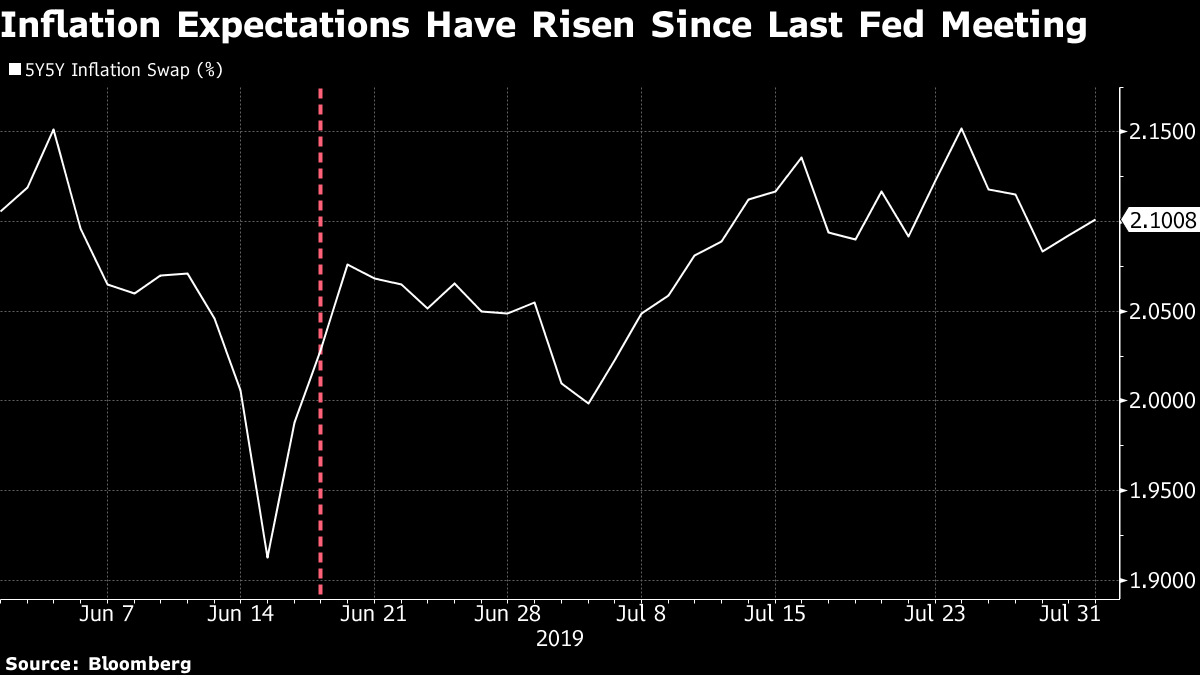

| Trump lashes out at China as trade talks restart. The White House is keeping a close eye on China's military presence on the border with Hong Kong. And Apple's outlook is rosy. Here are some of the things people in markets are talking about today. Welcome to Shanghai President Trump slammed China on the day his trade team arrived in Shanghai, accusing it of continuing to "rip off" the U.S. He tweeted: "China is doing very badly, worst year in 27—was supposed to start buying our agricultural product now—no signs that they are doing so." He added: "That is the problem with China, they just don't come through." His tweets came just as the two nations resumed negotiations following a three-month breakup. Here's how we got to this point. Border Patrol The White House is monitoring a buildup of Chinese forces on Hong Kong's border, a senior administration official said. Earlier, Beijing said recent violence in the city's protests was the "creation of the U.S.," laying direct blame on Washington—which American officials denied. China has been trying to shift responsibility for the unrest to unspecified foreign forces. Hong Kong GDP The unrest and ongoing trade spat haven't been good for Hong Kong. Economic momentum has weakened in recent months on "uncertainties," leader Carrie Lam said. There's "no room for optimism for the second quarter and the entire year," the city's chief executive told business groups. Consensus is for GDP growth in the June quarter to pick up to 1.5% year-on-year while slowing to 0.9% from the prior period. Rosy Outlook The iPhone didn't do so well, but Apple investors are looking ahead. The company predicted current-quarter sales near the high end of estimates—$61 billion to $64 billion—a sign of optimism in new handsets coming later this year. The all-important iPhone missed on both unit sales and revenue last quarter, but wearables and services are picking up the slack. Shares gained in post-market trading. Brexit Blame Game Boris Johnson said it's "up to the EU" to compromise on a Brexit agreement and avoid a no-deal divorce. "If they can't compromise, if they really can't do it, then clearly we have to get ready for a no-deal exit," he said, reiterating that Britain won't accept an Irish backstop. The U.K. prime minister is expected next week to commit hundreds of millions of pounds on hospitals and health care technology, as he seeks to deliver on his own most contentious political promise, a person familiar said. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Tracy's interested in this morning Well, it's Fed day. There will no doubt be a ton of information to pick over from the U.S. central bank's decision, but for me the interesting thing to watch will be the market's reaction to Fed Chair Jerome Powell's press conference. The market is pricing in a 25 basis point cut for this Wednesday, but it's clearly expecting more cuts later this year. If Powell doesn't signal that he's up for additional easing, investors could be disappointed.  In a similar vein, it appears there's potential for confusion around any mention of "data dependency." That phrase used to signal that the Fed was simply in wait and see mode; watching U.S. eco date to determine whether cuts or hikes were warranted. But with U.S. data still relatively strong (market-based measures of inflation have actually risen since the last Fed meeting, and the Fed's preferred measure of inflation, Core PCE, shows some signs of firming) the phrase seems likely to be interpreted more hawkishly than it has been previously. All of which is to say that the bar for a positive market reaction today looks pretty high. You can follow Bloomberg's Tracy Alloway at @tracyalloway. The best in-depth reporting from Asia Pacific and beyond, delivered to your inbox every Friday. Sign up here for The Reading List, a new weekly email coming soon. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment