| Inside: Some BP oil may never "see the light of day." These national leaders led hot-air production in 2018. Junk debt goes green. Chubb is done with coal and Bank of America is done with private prisons. A skier's guide to climate change (Hint: Go now). — Eric Roston and Emily Chasan Sustainable Finance  Insurer Chubb said it will stop underwriting coal. Saying it recognizes the reality of climate change, Chubb will no longer underwrite policies for construction or operation of new coal-fired plants and it will stop making new debt or equity investments in companies that derive more than 30% of their revenue from coal-mining or energy production from coal. BP's head of strategy said that some of the company's oil "won't see the light of day," because it's likely to be too expensive or complicated to extract. Oil has long been known as a dirty fuel. For investors, it is now a dirty word, the FT writes, after the London Stock Exchange changed a rule to allow FTSE Russell to relabel a group of oil-and-gas providers "non-renewable energy." U.K. companies could face requirements to disclose climate-related risks under government plans to slash carbon emissions in the country. The government published a Green Finance Strategy July 2 aimed at making the U.K. carbon neutral by 2050 and turning London into a center for green investment. Financial regulatory bodies in the U.K. jointly supported the strategy, saying that climate change "presents far-reaching financial risks relevant to our mandates."

Meet the political leaders who had the biggest carbon footprints of 2018.

The U.S. high-yield bond market saw its first green-bond issuance in more than two years. Hannon Armstrong raised $350 million last week.

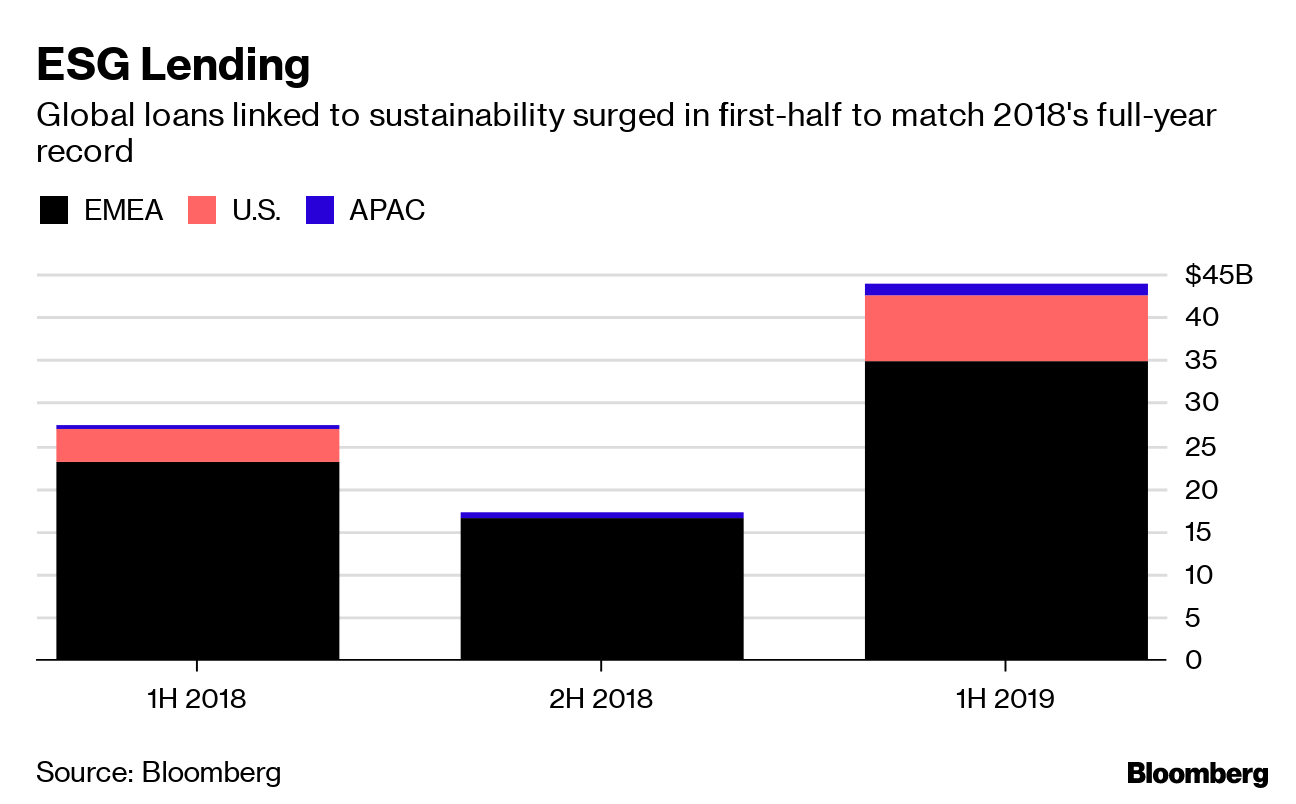

The boom in ESG-linked loans continued in the first half of the year with issuance leaping 63%, to $44 billion. That volume has already matched 2018's full year tally. In about half of deals, borrowing costs are linked to ESG grades from a third-party rating provider.  In Brief - Germany's KfW Group is pulling out of loans for new coal projects.

- Powering Past Coal Alliance, a public-private collaboration backed by investors including the Church of England, issued guidance to help the financial sector commit to the clean-energy transformation.

- PG&E is lobbying California for legislation that would allow it to securitize future profits to pay for wildfire liabilities.

- BNP Paribas passed Bank of America Merrill Lynch as the third-biggest global green bonds underwriter. Credit Agricole CIB holds the top spot with 6.65% market share.

- Hermes Investment Management and Beyond Ratings said companies that score highest on ESG issues have tighter credit-default swap spreads, according to new research.

- State Street Global Advisors launched an ESG-focused money market fund.

- Aviva introduced a workplace pension default investment strategy that considers ethical and ESG factors.

- The $142 billion Ontario Teachers Pension Plan unveiled a detailed plan on how it will make both short and long term investments in response to climate change.

Environment  France smashed multiple records in a heatwave made at least five times more likely by climate change. Last month was the hottest June ever recorded globally, with Europe taking a significant hit. Wildfires in eastern Germany caused munitions to explode at an abandoned military firing range, and chicken manure in Spain self-ignited, causing Catalonia's worse wildfire in two decades, AP reported. Trade in EU carbon opinions surged as the heatwave helped drive futures prices close to an 11-year high.

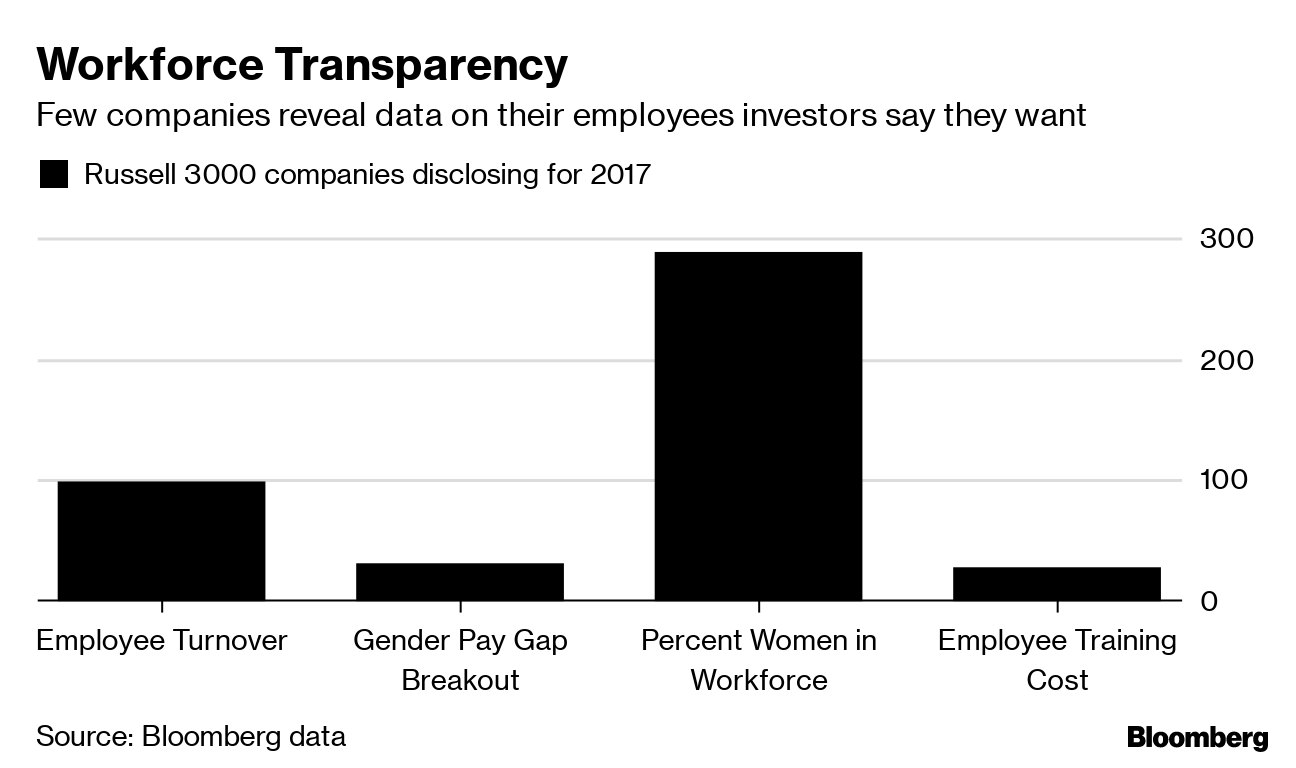

Recyclable diapers may be upon us — and not the old-fashioned cloth variety. Absorbent materials that go into diapers, sanitary products and some mop-pads can be made up of multiple kinds of plastic and are therefore difficult to separate and recycle. Procter & Gamble is seeking to patent recyclable versions of absorbent materials, to quell public backlash over the scale of consumer waste. What happens to global emissions as more and more countries require air-conditioning?, asks Chris Bryant of Bloomberg Opinion. India is expected to surpass the U.S. in coal power generation by 2030, becoming the world's second-biggest CO2 emitter from the power sector. Prime Minister Narendra Modi is taking advantage of the post-election mood to push through a mobility transformation that will electrify millions of scooters and rickshaws. Cummins, which is one of the world's largest makers of diesel engines, said it will acquire hydrogen fuel-cell maker Hydrogenics Corp. for about $290 million, including debt. Fuel-cell proponents say the technology makes sense for trucks and buses that have to dock at centralized depots. Bloom Energy Corp. announced a $250 million deal with Duke Energy for enough fuel cells to produce 37 megawatts of power. Weird weather delivered record snowfall this past winter that is keeping ski resorts open deep into summer. Bloomberg Businessweek's skier's guide to climate change says you should enjoy it for now. A freak hailstorm left Mexico's Guadalajara blanketed in ice this week. Nestle will wrap its Yes! bar in paper packaging to cut down on the consumer-goods industry's plastic problem.  Social More than 125 investors, overseeing $14 trillion in assets under management, asked companies this week to report more workforce-related data, from employee turnover to the gender pay-gap.

"This has long been a neglected aspect of ESG -- we've seen almost two decades focused on environmental issues," said Vaidehee Sachdev, senior research officer at ShareAction, which is backing the initiative. "Diversity metrics are chronically under-reported."  Bank of America will stop lending to companies that run private prisons and detention centers, after conducting site visits and holding discussions with civil rights leaders. Gap, Intel and Cisco Systems are among 14 companies who have signed the California Pay Equality Pledge, a voluntary program designed to root out biases leading to the gender wage gap in the state. New York made it easier to bring workplace sexual harassment claims to court, the third state to do so after California and Delaware. The new law is expected to prompt employers to update their anti-discrimination policies. Nike pulled its Fourth of July sneakers from stores, after criticism that the famous Betsy Ross flag has become a symbol for far-right groups. Governance Nearly 40% of Kroger shareholders voted to support an As You Sow shareholder proposal that would ask the largest U.S. supermarket chain to make all its packaging recyclable. Institutional Shareholder Services threw its support behind a dissident faction trying to remake the board of EQT Corp., an Appalachian gas provider that the critics say has underperformed since a big 2017 acquisition. Glass Lewis last week supported EQT, which it said was headed in the right direction. The SEC Division of Corporate Finance will hold a public event July 18 to hear from investors and others about how "short-termism" affects capital markets and whether the agency should reduce the frequency of financial reporting. President Trump indicated an interest in the question in a tweet in August.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

Post a Comment