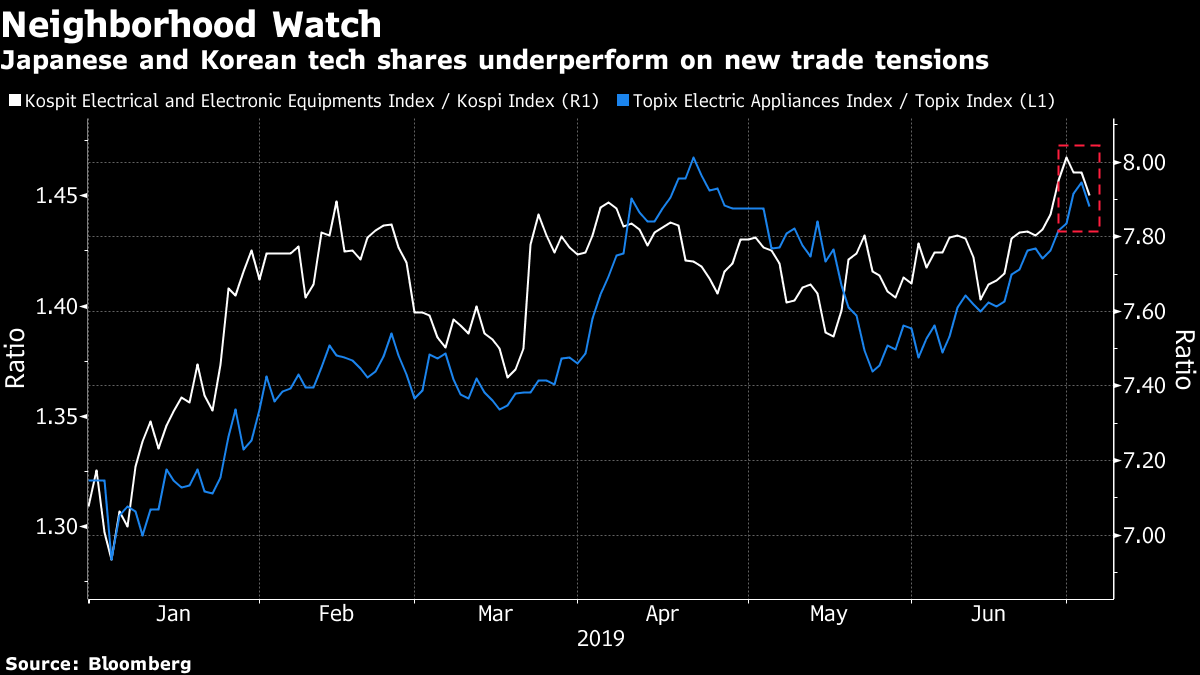

| China trade talks resume as Donald Trump says Beijing and Europe are playing a "currency manipulation game." Asia equity futures are higher after the Dow hits a record. And Boeing offers $100 million in "outreach" to Max crash victims' families. Here are some of the things people in markets are talking about today. Currency Game U.S. and Chinese officials will talk by phone in the coming week as they seek to resolve a growing trade war between the two countries, said Larry Kudlow, President Donald Trump's chief economic adviser. "They will be on the phone this coming week. And they will be scheduling face-to-face meetings," Kudlow said. Meanwhile, Trump accused China and Europe of playing a "big currency manipulation game" in a tweet, and said the U.S. should match their efforts "or continue being the dummies who sit back and politely watch as other countries continue to play their games." He didn't suggest specific policy measures. Stocks Hit High Asian equity futures are in the green after U.S. stocks rose, with the Dow hitting a record, in shortened pre-U.S. holiday trading. Treasuries extended the global bond rally, with 10-year yields down at 1.95%. The dollar was mostly lower, with the Aussie and kiwi leading G-10 gains. Oil jumped, while gold was flat. China Hits Out China accused the British government of "utter interference" in the affairs of Hong Kong after protests in the former British colony, and issued a strongly worded reminder the territory "is not what it used to be" before it was handed over to Chinese control. Its Foreign Ministry this week said the Sino-British "one country, two systems" agreement "no longer has any practical significance." The Communist Party's flagship newspaper, the People's Daily, blasted the protesters who stormed the city's legislative chamber on Monday as "extremists" who threaten to "ruin Hong Kong's reputation as an international business metropolis." Max Crash Compensation Boeing is offering $100 million to s upport the families of victims and others affected by two crashes of its 737 Max jetliner, which killed 346 people and have led to scores of lawsuits. The money will go toward "education, hardship and living expenses for impacted families, community programs and economic development in impacted communities," Boeing said Wednesday in a statement. The pledge — described as an "initial outreach" — underscores the high stakes for Boeing as it navigates one of the worst crises in its 103-year history. It Wasn't a Pie A routine keynote address by billionaire Robin Li morphed into a public humiliation when an unidentified man jumped onstage and doused the Baidu chief in water. Li was 10 minutes into a product introduction at an artificial intelligence developers' forum in Beijing when a man in a black T-shirt upended a small bottle over his head. It's unclear who the prankster was. "What's your problem?" Li said in English to the perpetrator. "As everyone has just seen, there will be a variety of unexpected happenings on the road to AI," said the CEO, before returning to his speech. Li created China's largest search service en route to a personal fortune estimated at $8.7 billion. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Cormac's interested in this morning Just when Korea investors thought they had caught a break with the weekend's trade truce, the grim reality of a slowing economy brought them quickly back to earth. From Monday's weak export data to the lowering of the government's growth outlook Wednesday, South Korean stocks have had no chance to enjoy the G-20 afterglow — the Kospi Index has underperformed the MSCI Asia Pacific Index by more than 2% so far this week. Further complicating matters, Japan moved to restrict the flow of materials vital to the country's all-important semiconductor industry Monday, escalating a long-running dispute between the neighbors over events dating back generations and hitting shares in Tokyo too.  The Kospi Electrical and Electronic Equipments Index is down almost 3% so far this week, and most Japanese technology stocks joined in the decline Wednesday after reports the tighter export restrictions could be expanded to additional products. While nobody is quite ready to announce the start of a soon-to-explode inter-Asian trade battle, investors are understandably nervous. An escalation could prompt Korea to take retaliatory measures related to its annual chip exports to Japan, putting the supply chain at risk, and even the tourist industry could be dragged in, according to Citigroup. Traders will be hoping this is one trade spat that gets nipped in the bud quickly. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment