Welcome to the Weekly Fix, the newsletter that knows the bond rally doesn't take a holiday even when the United States does. –Luke Kawa, Cross-Asset Reporter and Tracy Alloway, Executive Editor

Sovereign Supreme

A brief review of the action in developed-market sovereign debt this week that's taken the Bloomberg government debt total return index to record highs:

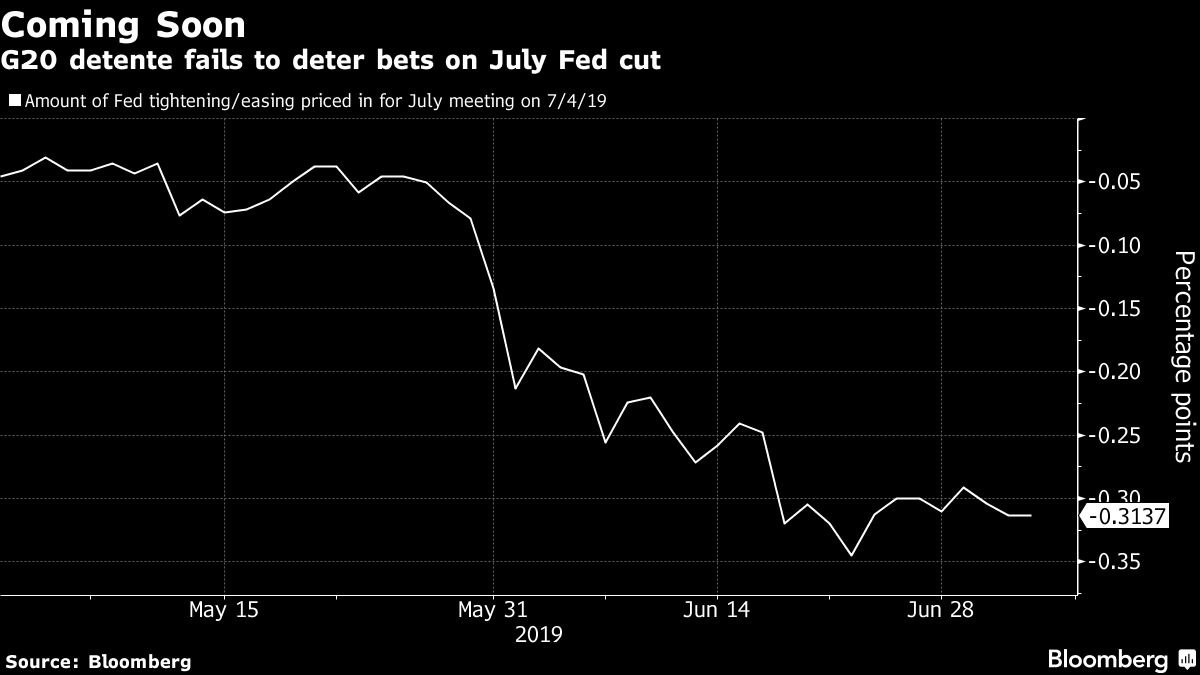

The trade détente between the U.S. and China last weekend moderately reduced the odds and magnitude of Federal Reserve easing priced in for the next year, but that negative catalyst for bonds was immediately overwhelmed by repeated reminders that manufacturing around the world is mired in a soft patch.

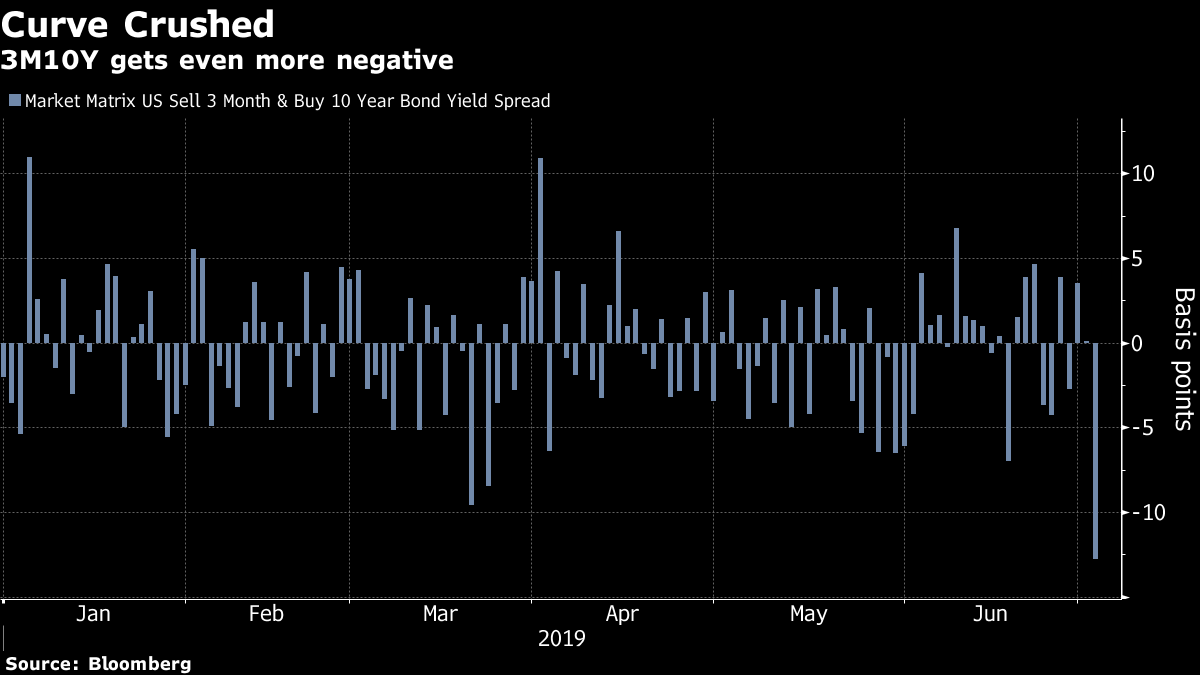

Then on Tuesday, a combination of debt-ceiling fears starting to creep into the front of the curve and less-than-dovish Fedspeak from Cleveland's Loretta Mester contributed to the biggest one-day rise in the three-month T-bill yield of 2019.

Geopolitical headlines added to the unease that sparked a rush into haven assets, including the 10-year Treasury. It all made for the biggest one-day drop in the three-month, 10-year yield curve for the year so far. That move erased more than all of the steepening that took place in June.

The fixed-income rally continued on Wednesday, with the U.S. 10-year yield closing at its lowest level since Donald Trump's election victory in 2016. The gains in Treasuries have been so unrelenting that even long-time bull Steven Major at HSBC Holdings Plc thinks it will reverse by year-end.

Seemingly, this was a case of global forces dragging American yields down.

Rates on Britain's 10-year gilts dipped below the Bank of England's policy rate for the first time since 2008 as Governor Mark Carney warned of the downside risks to growth and deemed it "unsurprising" that markets were betting on more stimulus. Ten-year German bund yields also fell below the European Central Bank's deposit rate, a surefire sign that the market is demanding more monetary accommodation before President Mario Draghi exits stage right.

With the U.S. off on holiday Thursday, the bond advance continued in Europe.

This week has been heavy on meaningful events – G-20 post-mortem, Christine Lagarde to the ECB, Fed board nominations, the Carney shift – with the price action to match. And yet, the fixed-income history of this shortened week may ultimately be headlined by the fallout from Friday morning's U.S. nonfarm payrolls report. It's the most important piece of data that lands between now and the Fed's policy meeting at the end of the month, for which more than a full 25 basis point cut is currently priced in. There's every reason to suspect another volatile session is in the cards.

Stateside, the fourth of July fireworks were on display Thursday night. In markets, the conflagration might continue Friday. The last time there was a jobs day immediately after Americans celebrated Independence Day – during the taper tantrum of 2013 – the 10-year yield climbed nearly 25 basis points over the course of the session, with the two-year, 10-year curve widening by almost as much.

The occasion comes at a time when all of Bloomberg's U.S. economic surprise sub-indexes are in negative territory for the first time since 2015.

Jim Bianco of Bianco Research – who identified himself as having been considered for a position on the Fed's Board of Governors in a Bloomberg Opinion column– highlighted an astounding fact that screams rate cut, no matter what the June jobs report shows.

There's $38-trillion of developed market sovereign debt. And 94% of it has a yield below the federal funds rate. Take out U.S. maturities longer than 10 years, and that share rises to 99%.

Should the rally in the long end accelerate in July, Fed officials may well be asking themselves, "What do we do with the single highest interest rate in the developed world?" at their month-end meeting, Bianco said.

In his mind, it's a rhetorical question.

Personnel Is Policy

This week brought a few lessons:

If you want to run a major central bank in the 21st century, consider getting a law degree instead of a PhD in economics. And if you want to be part of Trump's Fed, consider public praise of the president or a documented history of dovishness that matches his current policy prescription.

International Monetary Fund chief Lagarde is poised to become the first woman to lead the ECB. Strategists perceive that continuity with Draghi is now the order of the day, from a policy-formulation standpoint – which would not likely have been the case had Jens Weidmann, the Bundesbank president who has long been critical of ECB easing measures, got the top job.

Describing Lagarde as a politician fails to do justice to her career, though she may often need to enlist her political savvy to navigate the central bank's most acute challenges – not least of which may be getting finance ministers to take up more of the stimulus burden.

Kit Juckes at Societe Generale SA puts it this way: "Two jobs for new ECB boss. Banking union, and getting EU finmins to rethink fiscal policies. Not sure an econ PhD or a big career in cutting rates would help as much as running the IMF."

Similarly, Banque Pictet & Cie. global strategist Frederik Ducrozet hailed Lagarde's "experience and gravitas" while noting her support for unconventional monetary policy – which helps, as she seems set to preside over a resumption of quantitative easing.

"Lagarde's political connections and good reputation should help her to preserve the ECB's credibility and influence, with the hope that she can contribute, in her own way, to a shift towards a more proactive fiscal policy in Berlin," he concludes.

The move means the ECB and the Fed will both be run by lawyers. This means Philip Lane, the ECB's chief economist, will have the same kind of cachet in conceptualizing and influencing monetary policy as Fed Vice Chairman Richard Clarida has on the other side of the Atlantic.

Speaking of the Fed, Donald Trump announced his intention to nominate Christopher Waller, director of research for the St. Louis Fed, and Judy Shelton, an informal adviser to the president and current executive director for the European Bank for Reconstruction and Development. Both want easier policy and distrust the Phillips Curve. That's where the similarities appear to end.

Waller's policy views appear to mirror those of Jim Bullard – his longtime friend, onetime mentee, and current boss, who passed on a Fed board gig. That is to say he has many intriguing thoughts about the way monetary policy has been conducted this cycle, and disagrees with the degree to which policy has tightened.

"We didn't see any overheating in the economy coming, so the question was: why are we raising rates?'' he told Bloomberg's Kathleen Hays in a recent interview. "We didn't see any reason to raise rates just for the sake of raising rates.''

Shelton's views have been both intriguing and adaptive over the years. As a potential appointee, to say she is closer to Stephen Moore than Christopher Waller would be an understatement.

Sam Bell, policy director at the Employ America think-tank, has documented some of Shelton's intellectual journey.

She's perhaps best know for having advocating a return to some sort of a gold standard. But Shelton has also mused over the decades about the potential for dollarization in emerging markets, and a

more global currency, to boot.

She doesn't see why a central bank should be able to buy government debt. While this remark appears to be solely about QE, it's also important to note that purchasing debt through open market operations has traditionally been a very basic and uncontroversial mechanism to manage short-term interest rates.

In 2013, she put it in stark terms: the continued Fed underwriting of deficit spending will produce "the steady demoralization of democratic capitalism."

Shelton's policy views today: rates should be substantially lower, and a Bretton Woods conference to reset the international monetary system should take place. And it "would be great" if such an event happened at Trump's Mar-a-Lago.

Post a Comment