to have gone some way to securing the working majority he'll need to pass a Brexit deal through Parliament but would seem to have made very little progress in dealings with both the European Union and Ireland. The increased risk of a no-deal Brexit, brought about by Johnson and his government's stance, could ultimately send an already-bruised pound down even further and could further heighten the comparisons between the U.K.'s currency and those of emerging market nations. How long Johnson can dismiss that, we'll see. Carney's Conundrum It'll be those no-deal prospects and the new realities of Brexit that Bank of England Governor Mark Carney and his colleagues will have to tackle when they announce their latest policy decision on Thursday. The plummeting pound and lower bond yields are threatening to make the base case at the bank, for a gradual tightening of policy based on the assumption of a smooth Brexit, effectively meaningless. At least one big fund manager thinks the U.K. may be the next developed nation that will have to embrace zero yields on its government bonds. Banks, Banks, Banks If you're sick of bank earnings, you may want to look away now. It's another bumper day for reports from European lenders and we're already had a revenue beat from Standard Chartered Plc and net income ahead of expectations from Societe Generale, plus we still have Barclays Plc and France's Natixis SA to come. Elsewhere, German industrial giant Siemens AG warned on its margin guidance and insurer AXA SA reported net income below expectations. Still to come, we'll have oil major Royal Dutch Shell Plc and exchange operator London Stock Exchange Group Plc. Coming Up... The dollar was higher in Asian trading after the Fed decision and stocks slid by less than they had on Wall Street earlier, with Japanese shares supported by the decline in the yen. Still ahead, yet more economic data from Europe to add to the slew of negative reports already digested this week, this time covering manufacturing. Add to that jobless claims and manufacturing numbers from the U.S. later, plus a rate decision in the Czech Republic. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen's interested in this morning The first Fed rate cut since the financial crisis is an opportune time to take a look at central banks around the world and what exactly they have in their armory. Tom Orlik of Bloomberg Economics has done just that. He found easing cycles for developed market central banks tend to be around 75 basis points for mild slowdowns and closer to a whopping 500 basis points for major downturns. No major central bank has enough space for the latter, he says, and the European Central Bank and Bank of Japan don't even have enough to deal with the former. That leaves non-conventional quantitative easing policies such as forward guidance and asset purchases to take up the slack. The problem is according to Orlik, with yields already low, asset prices high and a full slate of QE already behind us, the effectiveness of these strategies will be limited. All the more so, when central banks are easing all at the same time. Investors are going to have to question how much faith they have in the ability of policy makers to come to their rescue, should it be required.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment