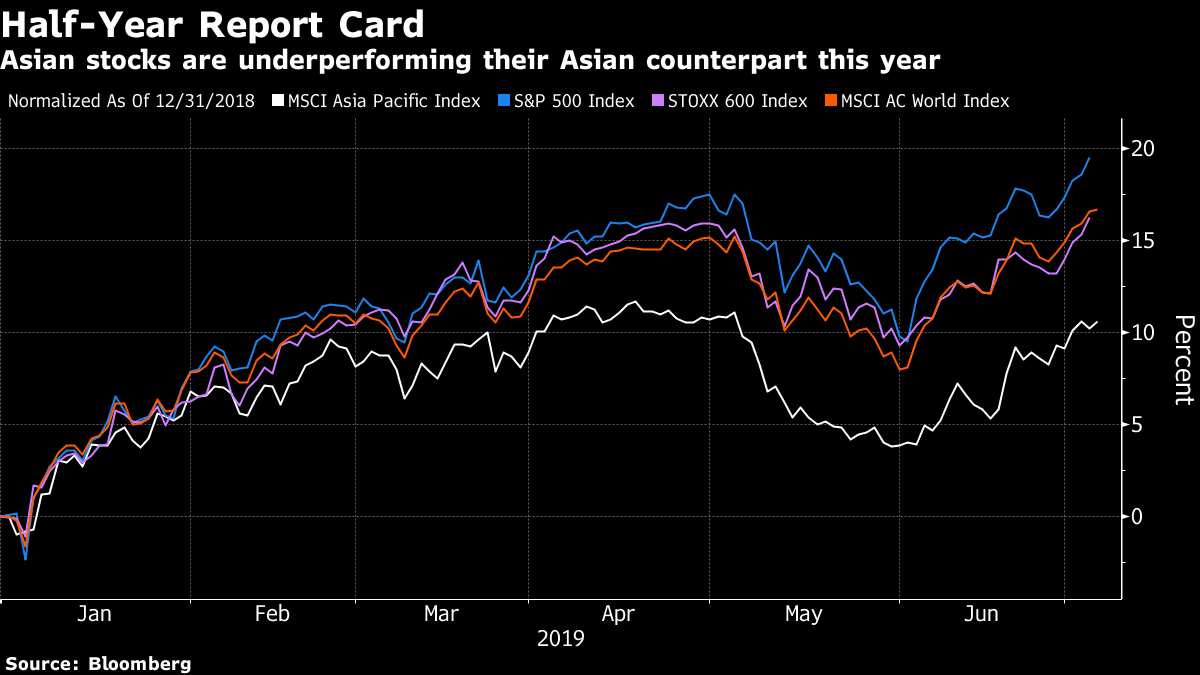

| A seized supertanker has sparked a diplomatic spat between the U.K. and Iran. Top earners increase their slice of the income pie. And it's budget day in India. Here are some of the things people in markets are talking about today. Supertanker Seized The U.K. and Iran are embroiled in a diplomatic dispute after British Royal Marines and Gibraltarian police seized a supertanker carrying Iranian oil to Syria in violation of sanctions. Iran said the action off Gibraltar was illegal and summoned the British ambassador to the Foreign Ministry in Tehran. It comes as the U.K., France and Germany try to stop Iran walking away from the nuclear deal. Stocks Muted Asian stocks looked set for a muted start to trading with no direction from their U.S. counterparts thanks to the American holiday. The dollar was flat as investors await the key U.S. jobs report Friday. Futures in Japan, Australia and Hong Kong were little changed, as were U.S. contracts. European shares drifted Thursday in a lackluster session marked by thin trading volumes. Treasuries weren't trading thanks to Independence Day. Gold slipped but stayed above $1,400, while oil futures fell, even amid further Middle East tensions. India's Budget India has lost its status as the world's fastest-growing major economy; with Friday's budget, Prime Minister Narendra Modi has his first chance since a decisive election win to give things a boost. Newly appointed Finance Minister Nirmala Sitharaman is expected to boost spending and provide tax relief to consumers. With the global outlook turning gloomy, and the Reserve Bank of India having already cut interest rates three times this year, the focus is shifting to the government to play its part. Here's a guide to the biggest challenges Sitharaman faces in her new job. China's Buildings Are Watching Property technology is altering the way urban dwellers interact with their living and shopping environments — most notably in China, where convenience can often trump privacy — by using big data and machine learning to help individuals and companies buy, sell and manage real estate. In 2018, investment into proptech startups came to almost $20 billion, data from market research firm Venture Scanner show. Installing sensors around residential communities to help with property management and using facial recognition technology to control access to offices are just two examples of the trend. Not Fair Top earners are taking a bigger slice of the global income pie, according to the International Labour Organization. Its research shows that just 10% of workers receive almost half of total labor income, while the lowest 20% earn less than 1%. Between 2004 and 2017, the top 20% of earners increased their share to 53.5% from 51.4%, potentially adding fuel to talk of inequality. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Cormac's interested in this morning With the first half of the 2019 in the bag, Asia traders can be forgiven for feeling frustrated — the region has been the clear global laggard. The MSCI Asia Pacific Index is up 11% year-to-date, underperforming both the S&P 500 Index's near 20% gain and the 16% rise in Europe's Stoxx 600 Index. The MSCI AC World Index has climbed almost 17%. With the Sino-American trade war rolling on and Chinese growth slowing, investors have turned their backs on the region. Global mutual fund allocations to Asia are near decade lows and hedge fund exposures remain subdued, according to a note Wednesday from Goldman Sachs Group Inc.  Perhaps of more concern for the rest of the year is the fact that earnings revisions are faltering again. The pace of downgrades for Asia ex-Japan earnings is beginning to accelerate, UBS Group AG strategists wrote in a separate note. The weakness in June's purchasing manager's data suggests this trend is likely to continue in the coming months, they said. The most likely culprit is the increase in U.S. tariffs on $200 billion in Chinese goods in May. Unless this trend in revisions reverses,the full-year scorecard could well show Asia lagging once again. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment