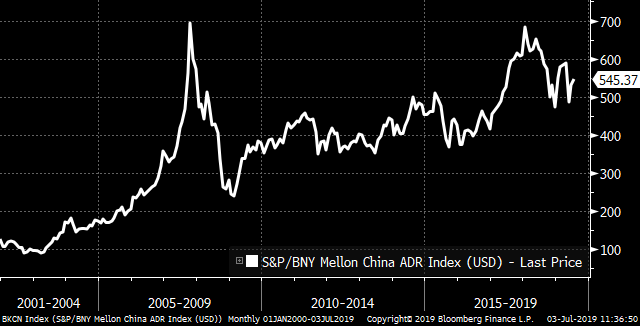

The never-ending bond rally doesn't end, new ECB and Fed picks, and PMI data points to downturn. New lows The global sovereign bond rally continues apace this morning. The yield on 10-year Treasuries dropped to the lowest level in more than two years, hitting 1.955%, while Germany's 10-year yield is trading within a gnat's whisker of the ECB deposit rate at -0.4%. The huge leg-up in Italian bondsstill has legs, with the 10-year yield hitting 1.703% this morning as the government eases its budget ambitions. Analysts don't see an end to the global rally anytime soon -- with a few notable exceptions. New heads The extended horse-trading in Brussels over who would head up some of the European Union's most important institutions has produced some surprising results. For markets, the most significant one is the selection of IMF chief Christine Lagarde as the next head of the European Central Bank. She would be the second French head of the bank, the first woman, and more of a politician than a monetary policy expert. In the U.S., President Donald Trump picked Christopher Waller and Judy Shelton as his nominees for the Federal Reserve board, with both of them seen as supporting easier policy. Nothing newComposite purchasing-managers data from the euro area this morning showed an expansion, coming in at 52.2 in June for the highest reading since November. The headline number hid a slump in both manufacturing and business confidence. A similar reading for the U.K. came in at 49.7, the first time it has pointed to a contraction since the immediate aftermath of the Brexit referendum in 2016. U.S. PMI numbers for June are due at 9:45 a.m. Eastern Time. Markets mixedOvernight, the MSCI Asia Pacific Index slipped 0.3% while Japan's Topix index closed 0.7% lower as the yen strengthened against the dollar and tech stocks reversed some of their recent gains. In Europe, the Stoxx 600 Index was 0.8% higher at 5:50 a.m. in a broad-based rally which sees only the oil and gas sector lower on the day. S&P futures point to a gain at the open, Treasury yields are as outlined above and gold is higher. Coming upWith the holiday tomorrow, today sees something of an eco-data dump. At 8:15 a.m., ADP employment change will give investors at look at the job market ahead of Friday's payrolls data. Weekly jobless claims and the May U.S. trade balance are at 8:30 a.m. Durable goods, factory orders and ISM non-manufacturing are all at 10:00 a.m. The NYSE is closing at 1:00 p.m. ahead of the holiday. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Tracy's interested in this morningThis week on Odd Lots, Joe and I interviewed Hyun Song Shin, head of research at the Bank for International Settlements. He's an expert on global financial flows, and especially the importance of the dollar, so you should definitely give it a listen. One thing that I've been thinking about is how the role of the U.S. currency in the international financial system leaves financial flows open to politicization. That means that while much of the current discussion on China-U.S. trade has centered around tariffs and the like, there's a much broader stream of money that America could use to inflict pain on China. There have been hints of this. For instance, Marco Rubio has written to MSCI Inc. to ask for more information on their decision to include Chinese equities in their benchmark indexes. But there's really a whole bunch of flow-type things that the U.S. could use to inflict pain on China, everything from banning investment in Chinese assets (something that's been mentioned on Odd Lots before) to cutting off Chinese companies' access to the ADR market. These are extreme measures of course, but I bet there are investors, U.S. politicians and their Chinese government counterparts who are already thinking about them.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment