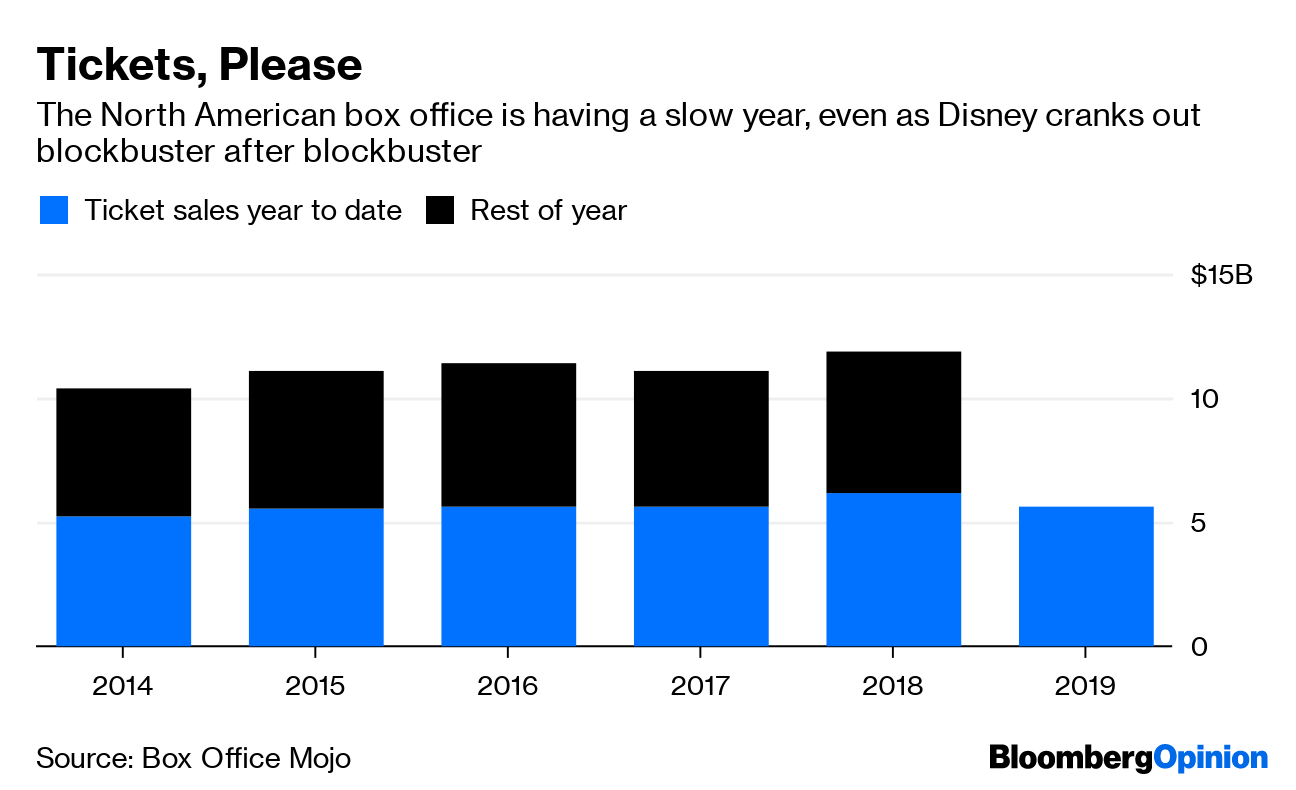

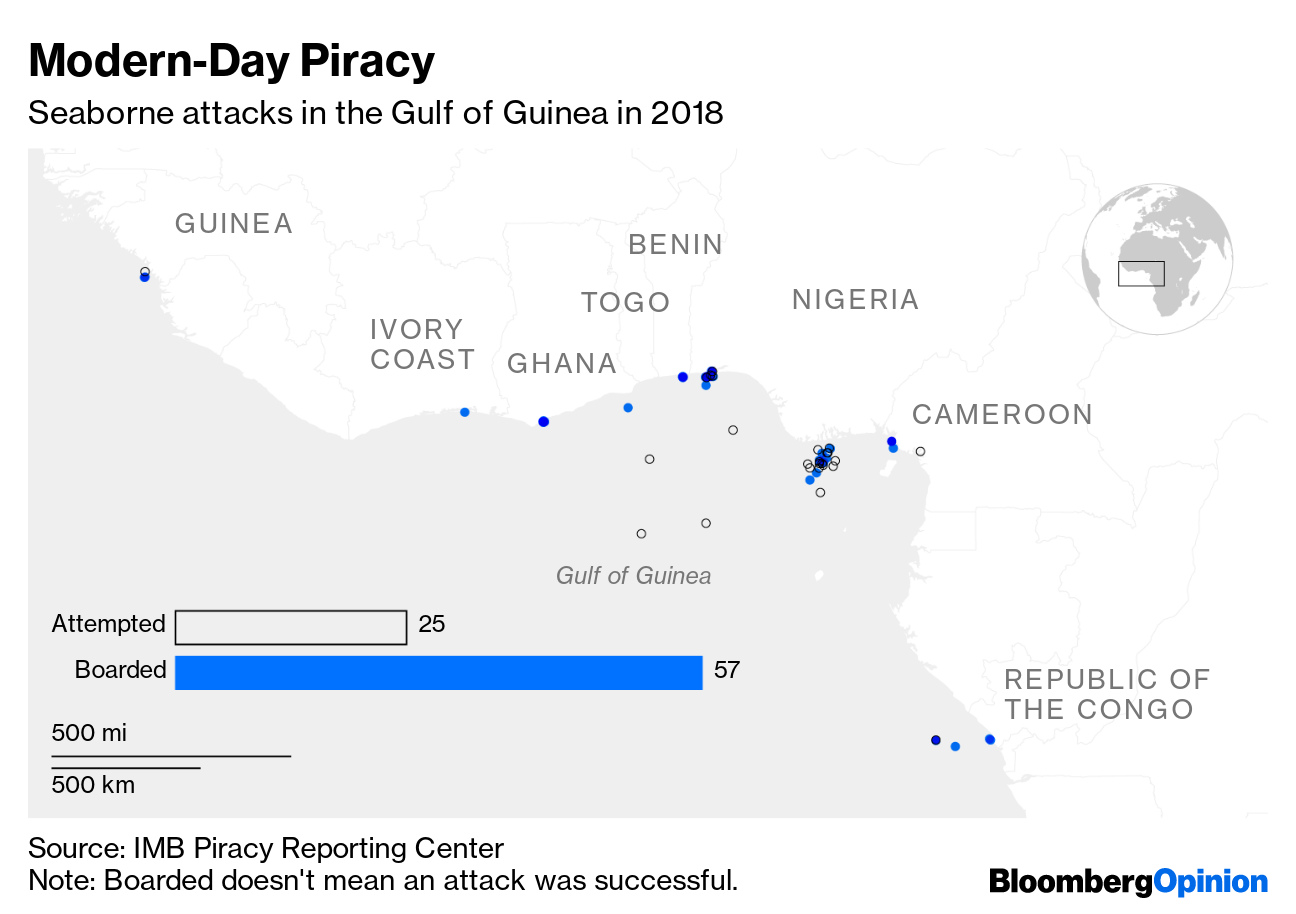

Today's Agenda  OPEC+ Speaks, Nobody Listens In the 2010 movie "Hot Tub Time Machine," sad sacks enter a hot tub that is a time machine, travel to the past, and (spoiler alert) vastly improve their lives. OPEC's time-travel efforts won't be so fruitful. The characters in that movie went back to 1986, which is roughly the last time OPEC was relevant. Now the cartel is reduced to desperately trying to keep a floor under oil prices. Since the start of 2017, OPEC+ (as it's called when joined by oil-rich buddies such as Russia) has squeezed production to address a global oil glut. At a meeting this week it agreed to keep doing that. As Liam Denning notes, this barely lifted oil prices, highlighting OPEC+'s weakness. Today oil gave all those gains back and then some, with Nymex crude tumbling more than 4 percent to less than $58 a barrel. The trouble is that OPEC+ seems to be pushing on a string. Oil fell today partly because of fears that a global economic slowdown will hurt oil demand. OPEC+ hopes to slash inventories to a level not seen since the glory days of 2008, when oil was solidly priced in three figures. This is wishful thinking, Liam Denning writes in a second column, partly because there's a new, more relevant player on the scene: U.S. shale oil. Sustained higher oil prices will either truly crush demand or encourage frackers to pump more oil, boosting supply. Neither ending is a happy one for OPEC. Europe Strikes Back The applause for President Donald Trump's China trade truce was still echoing when his administration announced it might slap tariffs on more European goods. Never a dull moment! Trump's approach to trade is not exactly measured and reliable – but given America's power, Europe may have no choice but to play along, writes Lionel Laurent. That doesn't mean the Old World will go down quietly. It just signed a new trade deal with four South American countries, which Therese Raphael writes sends a message the global trade order still has a pulse in the Trump era. This particular deal also took 20 years to hammer out, which should send a chill down the spines of Brexiteers promising Britain can quickly cut new trade deals after it crashes out of the EU. China Returns to the Debt Well On the world's other trade-war front, China, the economy is still struggling. That's partly because of trade but also because the government is trying to tame the debt market. So it's maybe a bit worrisome that China is turning increasingly to the hair of the dog that bit it – lending – to end a year-long slump in auto sales, Anjani Trivedi writes. This adds more risks to an already risky credit system. In Hong Kong, meanwhile, protests have caused a spike in interbank lending rates, Shuli Ren notes, which is maybe the last thing that financial sector needs. But at least Trump seems to be backing down (for now, maybe) on Huawei Technologies Inc., China's tech champion. That's annoying for U.S. allies who bought into Trump's warnings Huawei is a dire national-security threat, writes Eli Lake. Why should they shun Huawei if Trump's just going to embrace it? Further China Reading: Far from a weight around Australia's neck, China's economic slowdown may be a boon. – Dan Moss A Simple Idea for Data's Complex Problem One feature of modern life we all just accept is the fact that, increasingly, the biggest product our biggest tech companies sell is us – our likes, fears, connections, and other data. What we don't accept so easily is how sloppy companies can be with that data. So a new bill in Congress forcing companies to assign a price to our data makes some sense, until you ask: Then what? What good will it do anybody to know how much our data are worth, Bloomberg's editorial board asks. And who decides the value? It all seems unnecessarily complicated, when a much simpler way to make tech companies behave is to make them live up to a fiduciary standard when handling our data. Telltale Charts Even with the Walt Disney Co. cranking out blockbuster after blockbuster, this has been a bad year for movie theaters, writes Tara Lachapelle. And the blockbusters will dry up next year.  The Somali pirate problem didn't really go away; it just moved to the other side of Africa, writes Toby Harshaw (with help from this cool map from Elaine He).

Further Reading

Forget all the recession talk; the global economy is set up for a second-half rebound. – Conor Sen Taking over for Mario Draghi at the ECB, Christine Lagarde will have to prove her independence. - Ferdinando Giugliano Puerto Rico's bond cancellation shouldn't set a precedent for Illinois and other troubled munis. – Brian Chappatta Fixing income inequality isn't the only way to bring more Americans into the middle class. – Noah Smith Progressives want to end U.S. involvement in Afghanistan and elsewhere in the Middle East, but don't say much about how they'd do it. – Hal Brands Schools should teach kids how to use the Internet better. – Tyler Cowen ICYMI Nike Inc.'s in another political spat. Dr. Doom is at it again. Keep your burgers off the grill. Kickers The world's most popular banana is endangered. (h/t Mike Smedley) Young Arctic fox travels 3,506 kilometers in 76 days. (h/t Scott Kominers) Venice is dying a slow death. Scientists search for a mirror universe. Note: Please send Nikes and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment