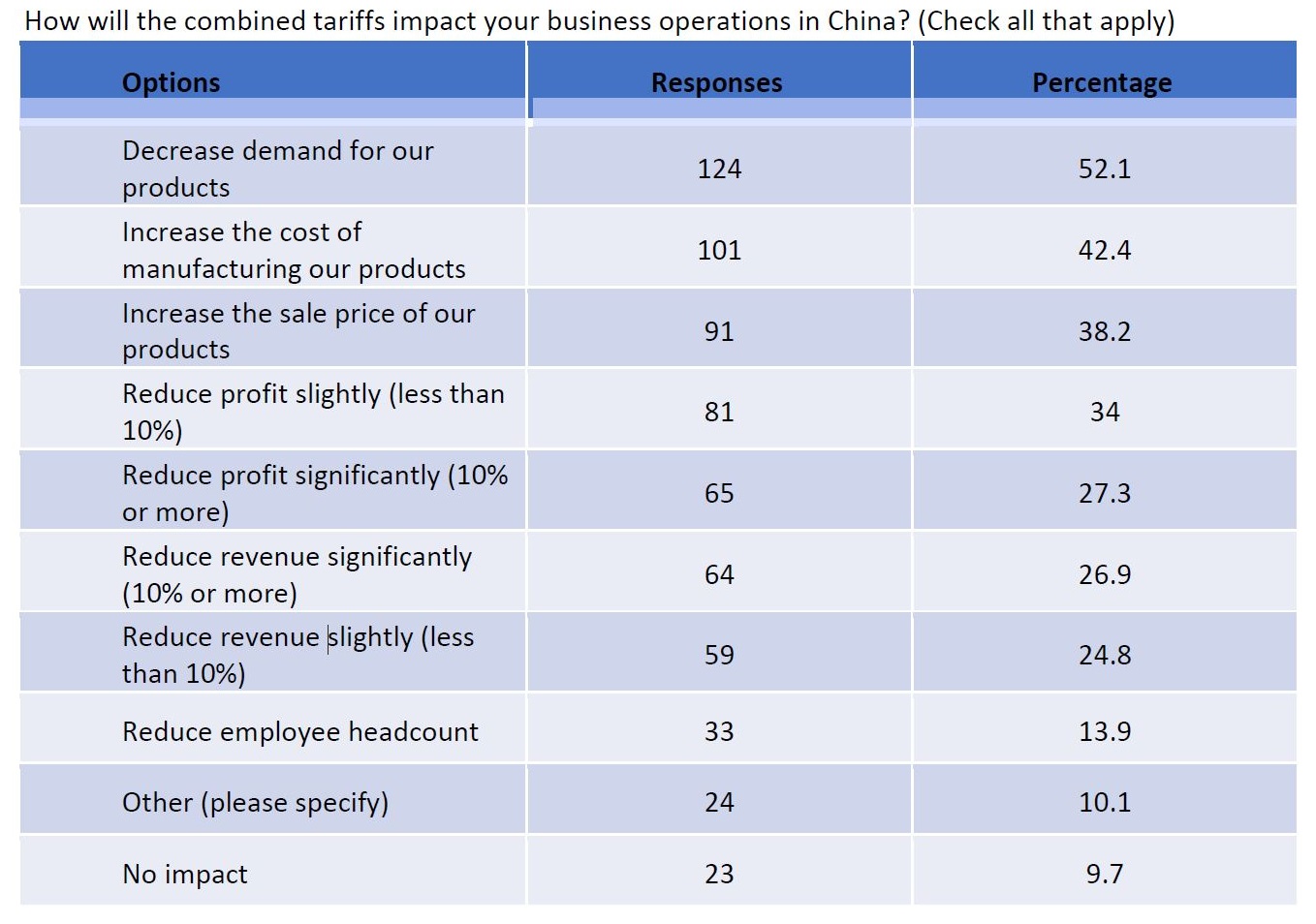

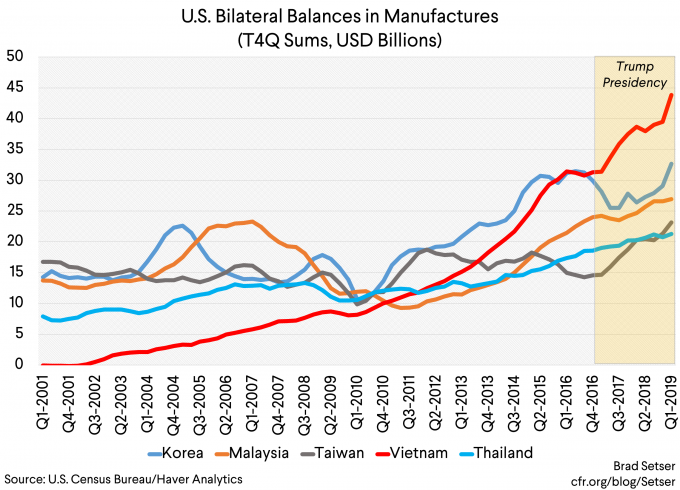

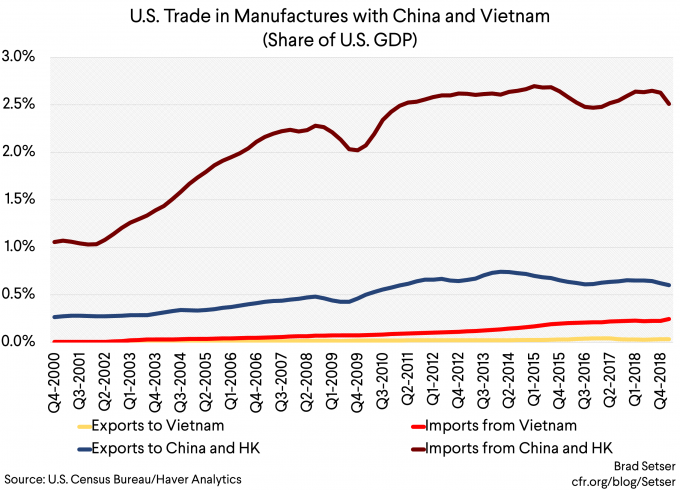

| Greetings, I'm Andy Browne, Editorial Director of the Bloomberg New Economy. A French fashion designer once described to me the pitfalls of setting up shop in Vietnam. We were in Ho Chi Minh City, a haven for manufacturers fleeing China due to rising costs and, more recently, the trade war. He had joined the exodus early. It was wrecking his business.  Rushing to assemble his first made-in-Vietnam collection in time for the Spring Fashion Week in Paris, he couldn't find stylish zippers, so he scrambled back to China to see his old supplier and returned with two bulging suitcases. These were held up for weeks by customs officials at Ho Chi Minh airport. Similar ordeals ensued to get hold of lace, embroidery and fancy buttons. If it's hard enough for a couturier to pick up and leave China, imagine the difficulties of shifting, say, an auto parts operation. This is why, even as U.S. President Donald Trump ramps up tariffs, few manufacturers are pulling out altogether. Rather, according to Lance Noble of Gavekal Dragonomics, the trade conflict is accelerating a trend in which globe-spanning supply chains are breaking apart into smaller segments serving regional markets in Asia, North America and Europe. Supply chains are anchored in China for good reason: No other country can match its trading infrastructure -- ports, railways, highways -- and vast domestic markets. The latest survey of U.S. companies in China shows about a third moving a portion -- not all -- of their production out of the country.  This manufacturing outflow shows up in the form of rising exports to the U.S. from countries such as Vietnam, Malaysia and Thailand, as the economist Brad Setser points out.  But wait. U.S. imports from Vietnam are still only a fraction of what it buys from China.  "China simply operates on a different scale," writes Setser. A final word on the Chinese labor force. Scale matters here, too. Trump's dreams of bringing back manufacturing jobs to the U.S. runs into the problem of finding armies of young workers in places like Ohio ready to toil at benches all day fitting screws into smartphones. Ingenuity is even more important. After four decades as the workshop of the world, China has irreplaceable skills (some brought over by U.S. factory owners who arrived with engineers as well as machinery). Widget-making is deeply embedded in the DNA of export hubs such as Shenzhen, as is a strong work ethic. I once watched a store clerk in an electronics market there soldering together the complex circuitry of a drone while serving customers, answering the phone, cradling an infant and slurping noodles from her lunch box. As for the French fashion designer, I later heard he had abandoned dressmaking and moved into logistics. There was more money to be made solving other people's headaches.  A Sunset for Oil? The pieties that oil executives spout about a zero carbon world are often belied by their actions, writes my Bloomberg Opinion colleague David Fickling. A case in point: John Browne, whose reign at BP Plc introduced the catchphrase "beyond petroleum" even while he more than doubled the company's oil and gas reserves. Skepticism is in order, then, when we hear Royal Dutch Shell Plc's chief executive Ben van Beurden saying things like "Shell can thrive through the transition of the global energy system." Still, Shell is actually running down its oil reserves. Perhaps it plans a massive acquisition to top them up. Or maybe -- just maybe -- it sees what environmentalists pray for: a sunset for oil. A Shipping Clean Up Here's more reason to hope: The world's shipping fleets are starting to clean up their act ahead of new environmental rules that require vessels to scrub their exhaust gas, write Anjali Raval and Josh Spero in the Financial Times. Why does this matter? Some 90,000 ships criss-crossed the oceans last year, burning fuel that contains sulphur concentrations more than 3,500 times greater than the diesel that triggered the emissions testing scandal at Volkswagen AG. That creates 2-3% of the world's total greenhouse gas emissions.  Like Turning Points? Subscribe to Bloomberg All Access. You'll get our unmatched global news coverage and two premium daily newsletters, The Bloomberg Open and The Bloomberg Close, and much, much more. See our limited-time introductory offer. Download the Bloomberg app: It's available for iOS and Android. |

Post a Comment