Welcome to the Weekly Fix, the newsletter thinks that Jerome Powell and Mario Draghi paid so much homage to Ben Bernanke that he deserves some royalty checks. --Luke Kawa, Cross-Asset Reporter.

Courage to Act, Volume 2

It turns out that central bankers are just like any average employee. They'll show up to work and do what they have to, but by and large aren't trying to be heroes. That's what the leaders of the Federal Reserve and European Central Bank told markets this week, with the same word – "act" – signaling their willingness to support economic activity if needed. The "if" is instructive – they don't think there's any urgency to do so. To riff off the title of Ben Bernanke's memoir, central bankers indicated they have the "Courage to Act" – but the desire to cross their fingers and hope things don't get worse.

Here were the two headlines of the week in that regard:

*POWELL SAYS FED WILL `ACT AS APPROPRIATE' TO SUSTAIN EXPANSION

*DRAGHI: ECB DETERMINED TO ACT IN CASE OF ADVERSE CONTINGENCIES

Given that the Fed's previous emphasis on patience was tantamount to guaranteeing inaction, Powell's remarks were particularly interesting, with the omission of the word patient (or any of its variants). That subtle shift helps move the Fed towards the market's view – which is heavily tilted towards easing this year. At the same time, by implying the need for stimulus was not imminent, he showed faith in a positive outlook for the U.S. economy.

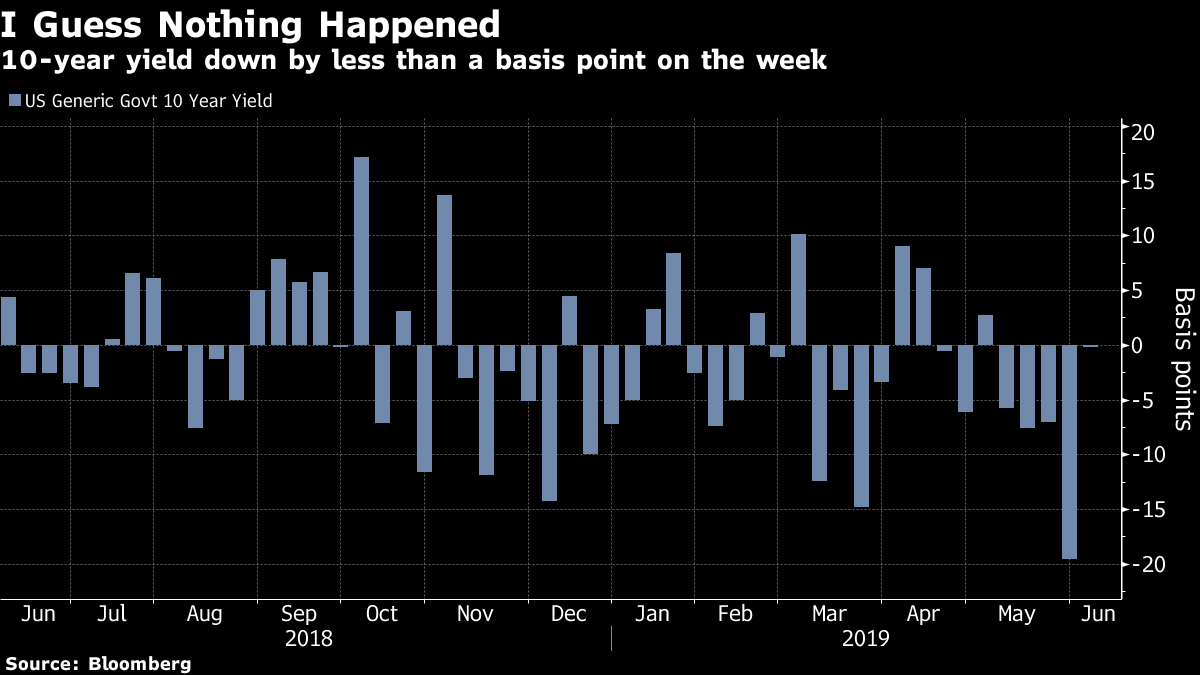

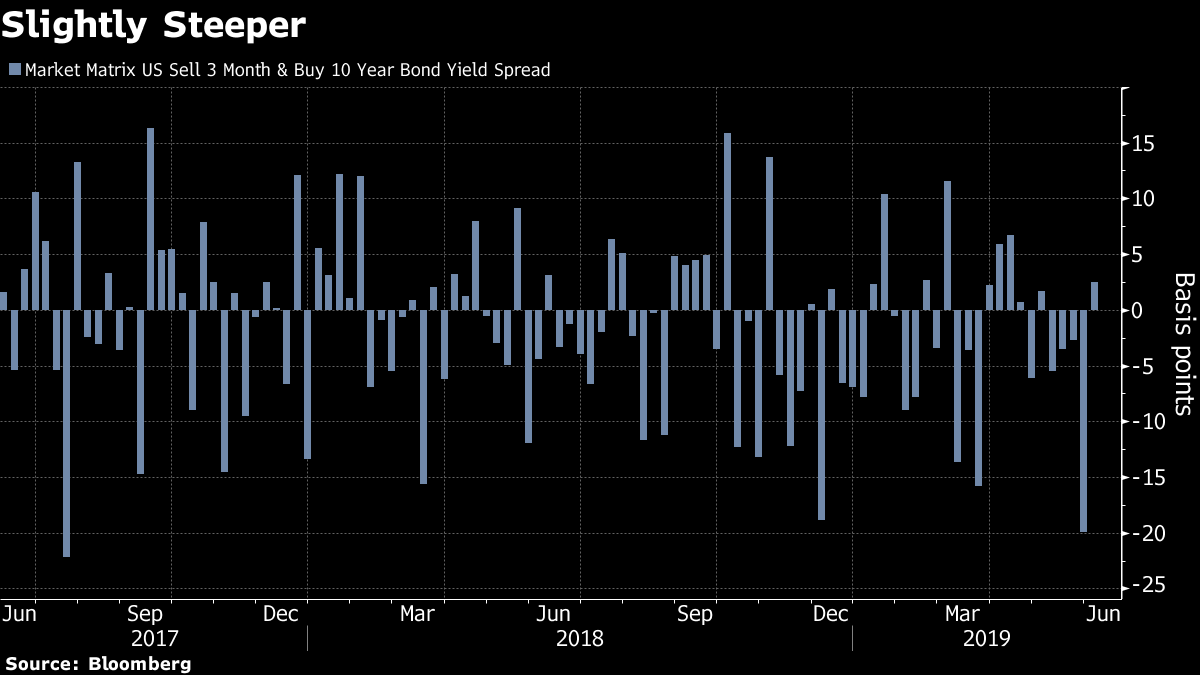

The 10-year yield may have moved less than one basis point so far this week, but the bond market has been anything but boring. It is minute, but there has been a change in the nature of the rally to bull steepening: short-end yields falling faster than the long-end after four straight weeks of flattening. Last week saw the biggest shrinkage in the three-month, 10-year spread (which became increasingly negative) since the middle of 2017.

The Powell connection: an openness to cutting sooner may somewhat mitigate the need to cut more later.

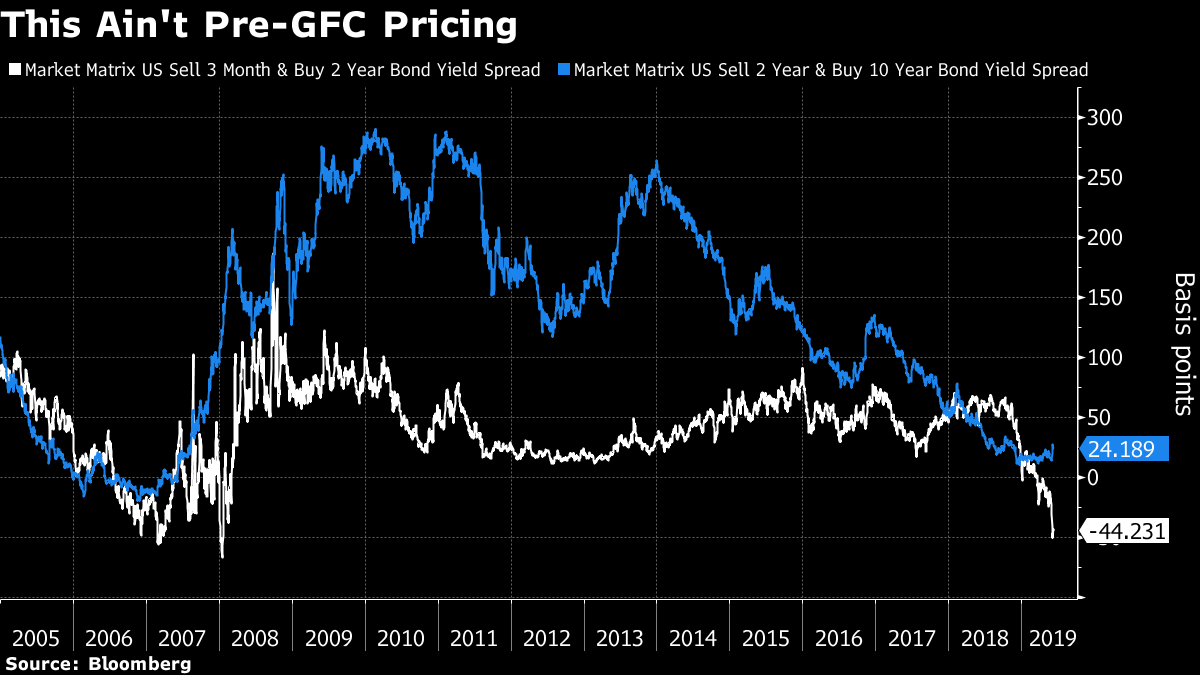

This dynamic, along with the combination of an inverted three-month, 10-year curve and a positive two-year, 10-year slope, hints at the enduring belief among market participants that any Fed easing cycle will be sufficiently shallow and proactive so as to avert a material downturn in the economy. We are closing in on the longest streak on record in which 3m10y is inverted while 2y10y remains positive. By the time 3m2y was this inverted in 2006, 2s10s was also subzero, pointing to expectations for a period of prolonged accommodation.

In other words, the bond market is saying that the Fed has enough ammo for this episode.

"It feels like the bond market message is that the Fed can cut a few times, the economy stabilizes around 2-ish percent, and recession is avoided," writes Renaissance Macro Research LLC's Neil Dutta.

For Vanguard Group's Gemma Wright-Casparius, the steepening trend is due to continue as the case for rate cuts crystallizes.

But consider a scenario in which the past is prologue -- namely, U.S. data is non-recessionary and risk assets stay resilient. That would likely involve traders pushing back expectations for any start of a rate-cutting cycle from the Fed, which would be supportive of flattening in cash curves. Friday's non-farm payrolls report will be the first test case.

From an international perspective, the Reserve Bank of Australia's start of an easing cycle might leave investors wondering which developed-market central bank will be the next to cut. But they might be better served by looking at the potential for imminent easing in emerging markets. For instance, more from the likes of Russia, South Africa, Indonesia, and India.

Unskewing Skew

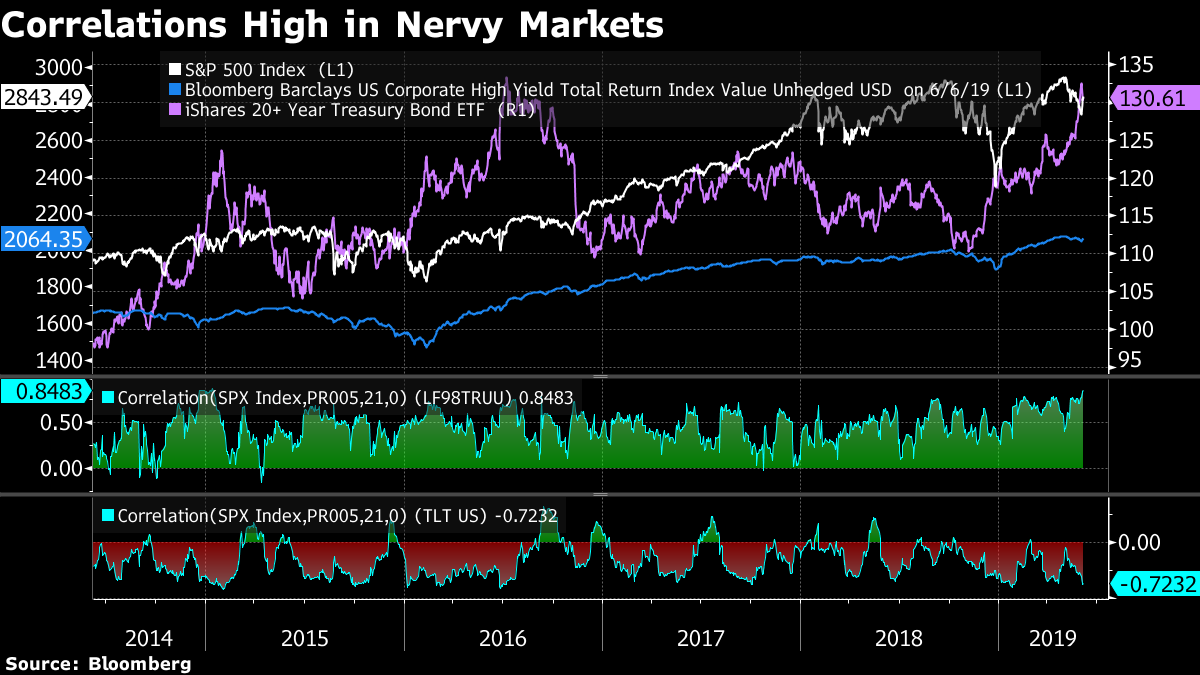

Cross-asset correlations are high, belying the seeming return to risk-on mode in U.S. equities.

Stocks are moving very inversely to long-term bonds, and the most in tandem with high-yield debt since the start of 2015.

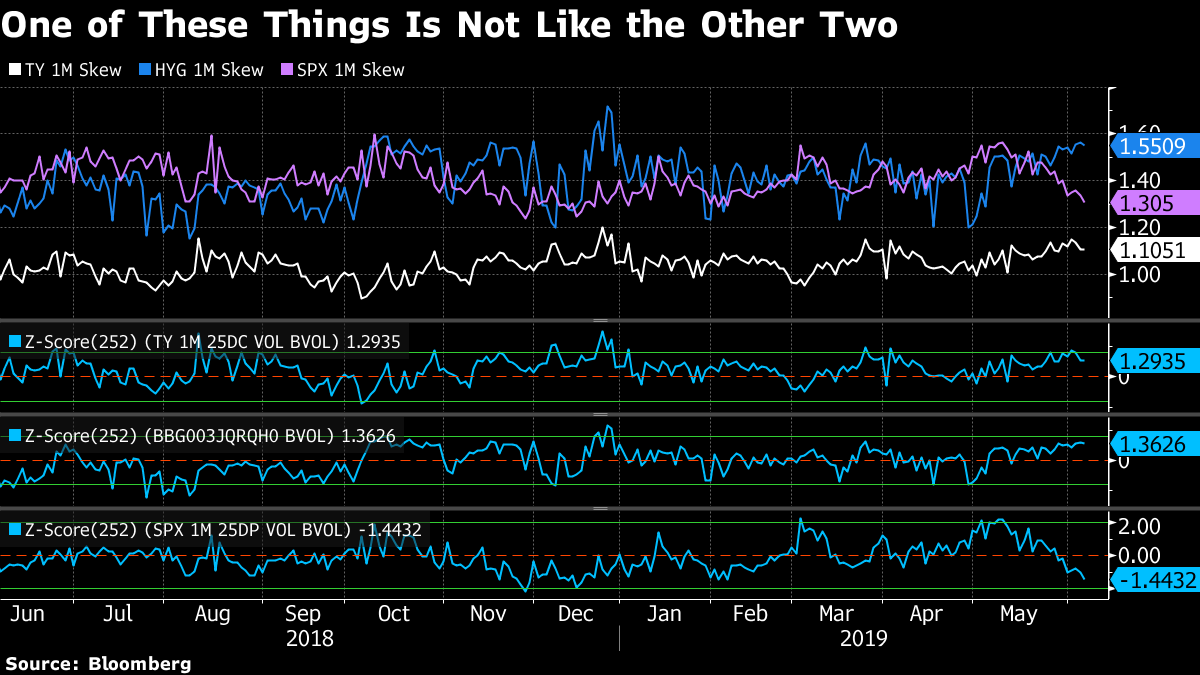

The options market, however, is not uniform in the degree of alarm being signaled by each asset class. Let's look at 25-delta skew for the TY note future, HYG ETF, and S&P 500.

(For TY, we've done call/put skew rather than the traditional put/call so that we have as close to an apples-to-apples gauge of risk aversion as possible.)

For bonds and junk debt, skew is about one standard deviation above its one year mean, compared to roughly 1.5 standard deviations below the one-year average for stocks.

What gives?

The relative divergence may simply tell us something about the nature of the asset classes, especially high-yield versus stocks. The mild equity drawdown could be more about traders simply upping their weights on a tail-risk scenario if trade wars escalate and growth slows materially, while keeping the base case of low growth, slow inflation, and an accommodative Fed intact. In high yield, chasing upside is less of a thing: creditholders want their coupons and their principal, so there's a more asymmetric risk profile.

More likely, this reveals something about market structure: the heavy presence of institutional selling of S&P 500 options that suppresses skew.

Post a Comment