Inside: The rewards of responding to climate change could outpace risks for companies. A solar scam snagged Berkshire Hathaway. Hurricane forecasters are worried about unusually warm water. Avatar director James Cameron sees a future in plant-based investing. There's an ugly side to the makeup aisle. Facebook investors can't win. — Emily Chasan Sustainable Finance Companies see $1 trillion in climate risk but expect even more in rewards from climate opportunities. Some $2.1 trillion of potential good news is embedded in corporate disclosures on climate risk, according to an analysis by CDP.

In a cautionary tale for renewables investors, the FBI alleges that DC Solar ran $800 million Ponzi-type scheme using lure of big federal tax credits to scam Berkshire Hathaway and others, writes Bloomberg's Brian Eckhouse.

ESG ratings firms are the new sheriff in town for corporate loans. Thanks to the rising trend in sustainability-linked loans, ESG ratings now affect the price borrowers pay on $32 billion of loans worldwide, up from just $3 billion in 2017, according to BloombergNEF.

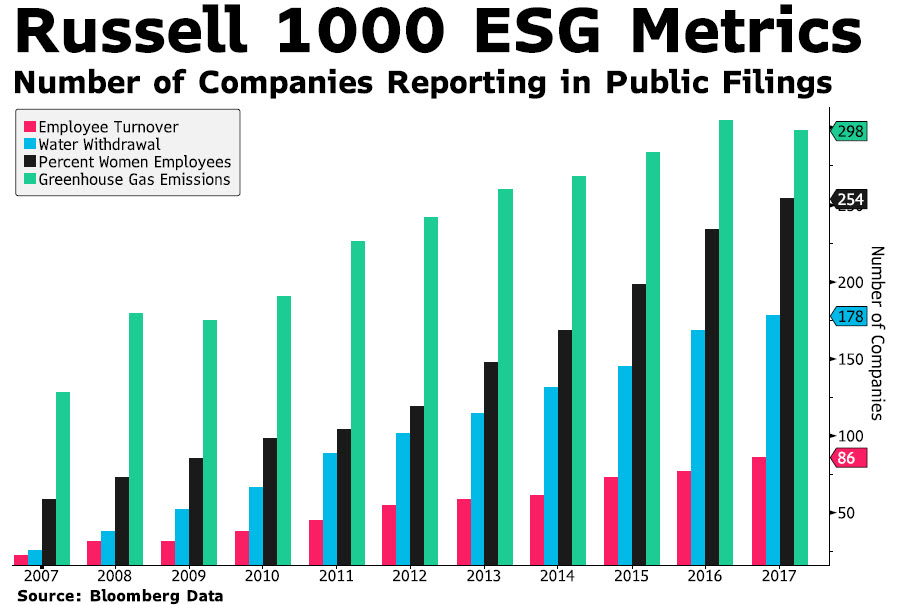

Quantitative investors are betting they can solve the data dilemmas in ESG. About 86% of the S&P 500 now publishing sustainability reports. Disclosures, however, are difficult to compare and have many gaps, with just about 300 Russell 1000 companies reporting greenhouse gas emissions, according to Bloomberg data. That's left space for quantitative investors who say they can use their skills to fill in the gaps. "We really believe there's alpha in ESG," George Mussalli, chief investment officer of PanAgora Asset Management said at the Bloomberg Invest conference in New York this week. Quants discussed using metrics such as employee satisfaction, carbon pricing and controversies to find signals. Watch the panel discussion here.

Emerging markets are catching up with developed ones on ESG issues, JPMorgan analysts said.

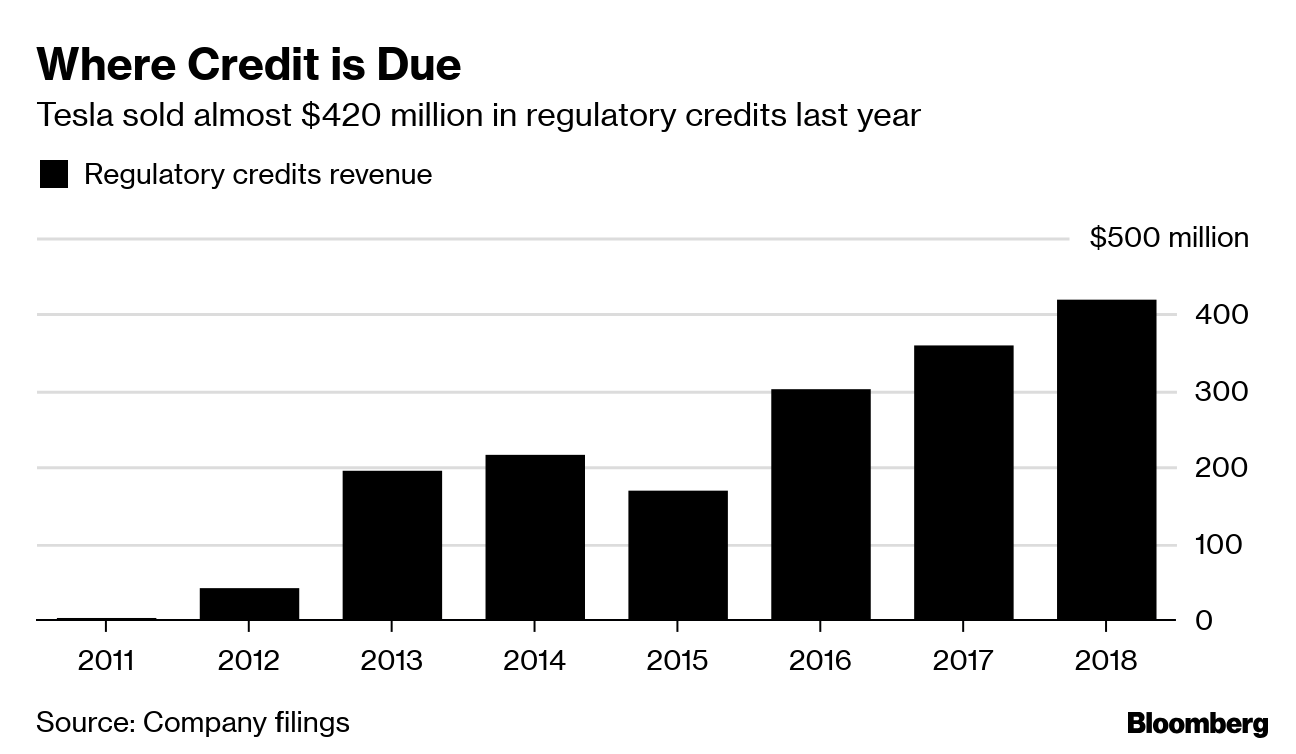

Tesla has a secret source of cash in selling greenhouse gas credits to other carmakers like GM and Fiat Chrysler that need to offset sales of polluting vehicles to U.S. consumers.  India's largest green energy company, ReNew Power, this week received $300 million more from investors via a rights offering led by Goldman Sachs, the Canada Pension Plan Investment Board and Abu Dhabi Investment Authority, the Economic Times reported. It had recently shelved plans for an initial public offering.

The Task Force on Climate-related Financial Disclosures, now supported by almost 800 organizations, sent its 2019 status report to the Financial Stability Board on Wednesday. The group, chaired by Bloomberg LP chairman Michael Bloomberg, noted that many companies incorrectly view the implications of climate change to be long term, but some are starting to see it as relevant to decisions made today.

In Brief - Sweden's AP2 Fund divested from about 60 companies involved in tobacco and nuclear weapons.

- The London Stock Exchange acquired ESG-focused fixed income data provider Beyond Ratings. Terms were not disclosed.

- Sun Life Financial is considering its first sustainable bond.

- Al Gore urged Harvard to divest its endowment from fossil fuels.

Environment James Cameron sees global salvation in plant-based investing. The Avatar director's family office is focusing on sustainable ventures in vegetarian food, ranging from an organic farm in New Zealand to a Canadian plant that makes protein concentrates from peas and lentils.

The U.S. East Coast's official hurricane season started on Saturday, and abnormally warm water close to the U.S. and Bahamas has forecasters worried. Researchers at Colorado State expect 14 storms before the end of November, while the U.S. government is expecting 8.

Norway's greenhouse gas emissions rose in 2018 despite its push into renewables.

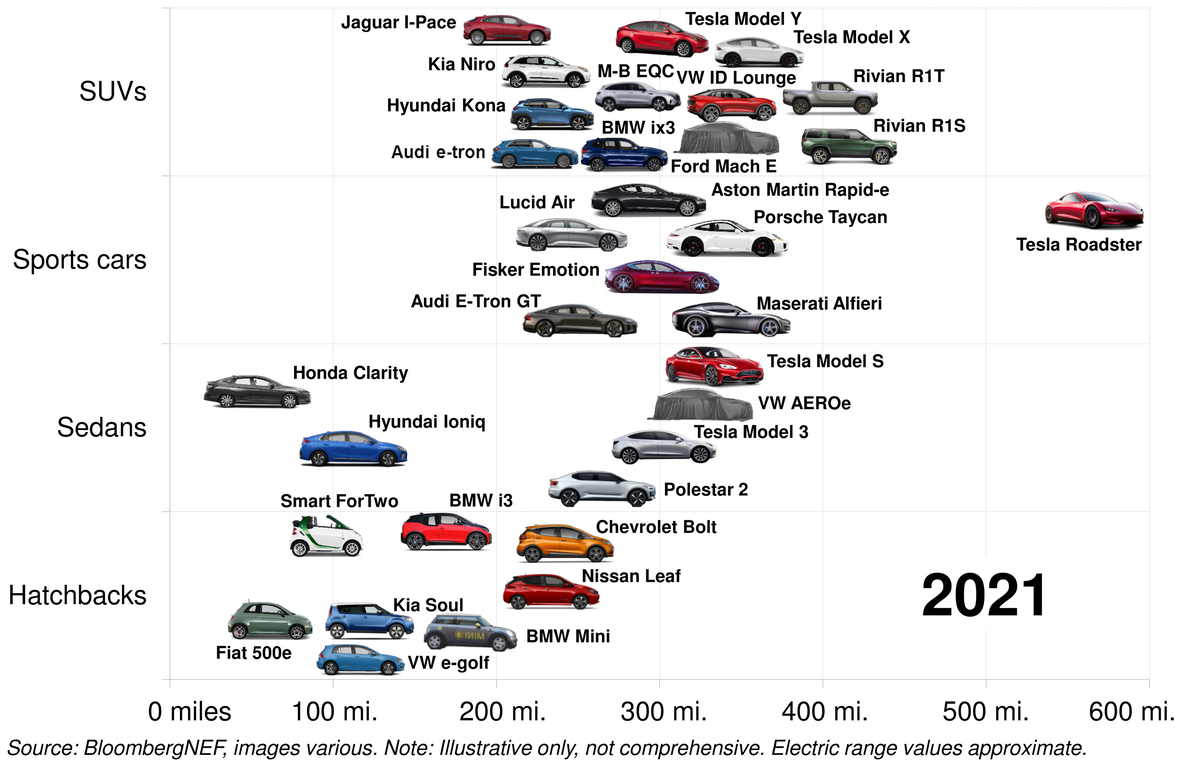

There's an ugly side to the makeup aisle. The health and beauty industry is a wasteland of plastic trash. Empty containers are often too small for recycling and beauty products often end up largely unused, gathering dust. Some brands are looking to change that with refillable beauty products, if customers bite. Your bowl of rice is hurting the climate too. Cultivating the staple could be as bad for global warming as 1,200 coal plants but consumers don't seem to be bothered, write Bloomberg's Aine Quinn and Jeremy Hodges. The number of electric vehicle models in the U.S. are set to double fast. Automakers plan to launch over 20 fully electric vehicles by 2022 and could push the category to 11% of light-duty passenger vehicle sales. The rapid penetration of electric cars and shared mobility means global oil demand for road transport is likely to peak in 2030, according to BloombergNEF's most recent outlook.  SocialA scaled-back Illinois board diversity bill is on track to become law. The law would require companies based in Illinois like Boeing and McDonald's to report on their director's diversity.

JPMorgan agreed to pay a record $5 million settlement to resolve a discrimination claim from a male employee who alleged the bank's "primary caregiver" parental leave policy was biased against dads.

Worker rights advocates are pushing to give rank-and-file employees a voice on boards of directors. Both Alphabet and Walmart will soon face investor votes on proposals for a director who could speak on workers' behalf about issues like hourly wages or corporate culture. Royal Dutch Shell told a Dutch parliamentary committee on May 29 at a that later this year it will publish how much tax it pays in each jurisdiction where it is active, in response to criticism over profit shifting. Dutch State Secretary for Finance Menno Snel urged other companies to emulate Shell's plan.

The U.S. Food and Drug Administration confirmed that it has found issue of per- and polyfluoroalkyl chemicals, also known as PFAS in the U.S. food supply. The chemicals, known as "forever chemicals" because of their unwillingness to degrade, are used in firefighting foam and non-stick coatings, among other products. Listen to Bloomberg Environment's David Schultz discuss the FDA's findings on Bloomberg Radio. Governance Facebook CEO Mark Zuckerberg has himself to thank for the fact that he's still chairman of the board. Facebook investors voted for change at the top but can't win due to the founder's controlling voting stake, writes Bloomberg's Kurt Wagner.

Exxon investors moved closer to upending the dual CEO-chairman role at the company with almost 41% of investors backing a proposal for a split.Support for directors also fell to 93% from 97% last year. The results are "a warning shot to management," said Edward Mason, head of responsible investing for the Church Commissioners for England who has been pushing the oil firm to better address its climate impact. The result "is a measure of investors' profound dissatisfaction," he said.

State Street updated its climate change risk oversight framework for boards of directors evaluating climate risks.

The SEC is looking to update rules for proxy advisers and shareholder proposals in the coming months, writes Bloomberg Law's Andrea Vittorio.  Note: Please send tips, suggestions and feedback to Emily Chasan at echasan1@bloomberg.net. New subscribers can sign up here. To see this on the web, click here. |

Post a Comment