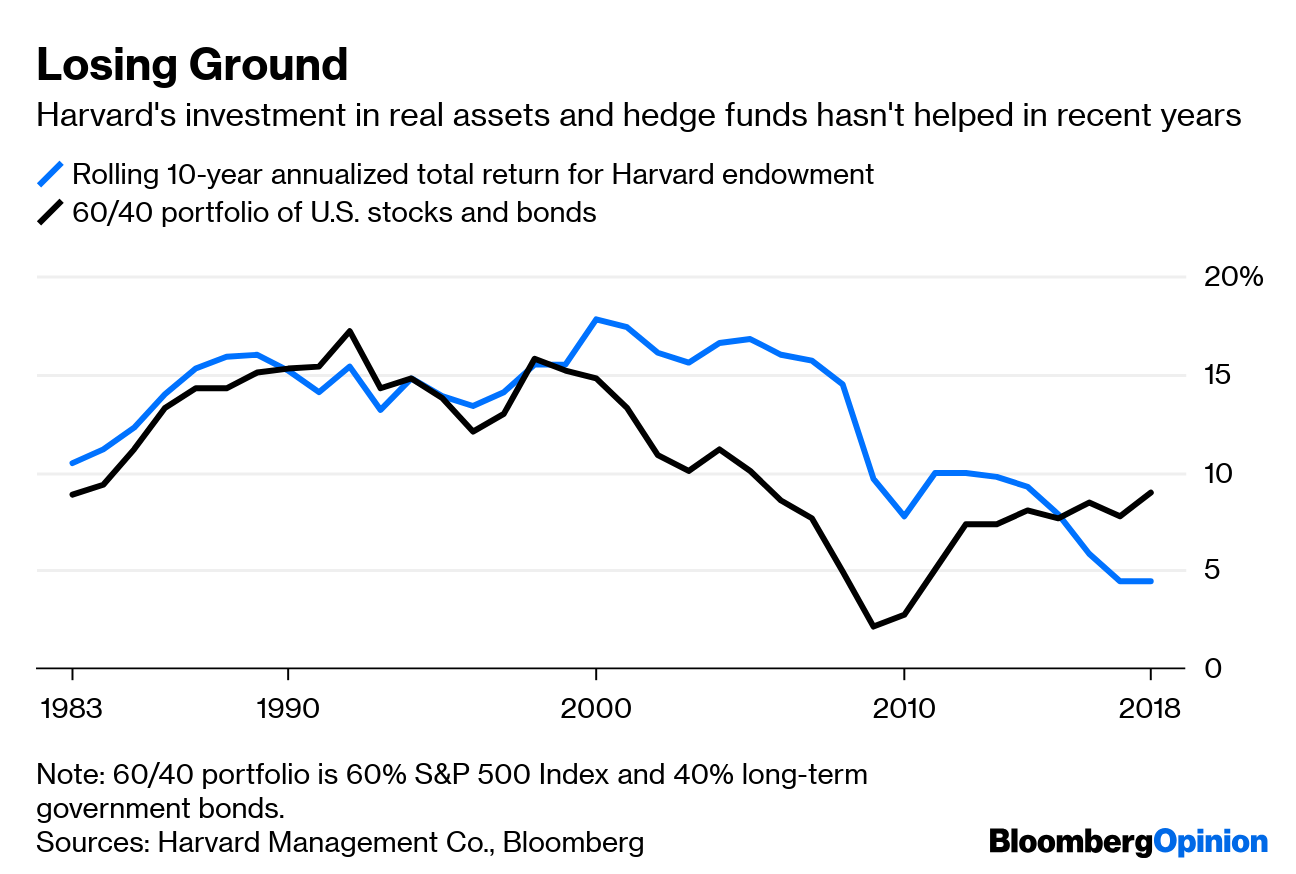

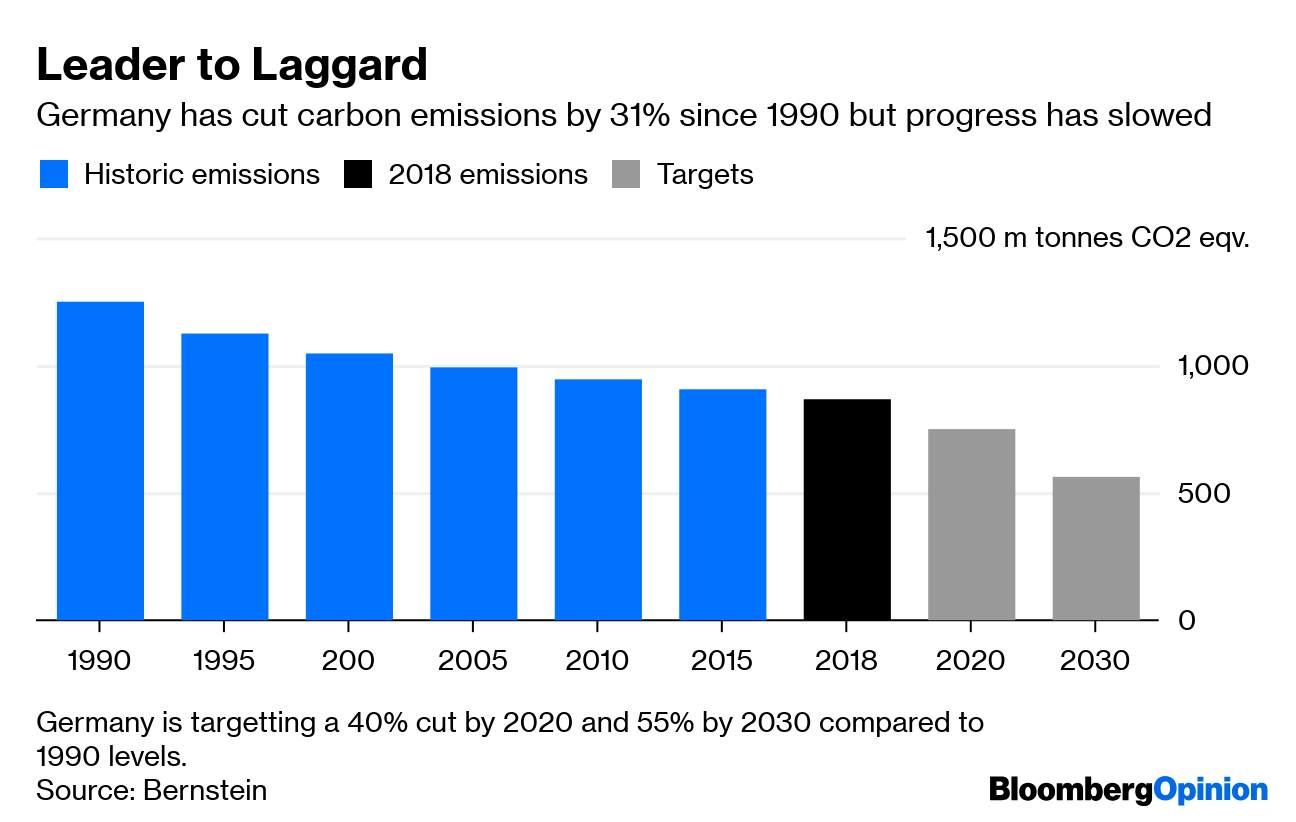

Today's Agenda  Markets Cheer Imaginary Rate Cut Wall Street just spent another day doing its favorite thing: leaping about on the Jump to Conclusions Mat. Stocks rallied roughly four bajillion points after Fed Chairman Jerome Powell said the central bank was "closely monitoring" his boss's trade war, adding, "as always, we will act as appropriate to sustain the expansion." This was enough to spark a massive rally, though Brian Chappatta argues Powell said nothing new (note the "as always" in his statement), and there's nothing very shocking about a promise to keep the expansion going. Though the Fed's next move is probably a rate cut, the timing is still very much in doubt, Brian writes. Of course, the market is right to be jumpy, suggests Komal Sri-Kumar. Whether the bond market has gotten ahead of itself pricing in Fed rate cuts or not, the worsening outlook for rates and inflation suggests there's not much upside for stocks, Komal writes. And investors are rapidly running out of safe havens, writes John Authers — unless you count gold and Treasuries, which is not exactly encouraging. On the plus side, if the trade war does cause a recession, then it won't be a result of systemic excesses as in 2001 and 2008, writes Conor Sen. That suggests the recovery might be bouncier. Hooray? Further end-is-nigh reading: After its first rate cut in three years, Australia's central bank may be headed for QE. – Dan Moss Refill the Think Tank The trade war that's upsetting markets gained steam again today, as China warned its citizens against traveling to the U.S., citing police harassment and frequent shootings. This will probably not be a decisive blow in the conflict, but it feels like the kind of targeted tactic that comes from knowing how to needle your adversary. During the original Cold War, the U.S. gave itself a leg up by funding think tanks, graduate programs and the like that helped policy makers better understand the Soviet Union, Hal Brands writes. The U.S. lacks the same investment in understanding China or Russia now, Hal writes, even as China ramps up its study of America. The repercussions of a growing knowledge gap could be profound. The war might be worth it, at least in the minds of President Donald Trump and his advisers and supporters, if it made manufacturing return to America. But it seems to be benefiting developing nations such as Vietnam a lot more, Noah Smith writes. This could cause Trump to open still more fronts in the trade war — but Noah suggests the U.S. has good reason to want a richer Vietnam. Further new-cold-war reading: Because Russia's present is so depressing, let's start thinking about its brighter (but far distant) future after Putin. – Leonid Bershidsky Protect the Internet Today marks the 30th anniversary of the Tiananmen Square massacre, when Chinese troops opened fire on protesters, marking a bleak new paradigm for the government's relationship with the West and its own people, as Hal Brands has written. One feature of this paradigm has been Beijing's iron grip on information, including tight control of the internet. This should remind the rest of the world that China should have as little influence over the broader internet as possible, writes Eli Lake. Not that China is alone: Governments around the world have developed the habit of turning off the internet in times of unrest or political tension, Bloomberg's editorial board writes. Their intentions may sometimes be good, as when they clamp down on rumors spread through social media, but the trend is too troubling to run unchecked, the editors write. Big Tech's Big Worry Back in the States, meanwhile, U.S. tech giants are under increasing scrutiny; news of Trump administration probes of some "FAANG" companies sent the Nasdaq tumbling yesterday. Some politicians on both sides of the aisle are even calling for breaking up behemoths such as Facebook Inc. and Google. They don't need to worry about that, writes Noah Feldman: The antitrust standards that have prevailed for 40 years might argue for a little more regulation, but nothing as radical as a breakup. That might have to wait for an Elizabeth Warren presidency. Telltale Charts Harvard and other college endowments must start squeezing hedge funds to lower fees, writes Nir Kaissar.  Germany is making a huge mistake and hurting its own carbon-emissions ambitions by shutting down nuclear power plants long before it shuts down coal plants, writes Chris Bryant.  Just when miserable British consumers got a brief Brexit reprieve, fresh political turmoil struck, notes Andrea Felsted.  Further Reading No matter how many summits they hold, "Arab unity" is an oxymoron. – Bobby Ghosh Impeachment opponents keep making weak arguments. – Jonathan Bernstein Steve Bannon failed to become Europe's nationalist pied piper because he doesn't understand Europe. – Leonid Bershidsky A defense of Art Laffer, or at the very least supply-side economics. – Karl Smith The idea that 40 percent of Americans can't handle a $400 emergency is a myth. – Michael Strain CVS Health Corp. seems to have the right idea for making its massive Aetna deal work. – Max Nisen With e-cigarettes, we risk making the perfect the enemy of the good. – Faye Flam There's evidence Roundup is far more destructive than we realize, beyond cancer. – Mark Buchanan ICYMI Jeff Bezos is condo-shopping in Manhattan. Meet the couple that allegedly scammed Berkshire Hathaway. Too many medicinesjust don't work. Kickers The plane of the future has seats in the wings. (h/t Scott Kominers) Planets influence the sun. Out: 10,000 hours of practice. In: generalists. Too many people want to travel. Note: Please send plane tickets and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment