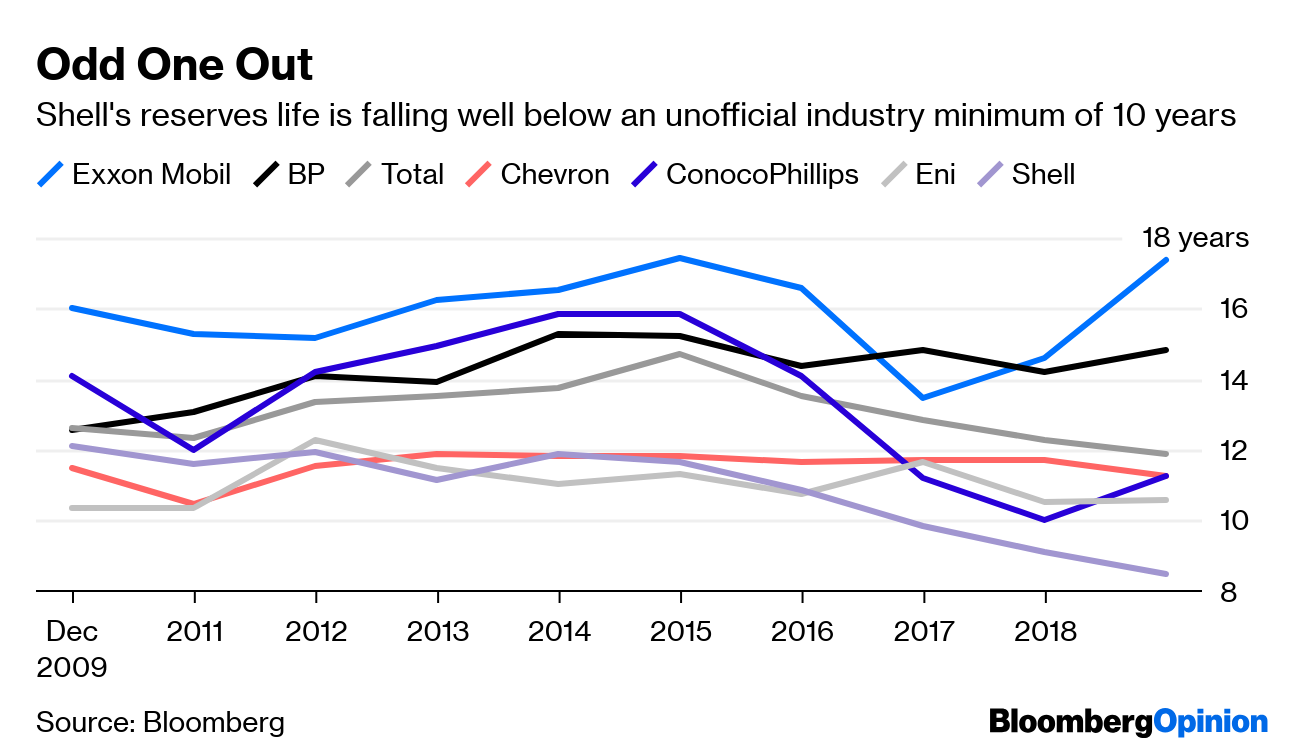

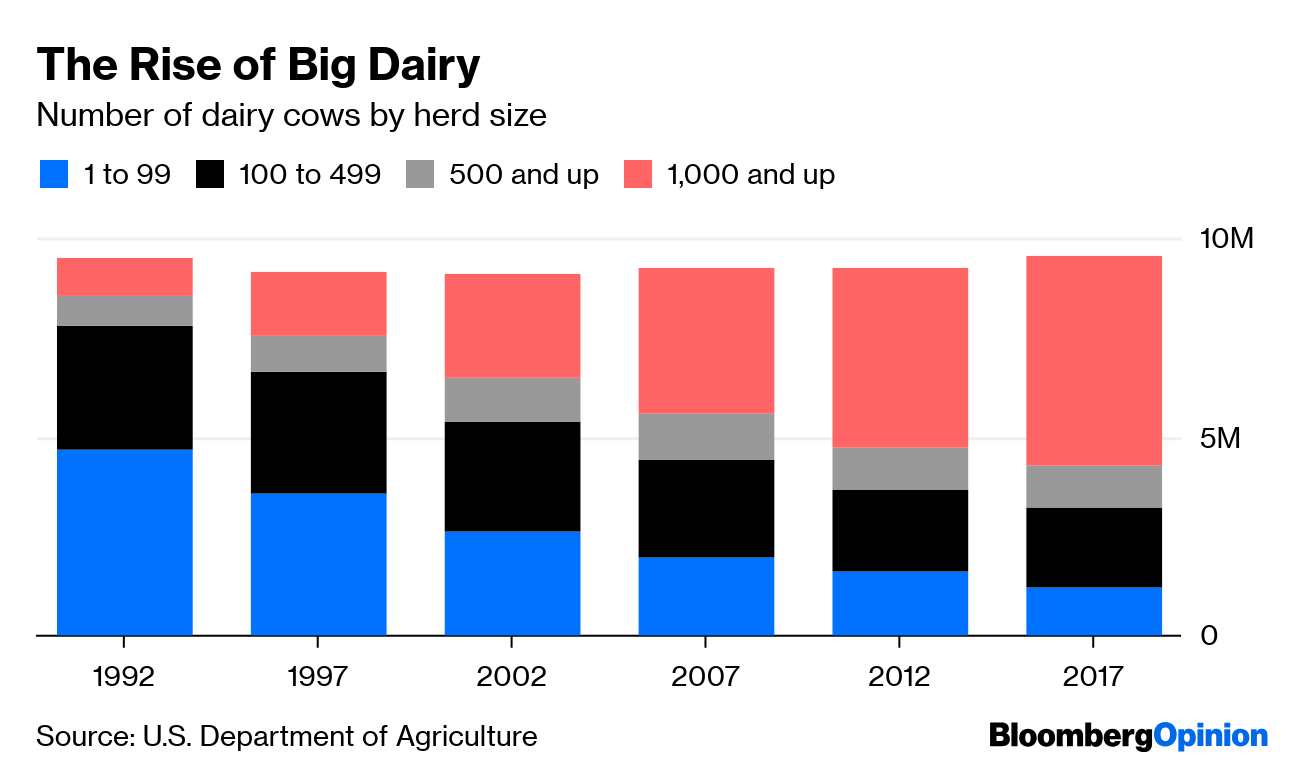

Today's Agenda Don't Sweat Big TechWall Street is predisposed to hate and fear regulation, which is why the Nasdaq tumbled this week after the Trump administration and congressional Democrats reached a rare consensus that something must be done about tech behemoths. But investors may be worrying for nothing. True, a heated election season might lead both sides to compete over how aggressively they can attack Silicon Valley's suddenly unloved champions. But regulators should resist this urge, writes Bloomberg's editorial board. Some of the FAANG companies –particularly Google parent Alphabet Inc., Amazon.com Inc. and Facebook Inc. – have big problems, from bloated market power to irresponsible data handling. But they do more harm than good, the editors suggest, and shouldn't be run out of business for their sins.In fact, there seems to be little appetite among the current powers-that-be for breaking these companies up or similarly aggressive moves, notes Lionel Laurent. Instead, there's widespread agreement we should scrutinize their future acquisitions much more carefully, to avoid another mistake like letting Facebook waltz away with Instagram. And all this regulatory scrutiny might be a good sign for investors in these companies, writes Conor Sen. Sure, it may lead to years of uncertainty and curb future growth, but then growth was already slowing anyway, Conor notes. That's all the more reason for these companies to adopt the classic old-company strategy of pacifying shareholders by shoveling cash into their faces. Further Big-Tech Reading: Tim Cook was disturbingly quiet about developers at Apple Inc.'s latest developer conference. – Shira Ovide The Recession QuestionThe stock market rallied for a second day, though behind the cheer lurks fear of an economic slowdown. The rally is based partly on the belief the Federal Reserve will soon ride to the rescue, but Mohamed El-Erian points out the economy may have many more problems than the Fed can reasonably be expected to fix. One such problem? The market's endless thirst for easy Fed money. You see the conundrum here. We'd probably be less stressed about monetary policy if fiscal policy had more automatic stabilizers in place to help the economy through downturns, writes Noah Smith. Having fiscal stimulus measures kick in when growth sags would take the sting out of recessions and leave vulnerable Americans less reliant on a slow-moving Congress or a Fed with limited resources, Noah writes. Then again, if all we ever focus on is avoiding recession, then we're missing the big picture, suggests Narayana Kocherlakota. The goal should not be smooth, uninspiring growth but making sure the economy reaches its full potential, Narayana writes. By this measure, the U.S. economy has been failing for nearly 20 years. Further Economic Policy Reading: Mario Draghi has one last fire to put out on his way out the door. – Ferdinando Giugliano Trade Wars: A New HopeTrade-war optimism also boosted markets today. Mexican emissaries traveled to Washington for talks, and President Donald Trump's trade-war whisperer, Peter Navarro, said Mexico could avoid tariffs by meeting three (maybe not-so-simple) demands. Bill Dudley suggests trade peace with China and Mexico is the likeliest result here, because it's the one outcome that will best help Trump get re-elected. In another possible sign of thawing relations, Boeing Co. is in talks about selling China a bunch of airplanes. Politics may yet derail such a deal, writes Brooke Sutherland, but both sides have reason to make it happen. Boeing wants to fill the hole in its order book where the 737 Max used to be, and China wants to boost its domestic plane fleet and maybe chip away at its massive trade surplus with the U.S., Brooke notes. Telltale ChartsOther oil majors pay lip service to the idea of disappearing oil demand, but Royal Dutch Shell Plc is betting money on it, writes David Fickling.  Small dairy farms are disappearing rapidly, writes Justin Fox, into in the cud-chewing maw of Big Cow.  Further ReadingCredit rating firms see a gold mine in Chinese local bonds, but it could collapse on them. – Shuli Ren Nissan shouldn't be dragged into any Fiat-Renault merger; its challenges are better faced alone. – Anjani Trivedi We have a few questions for Campbell Soup Co. – Sarah Halzack New cell-therapy cancer treatments from Amgen Inc. and Iovance Biotherapeutics Inc. deserve the hype – Max Nisen The Arab embargo of Qatar has failed in every conceivable way. – Bobby Ghosh We focus too much on the popularity of impeachment. We should focus instead on Trump's approval rating; the more that falls, the likelier he will be removed. – Jonathan Bernstein Republicans can't force Americans to embrace traditional values and should try libertarianism instead. – Karl Smith ICYMIA gay former VP is suing Goldman Sachs, claiming discrimination. Trump may ban gun silencers. An old trick for lowering your cable bill may not work now. KickersFINALLY, there's an Xbox body wash. (h/t Scott Kominers) Quantum leaps actually take time. There's a new theory of how consciousness evolved. Ken Jennings reflects on James Holzhauer's "Jeopardy" streak. Note: Please send Xbox body wash and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment