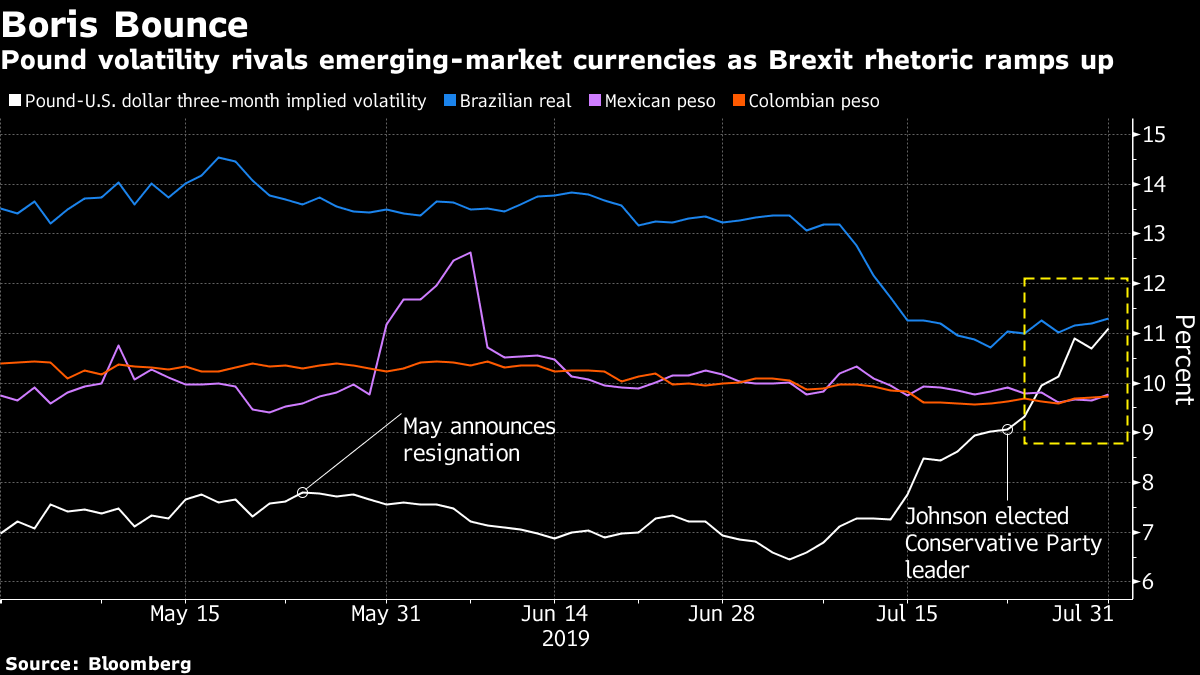

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Trade concerns are weighing heavily, no-deal Brexit fears are battering the pound and it's another bumper earnings day before the Fed announces its rate decision. Here's what's moving markets. 'Rip Off' The world is still awaiting confirmation of exactly how the trade talks between the U.S. and China are going, but President Donald Trump's tweets Tuesday appear to indicate any deal may prove elusive, as he lashed out and said China continues to "rip off" the U.S. The president may also have scored a victory in his battle with the World Trade Organization. China is defending itself with more stimulus pledges, also suggesting little optimism about a detente being reached, even if its negotiators are trying to woo their American counterparts at a landmark Shanghai hotel. Won't Back Down U.K. Prime Minister Boris Johnson has set out his stall and doesn't intend to back down from his demand that the European Union renegotiate the current Brexit deal that Parliament has rejected. His stance, backed by his cabinet colleagues but consistently turned down by the EU, has hit the pound hard as fears of a no-deal Brexit increase, raising questions about how low sterling could ultimately go. Johnson's making the stand against a rough economic backdrop in Europe, demonstrated by sinking confidence levels which will put more attention onto the euro area GDP data due on Wednesday. Cosmetics and Banks Another bumper day for earnings fans. French cosmetics giant L'Oreal SA reported a slump in North American sales after the close on Tuesday, but overall growth is the best in a decade. It's a very busy day for the European banking sector. Credit Suisse Group AG's revenue topped estimates, France's BNP Paribas SA's income beat expectations and Spain's BBVA SA also reported net income a little ahead. The U.K.'s Lloyds Banking Group Plc and Italy's Intesa Sanpaolo SpA are still to come. Also note that Airbus SE, the planemaker, beat earnings expectations. Beyond iPhones Results from Apple Inc. make for interesting reading. Shares in the technology giant rose following the report, where it projected revenue ahead of expectations on new models of the iPhone. But there's also a shift taking place whereby the group generated less than half its quarterly revenue from smartphones for the first time since 2012, a sign of the increasing push by Apple to move away from a reliance on its flagship product and to aggressively pursue growth from services and wearables. Keep an eye on its European suppliers for any read-across. Coming Up... Trade concerns weighed on Asian stocks but eyes will now turn to the Federal Reserve and its policy decision, due to come after European markets have closed. Oil prices jumped a little as traders bet on the Fed following through with an interest rate cut and as tensions with Iran linger. U.S. oil inventories will also arrive in the European afternoon. Plenty of economic data to chew over as the day progresses, including euro-area inflation and consumer-confidence numbers from the U.K. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen's interested in this morning Sterling is buckling again, having fallen every day but one since Boris Johnson took over as prime minister on July 24, to its lowest in more than two years. And traders are betting the Bank of England could add further pressure to the currency when it meets this week. That's sent sterling-dollar volatility to levels higher than emerging-market currencies such as the Mexican and Colombian pesos and in line with that of Brazil's real. Money markets are now pricing in more than a 60% chance of a 25-basis point rate cut by December on increased concerns about a no-deal Brexit. That compares with just 20% in June, shortly after the BOE bucked global trends and cited the need to raise rates in coming years. The central bank is expected to signal it's unlikely to do so in coming months, removing a degree of support for the pound. Boris has yet to get the European Union to change their stance, but it seems he's managed to do just that for the policy makers on Threadneedle Street.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment