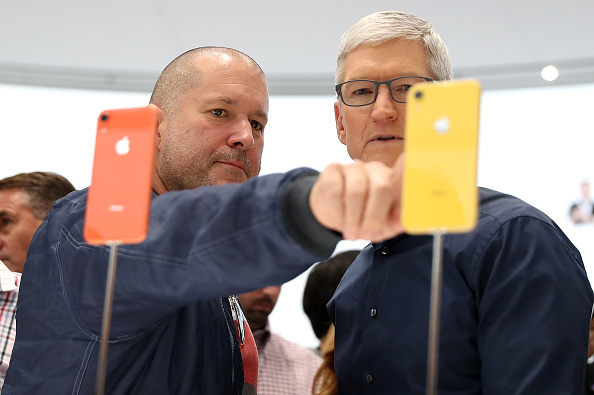

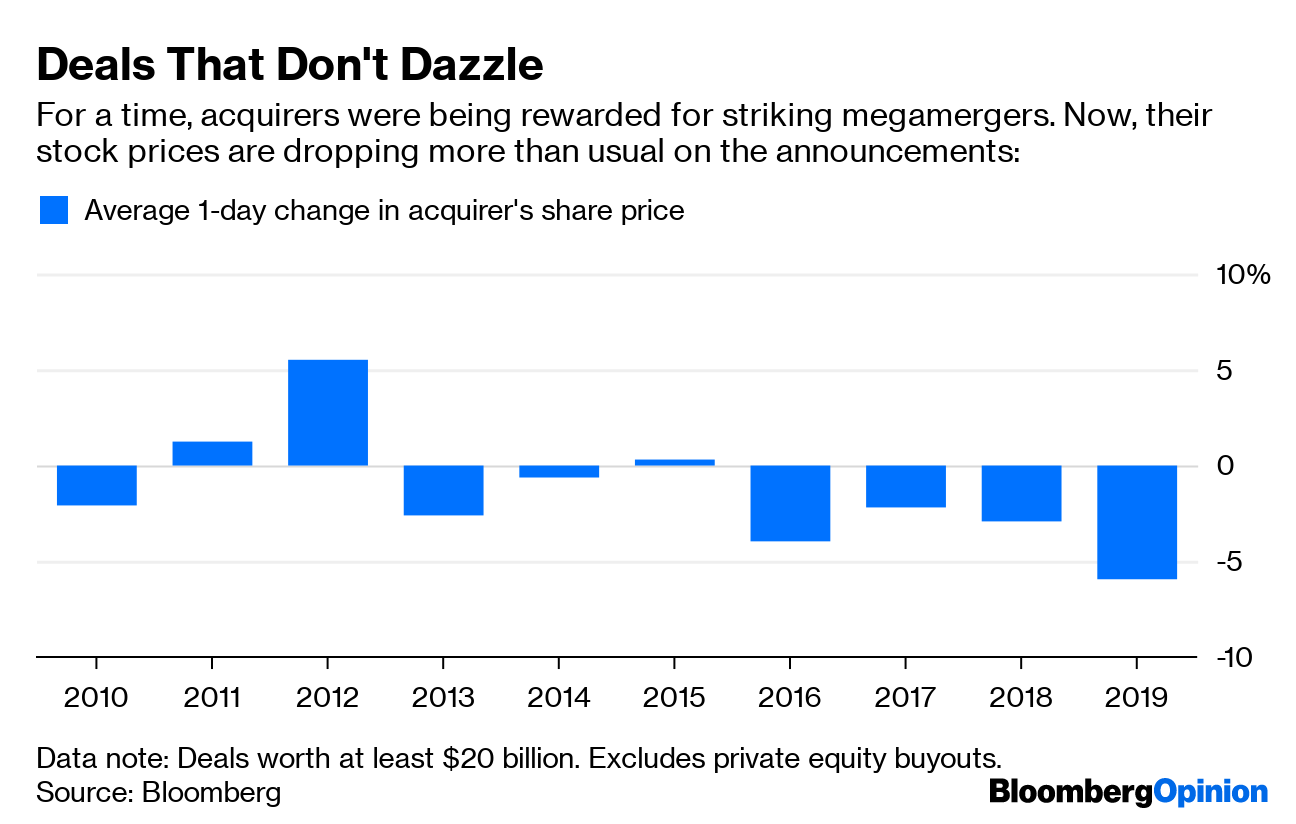

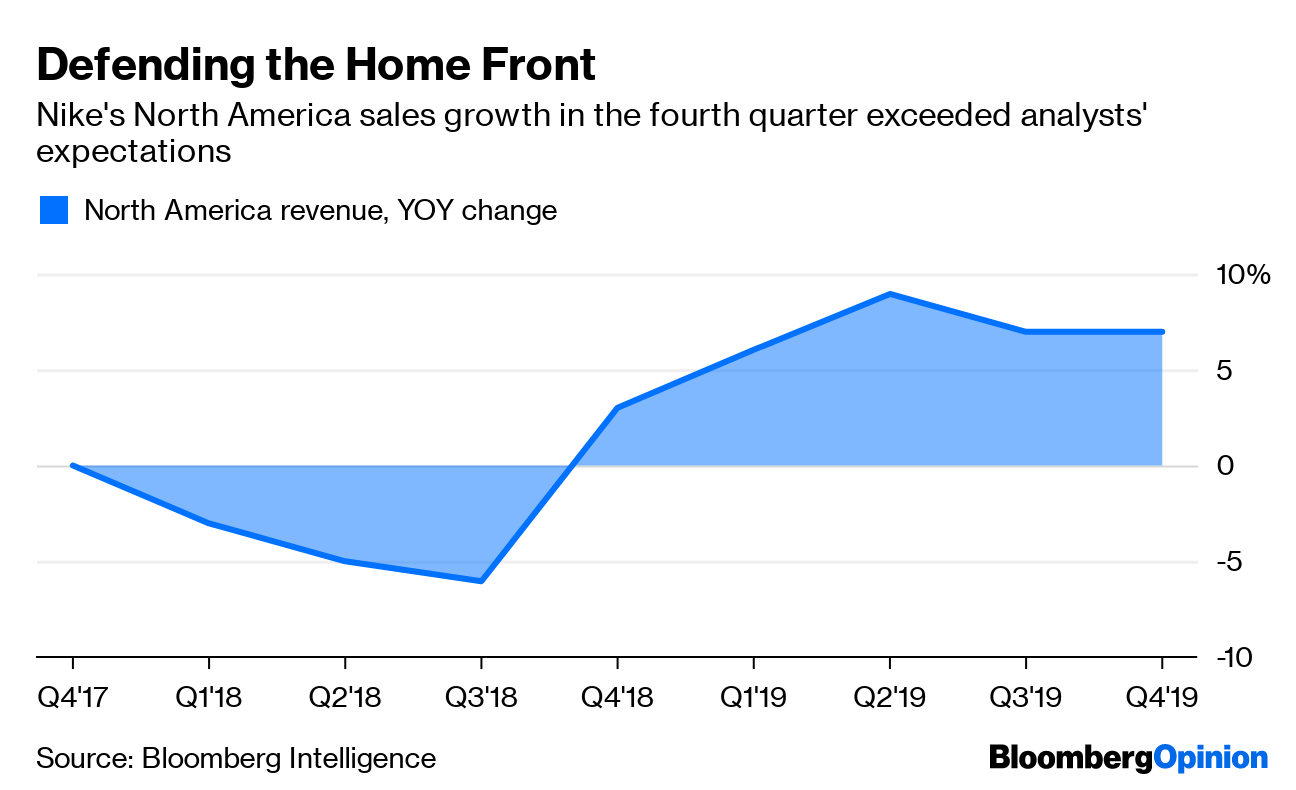

Today's Agenda  The End of the Jony Ive Era A strong contender for America's Company has got to be Apple Inc. It regularly tops lists of most-admired companies, it's nearly the world's biggest by market cap, and it's a global cultural ambassador. And aside from Steve Jobs, nobody is more responsible for Apple's standing than Jony Ive. That's why Thursday's news that Ive is leaving Apple is such an epochal moment, for the company and in low-key a way for the whole country. After a long 27 years at the company, the simple fact is that Ive's time was up, Shira Ovide writes. His obsessive design aesthetic, which meshed perfectly with Jobs's, led to revolutionary devices such as the iMac, the iPod and the iPhone. They changed the culture while catapulting Apple from bankruptcy to the top of the corporate world. But the Age of the Device is fading as smartphone sales slow, Shira notes. Dawning now is the Age of Software in Everything, making design much less important to Apple. Given his near-spiritual affinity with Apple's founder, Ive's departure also clearly marks the end of the Steve Jobs era at Apple, writes Tim O'Brien. But his legacy won't soon be erased. The simplicity and beauty of Ive's designs turned mere consumer products into something approaching art, which helps explain why they have been so coveted and Apple's reputation is still so exalted. Lessons From the Democratic Debates Marianne Williamson did her best to elevate the first round of Democratic presidential debates to an astral plane, but sadly no candidates achieved Nirvana and vanished; the field remains as crowded as ever. It's a strong group, at least, as the debates demonstrated, Bloomberg's editorial board writes. But everybody would be far better served if these affairs were less messy – say, four one-hour debates of five candidates each? That may produce less shouting and deeper policy discussions, of which most of these candidates are highly capable. If there's one clear winner from the first round, it has to be Senator Kamala Harris, writes Jonathan Bernstein. She demonstrated her competence on the stage, hinted at how she might credibly take on President Donald Trump, and effectively gutted front-runner Joe Biden. Harris's biggest mistake may have been raising her hand when asked which candidates wanted to ditch private health insurance; today she claimed she misinterpreted the question. This particular health-care question could be a way Biden can recover from last night's drubbing, writes Ramesh Ponnuru. Most of the country is leery of ending private insurance, and Biden can hold his ground by taking their side, Ramesh suggests. The health-care issue is one of the biggest in this election, in fact, full of opportunity and peril for all of the candidates. Max Nisen suggests we've only just begun to fully explore what the candidates want to do and what it would mean for the health-care system. He's got some advice on how to move the discussion forward. Further Debate Reading: Save the Census The 2020 census was already in trouble when Trump took office, due to underfunding and understaffing at the Census Bureau, Bloomberg's editorial board notes. And then Trump and his Commerce Secretary, Wilbur Ross, made things worse by trying to add an immigration question to the survey. Citing the administration's dubious motives, the Supreme Court has thwarted its plans for now. This leaves Trump with a choice, the editors write: He can either disrupt the census further by trying to jam his immigration question through, or he can let the census proceed. The latter choice is the better one for the sake of the country. Currency War: What Is It Good For? Trump rolled into Osaka for a contentious G-20 meeting embroiled in fights of all sorts and apparently spoiling for more. He and Xi Jinping took turns throwing cold water on hopes for their trade talks. And Trump blasted countries from Europe to Vietnam for running big trade surpluses with the U.S. Meanwhile, he's threatening sanctions on anybody doing business with Iran and North Korea. David Fickling points out these are contradictory positions: The impact of American sanctions is only powerful because the dollar is the global currency of exchange, which is the case precisely because the U.S. runs huge trade deficits. Trump has bemoaned the dollar's strength and openly called for the Fed to weaken it by cutting rates already. But the world's other central bankers won't sit pat while the Fed acts, notes Dan Moss. And even if the Fed could weaken the dollar, flagging global economic growth and rising volatility will push investors back to the safety of the buck, writes Komal Sri-Kumar. Telltale Charts CEOs and bankers love them some megamergers. Investors? Not so much, writes Tara Lachapelle.  Strength on the home front will help shield Nike Inc. from trade-war troubles, writes Sarah Halzack.  Further Reading A heating planet will boost demand for air conditioning, which will further heat the planet. Rinse, repeat, melt, unless we quickly make buildings and cooling systems more efficient. – Chris Bryant Elena Kagan got the better of Neil Gorsuch this week in the battle over the administrative state. – Cass Sunstein Boris Johnson's supporters want voters to believe an obscure trade rule is a magic pill for no-deal Brexit. It's not. – Therese Raphael The RealReal Inc. started publicly trading today, a key moment in the rise of secondhand fashion sites. Too bad they'll probably never be profitable. – Sarah Halzack Baseball's British invasion is off to a shaky start. – Alex Webb ICYMI Apple's moving Mac Pro production to China. France is suffering through record heat. People claim Social Security benefits too early. Kickers NASA's going to Titan to look for life. Our brain hits rewind to make decisions. What's the best Beatles song? Photos of the week. Note: Please send songs and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment