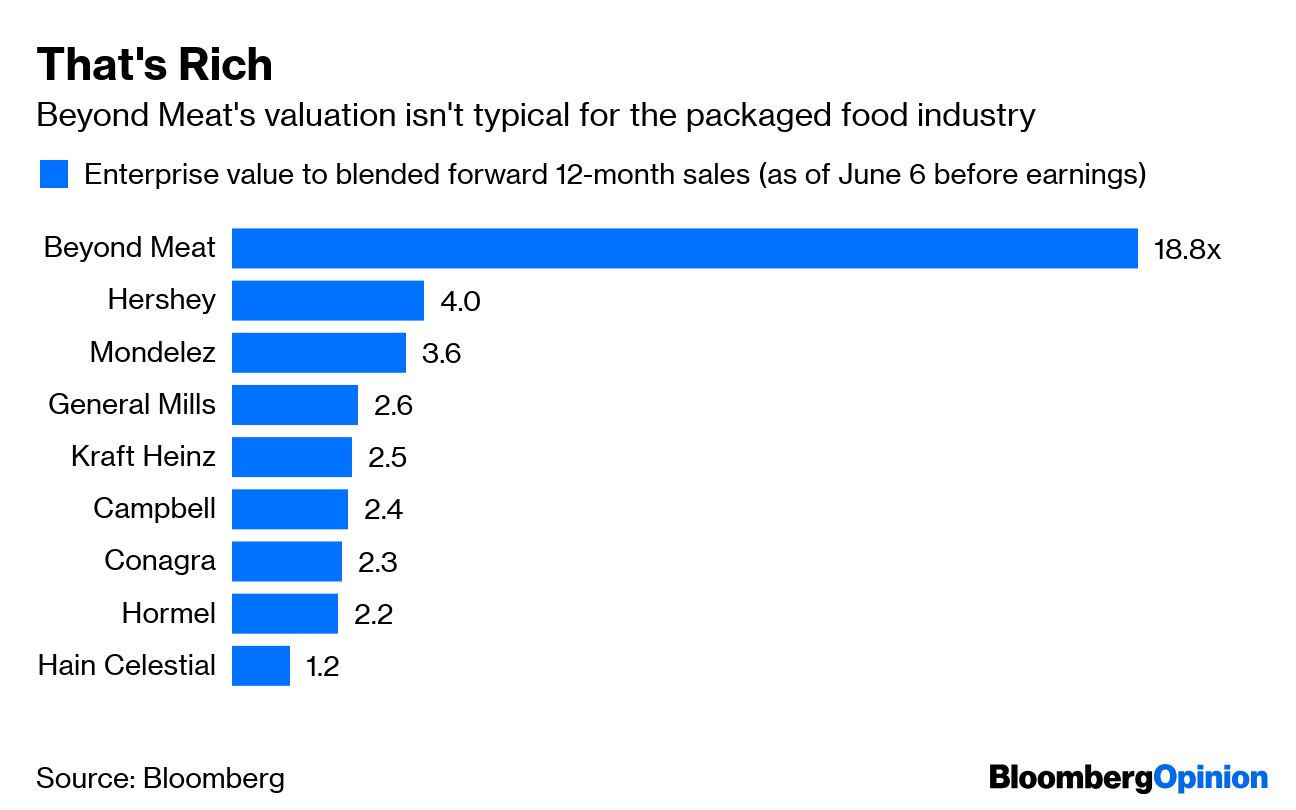

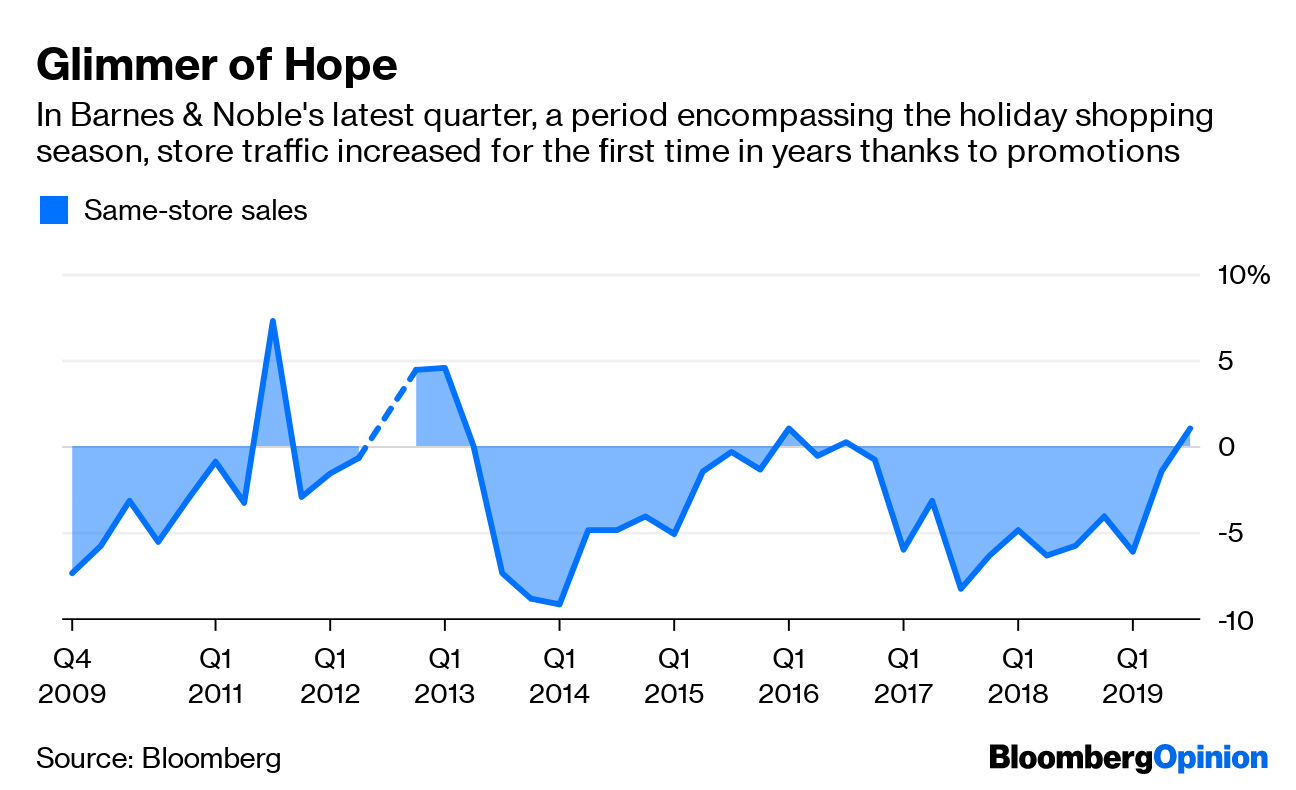

Today's Agenda  The New Moonshot: Climate I recently took my tween sons to see the "Apollo 11" documentary, partly just to make them aware that we – Americans, humans –used to actually do incredible stuff like that. But saving the world from catastrophic climate change is just that sort of heroic effort, and we can start it right now, Bloomberg LP founder Mike Bloomberg writes. It's bigger than going to the moon, and far more vital. Just like the moonshot, staving off the worst effects of climate change will be expensive and sometimes unpopular, Mike notes. Unlike JFK, current president DJT doesn't think the job is worth doing, and his party agrees. But we can't wait and hope for the best in the next election, Mike writes. So he's putting $500 million into a new initiative called Beyond Carbon, which will fight Trump's regressive EPA, invest in clean technology, and promote political activism for climate solutions. One excuse for inaction or indifference is that global warming is something that will affect the distant future. But that's false; its destructive effects already surround us. "[T]he question isn't, 'How do we tackle climate change?'" Mike writes. "The question is, 'Why the hell are we moving so slowly?'" Read the whole thing. It's Beginning to Look a Lot Like Rate Cut Time Every parent knows you shouldn't reward bad behavior, but sometimes it's unavoidable. If your kid is melting down in the middle of, say, a funeral, then that kid is probably getting a lollipop. The Fed's in a similar spot with President Donald Trump. It became clear today the Fed must soon cut interest rates, as Trump has repeatedly demanded it do, in order to clean up the economic mess his trade hostilities have created. Job growth in May was worse than the market expected, and previous months' numbers were revised lower too. The pace of hiring has clearly slowed, thanks partially to the uncertainty Trump's trade belligerence has caused. Unemployment is still low, but that hasn't done much for wage growth. All in all, the numbers suggest there's plenty of slack in the labor market, Mark Whitehouse writes – enough to let the Fed cut rates to insure against a downturn without sparking any kind of inflation. In fact, the bond market is hollering that Fed policy is too tight. Ten-year Treasury yields tumbled after the jobs report, pushing them even further below the rates on three-month bills – the "yield curve" is deeply "inverted," in other words. This rarity has been going on for 10 straight days, which Robert Burgess notes has historically been a guarantee of a recession some time in the not-too-distant future. The Fed will probably want to wait for another disappointing jobs report before pulling the trigger on rate cuts, writes Brian Chappatta. But the pressure is on, to the market's – and certainly to Trump's – delight. Further Trumponomics Reading: The early read on the 2017 tax cuts' economic impact is underwhelming; it should be the final nail in the coffin of supply-side economics. – Noah Smith India's Quiet Crisis We don't hear much about it in the West, but India's shadow banking system has been melting down since what Andy Mukherjee has called a "mini-Lehman moment" in September. "Nonbank" lenders – those that can't rely on the state or central bank – have been falling regularly. The sector needs the equivalent of a Troubled Asset Relief Program, Andy writes, before the pain spreads further. India's economy is slowing dramatically, meanwhile, frustrating hopes it could pass China in growth. Arrogance and isolationism are to blame, Mihir Sharma writes, and until those attitudes change, the country will keep missing opportunities. Telltale Charts Beyond Meat Inc. is in a sweet spot of consumer trends, but its valuation may be a teensy bit overcooked, given its lack of scale and the risk of big competitors jumping in, writes Sarah Halzack.  Barnes & Noble Inc. has reached the end of the road as a public company, and you can kind of see why, Tara Lachapelle writes.  Further Reading Italy must get its finances in order, but the EU's erratic approach to fiscal discipline isn't helping. – Bloomberg's editorial board Trump's threat to target the NHS in U.S.-U.K. trade talks is a wake-up call for Britain, highlighting both the health service's popularity and its growing weaknesses. – Therese Raphael Europe will finally have a giant tech champion when Naspers Ltd. goes public. But its ownership structure is unfair and opaque, and index makers should push for change. – Alex Webb Here's why Germany would send a warship through the Taiwan Strait. – Leonid Bershidsky New Zealand's budget prioritizing citizens' well-being is worth emulating. – Cass Sunstein Joe Biden's twists on Medicaid funding for abortion expose his worst traits. – Ramesh Ponnuru Trump's ban on fetal-tissue research is pure virtue-signaling; it won't stop any abortions, and could endanger human health. – Faye Flam ICYMI Tariffs have basically wiped out the average family's tax-cut savings. Nike Inc. employees are unhappy it's outsourcing child care. The other way to become a Silicon Valley billionaire: real estate. Kickers Nothing terrifying about a 55-story-high infinity pool, nope. FINALLY, a vending machine for buying likes and followers. (h/t Scott Kominers for the first two kickers) People with intellectual humility know more stuff. Friends play the same D&D game for 30 years. Photos of the week. Note: Please send followers and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment