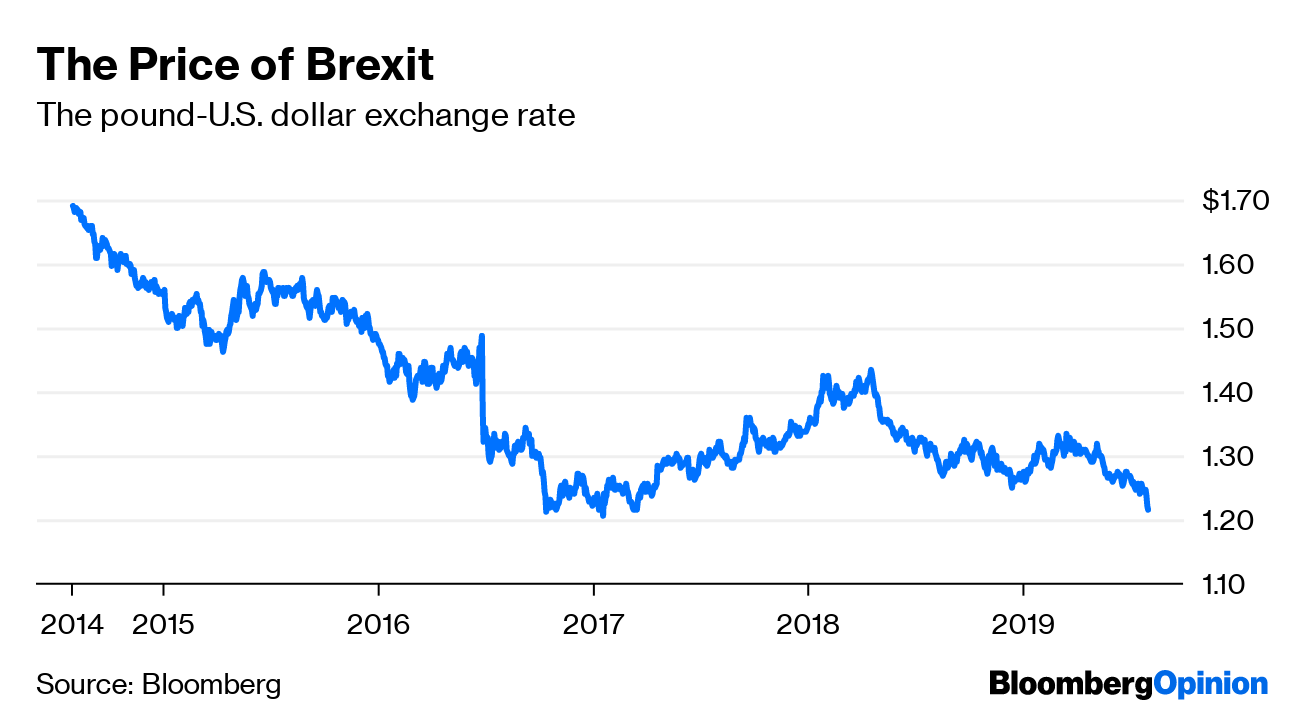

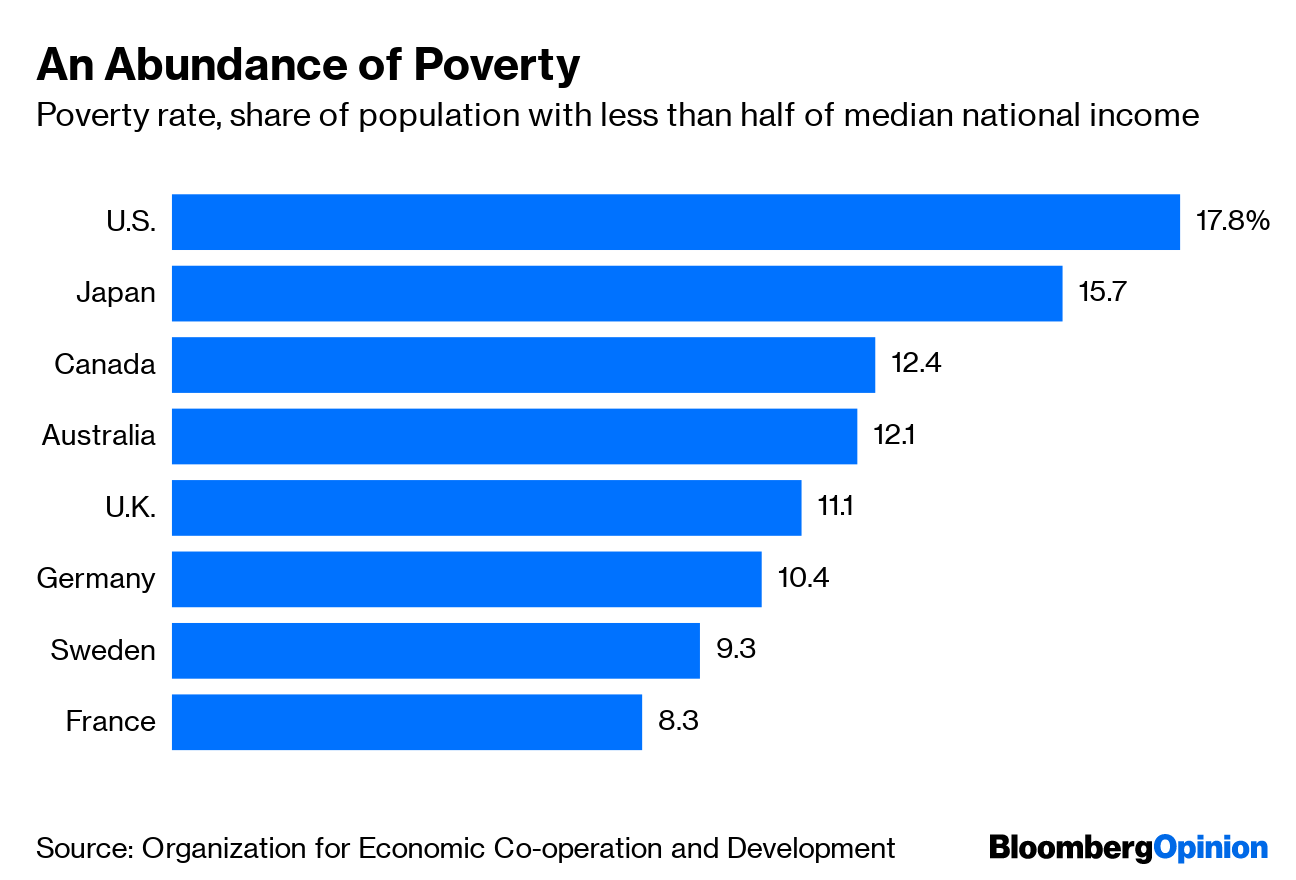

Today's Agenda  Democrats, Assemble! Because America could not get enough of the sweaty speed-dating experience of the first round of Democratic presidential debates, we're doing it all over again. In tonight's opener, Bernie Sanders and Elizabeth Warren will headline, Pete Buttigieg will make another push for the top tier, Beto O'Rourke will try to figure out what it is that he does, and Marianne Williamson will taste colors. Five other people will also be there. For those replacement-level candidates, this is probably do-or-die time, Jonathan Bernstein writes. The next round of debates won't be until September and will be much more exclusive, meaning the Bullocks and Hickenloopers of the world will soon start dropping like Swalwells. With two dozen candidates, it can be confusing keeping track of where they all stand on the issues. Of course, there aren't many "issues" people care about any more, but health care sure is one of them. That's why we all owe a debt of gratitude to Max Nisen and Elaine He for putting together a slick, super-helpful, interactive data visualization of where all the Democrats come down on health care. Whether you're looking for a candidate who shares your values or just want to know whom to call a "socialist" on Twitter, this is the dataviz for you. Further 2020 Reading: Tom Steyer keeps demonstrating why amateurs aren't so great at politics. – Jonathan Bernstein The Energy Times They Are A-Changing If oil had a patron saint, it would probably be T. Boone Pickens. The son of an oilman, he made his fortune in the stuff and then became a household name buying and selling companies that produced it. So it says a lot that he's getting into wind and solar. Just last year, his investment firm launched an ETF meant to cash in on rising oil prices, with the ticker symbol BOON. But BOON never really BOONed, and now Pickens is shifting the fund's focus to renewables, ticker symbol RENW. This is partly about oil companies not being especially thrifty with any BOON of rising oil prices, notes Liam Denning. But it also marks a paradigm shift, in which not even Persian Gulf tensions can boost oil much in a world swimming in the stuff and looking for cleaner alternatives. That even somebody like Pickens – who has profited from oil basically since the day he was born in 1928 – recognizes this highlights just how out-of-touch President Donald Trump's energy stance is. To him, coal is clean and climate change is a Chinese hoax. In keeping with this worldview, he's trying to roll back the clock on Obama-era fuel-efficiency standards. But several automakers just signed a deal with California agreeing to clear a much higher bar. Why would they do this? For one thing, David Fickling notes, California is an enormous car market. For another, Trump's efficiency standards are far behind the rest of the world's, and automakers these days don't want to bother building different cars for different markets. Energy is getting cleaner, whether Trump likes it or not. Further Climate-Denial Reading: The U.S. isn't paying enough attention to the strategic threat of a thawing Arctic. – Hal Brands Forecasting the Fed Though Trump today demanded a "large cut" from the Federal Reserve tomorrow, central bankers will probably only deliver a small one. In fact, despite (or perhaps partly because of) Trump's hollering, the case for any rate cut at all has gotten much iffier lately, as economic data have improved, notes Bill Dudley. Tomorrow's small cut might be the last one for a long time. Of course, the economic numbers might deteriorate again. The recovery is long in the tooth. China and Europe are struggling. Trump keeps chucking bombs at global trade. Even in that event, though, it shouldn't fall only on the Fed to boost growth, Bloomberg's editorial board writes. For example, there's nothing the Fed can do about self-destructive policy from the White House. The trouble for the stock market here is that it could really use a more-dovish Fed, writes Robert Burgess. With earnings stagnant, the market needs super-low rates to justify its valuation. Trump won't be the only one angry if and when the Fed stands pat. Telltale Charts Currency traders have judged Boris Johnson's Brexit strategy and found it wanting, writes Ferdinando Giugliano. That makes Johnson's weak negotiating position with the EU even weaker.  The conservative theory of poverty – that it's all about moral failing – doesn't fit Japan, which has a lot of poverty but very little crime or drug abuse, writes Noah Smith.  Further Reading The U.S. and Europe really should work together to protect shipping in the Persian Gulf, to avoid accidents and deter Iran more effectively. – Bloomberg's editorial board There are signs Jared Kushner's Middle East "deal of the century" keeps getting worse for Palestinians. – Zev Chafets It's time to stop letting Europe automatically pick the IMF director. – Mohamed El-Erian Trump wants to make loyalist John Ratcliffe the director of national intelligence, but it probably won't help him. – Eli Lake India should let more stressed shadow banks fail. – Mihir Sharma Under Armour Inc. is still struggling at home. – Sarah Halzack ICYMI The housing-affordability crisis hits the heartland. California seeks to keep Trump off the ballot in 2020. Elon Musk is tweeting again. Kickers Humans interbred with four extinct species. India's tiger population is rebounding. How money was invented. Why kids invent imaginary friends. Note: Please send imaginary friends and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment