| Friday Sport. The news at the end of last week that the U.S. will not, after all, impose tariffs on all Mexican goods this week reminded me of a famous tabloid headline from the U.K. Here it is:  The Sunday Sport isn't known as the most reliable source of information in the U.K., and this headline generated much amusement among people reading the paper in the pub over their Sunday lunch. A few weeks later came a fresh headline which I couldn't, alas, find on the internet: "World War 2 Bomber Found on the Moon Mysteriously Disappears." The story had been nonsense in the first place. But the editors kept a straight face and tried to make another news story out of what had never been true from the start. My first thought on this episode is that it must be fun to work for a British tabloid. A second and more important thought is that these presidential tweets from Friday evening have much in common with the news of the disappearance of the bomber from the moon:  It's hardly a stretch to suppose that the tariffs were never going to happen, and that the "deal" on Mexico's policy toward immigration was always going to happen, making the disappearance of said tariffs as newsworthy as the disappearance of the bomber from the moon. As for the all-capitals tweet on agricultural products, it is unclear at the time of writing whether there is anything to it. The Nafta trade accord made life very hard for Mexican farmers, so it would be quite an advance if Mexico somehow agreed to buy even more from the U.S.

The central issue at stake was immigration, and Mexico has agreed to change its treatment of migrants from Central America bound for the U.S. Such issues have been under discussion for a while. According to the New York Times, in a piece hotly disputed by the president, all the central elements on migration had been settled some months ago, while Kirstjen Nielsen was still Homeland Security secretary. When it comes to stiffening security at its southern border, Mexico is doing something that is in its own interest and that it might well have done anyway. It has a long history of brutal and ultimately ineffective attempts to stem the flow of migrants, as this academic study from as long ago as 2002 makes clear. So the measures Mexico is taking appear to be ones the government had already agreed to take, and that are roughly in its own interest. And there is no particular reason to believe that they are any more capable of stemming the flow of migrants than the U.S. authorities themselves.

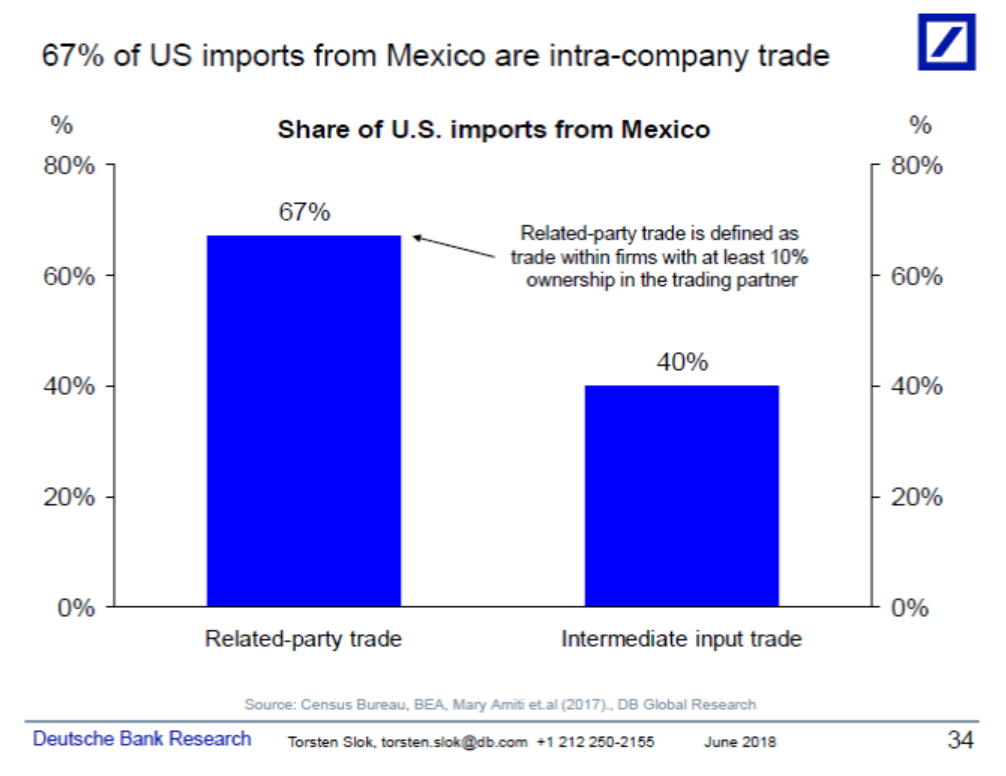

Meanwhile, the nature of supply chains is such that the threatened tariffs would have inflicted terrible damage on the U.S. Mexican manufacturers are deeply involved in the production of cars and their components across the U.S. border. One vehicle can cross and re-cross the border several times during the process of assembly, and so tariffs risked bringing the entire industry to a halt. As this chart from Torsten Slok of Deutsche Bank shows, fully two-thirds of Mexican imports to the U.S. come as part of intra-company trade, mostly in cars:  The incident might be presented as 1) a decisive intervention to persuade Mexico to act in U.S. interests. It could also be seen as 2) a nasty attempt to gain political credit where none is due, using an empty threat. Or it could be viewed as 3) an illegitimate attempt to use trade policy to bully a relatively weak nation to the will of a relatively strong one. We can look forward to a political argument over that one. The president's supporters will sell it as 1), while many international markets will worry about 3). I tend to go with 2).

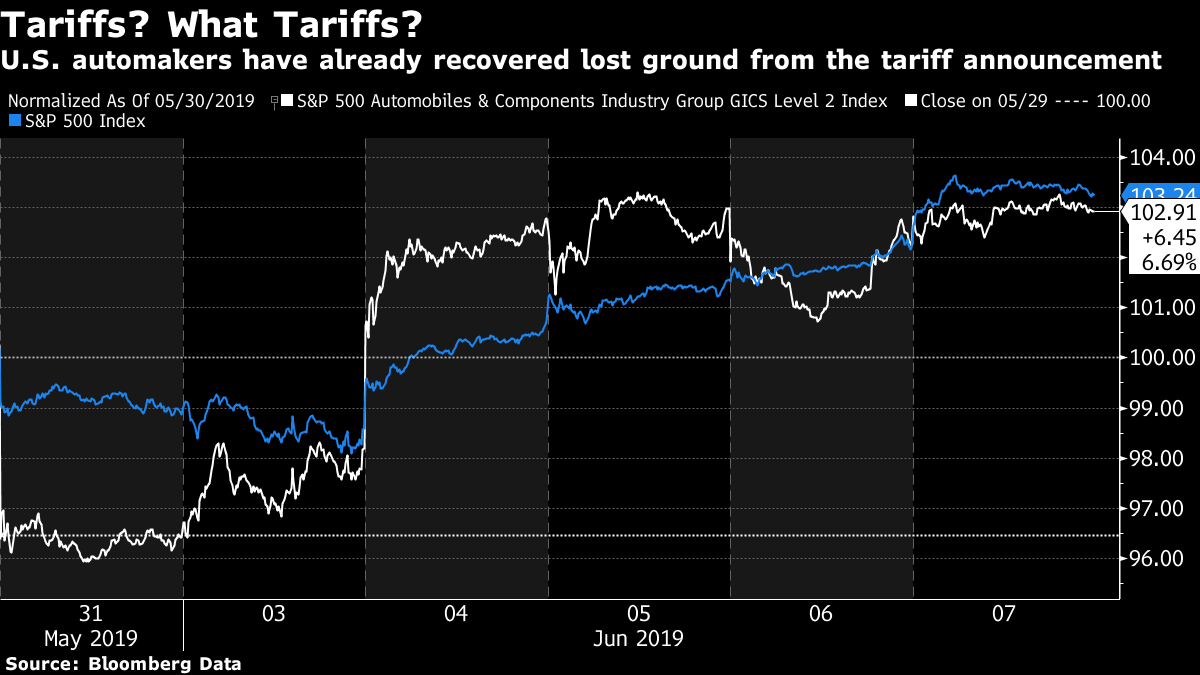

Now, what are the market ramifications? Plainly, this news is positive. The tariff threat may well have been as unreal as a bomber on the moon but any chance that it could happen was clearly market-negative. The stock market has rallied since the tariff threat was unveiled, so the threat wasn't taken terribly seriously there. As for bonds, the risk of tariffs on Mexican goods may have been a factor in the move to push benchmark yields lower and amp up bets that the Federal Reserve has to cut rates soon. So, all other things equal, the short-term response should be a rise in bond yields and a gain for stocks. The behavior of the automotive and components sectors since the tariff announcement, however, suggests that we shouldn't brace for that big of a response, because little risk was priced in:

Given that automakers had made up all their initial lost ground, and even outperformed the market as a whole since the tariffs were first announced via tweet on the night of May 30, we can say with some certainty that the the market had already decided that the threat was about as real as a World War II bomber on the moon.

Meanwhile in Mexico...

If there is any great opportunity to come out of the Mexican tariff incident, it probably involves Mexican assets themselves. This was a specific and serious threat to the Mexican economy. With the threat lifting, there are now two big reasons to believe that Mexican assets are worth buying: - Mexico is one of the few countries that should directly gain from the trade conflict between the U.S. and China. Mexico lost many manufacturing jobs to China after Chinese entry to the World Trade Organization. It now becomes an obvious base for U.S. companies looking for a relatively cheap place to manufacture and assemble products. There is a decent chance that Mexico can retrieve some of the jobs it lost to China, and it is as plausible an "overweight" in the event of a U.S.-China trade war as any.

- Mexican assets are still trading at a heavy discount to account for the risks associated with President Andres Manuel Lopez Obrador (Amlo), who was elected last summer and took office at the beginning of December. He had a recent record of strongly left-wing populist rhetoric, and a longer-term record of rather more pragmatic behavior when in office. Since being elected, he has been far more conservative than many thought he would be, delivering a budget surplus with the aid of cuts to education. And in the contretemps over tariffs he has kept the rhetoric tamped down, and allowed President Donald Trump to claim a victory. This was doubtless uncomfortable for a left-wing Mexican politician, but it was in Mexico's interests.

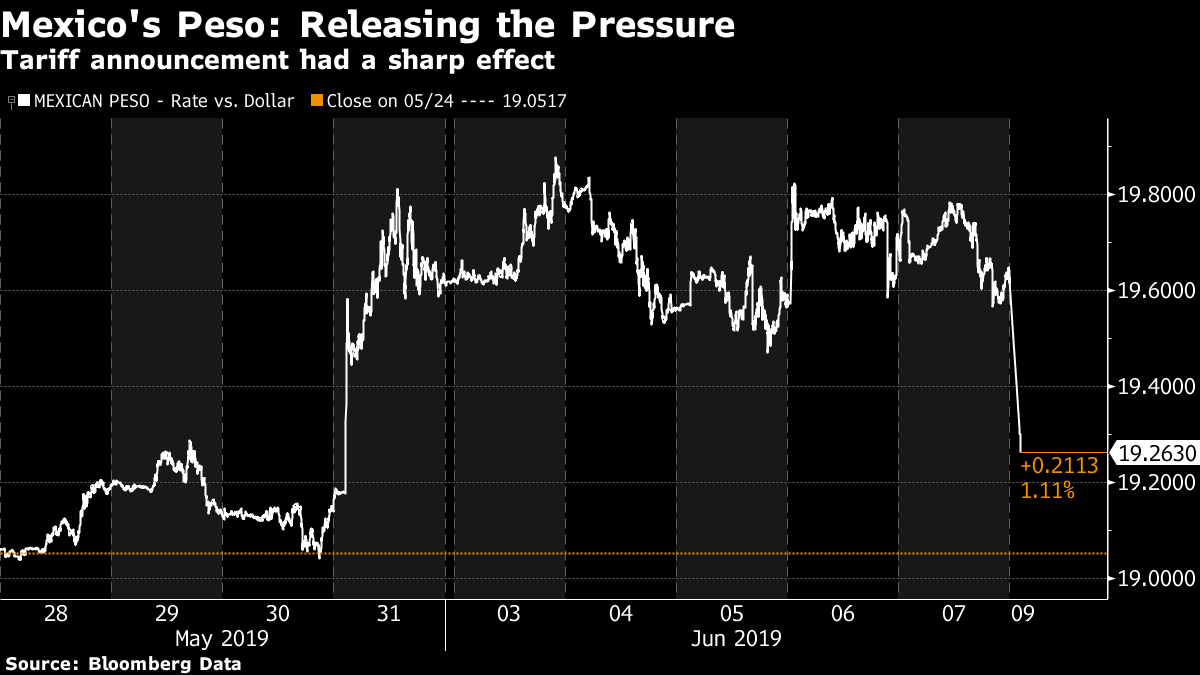

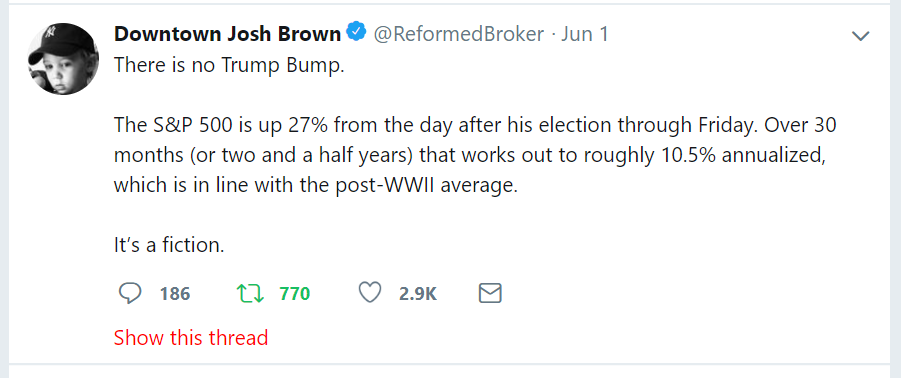

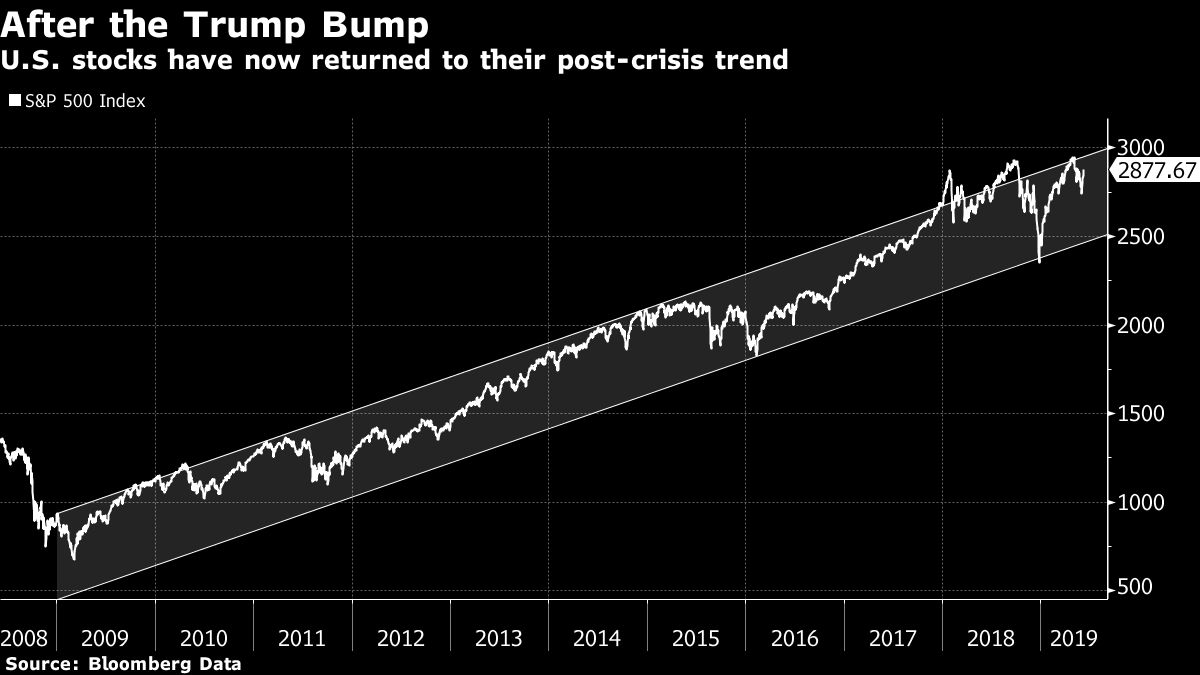

A quick look at the performance of Mexican assets makes clear that these positive factors aren't yet reflected in prices. This is how MSCI's index of Mexican stocks has performed compared to its index of developed and emerging markets over the last five years:  It hasn't recovered from the hits it took following the elections of Trump and Amlo. There must be a decent chance of a rebound now. Meanwhile, it should also be a very fair short-term bet that the Mexican peso can recover. This is how it has performed against the U.S. dollar since the first tariff tweet:  The initial reaction in Asia, at the time of writing, looks positive. Whatever else the U.S. president achieved with his threatened tariffs, he might have created a buying opportunity in Mexico. The Trump Bump Bumped Last week, financial Twitter had one of its more interesting spats, after @ReformedBroker posted that there was no "Trump Bump" in the stock market. It provoked a predictably big response, many of which flouted the Twitter norm by being measured and thoughtful. This was a discussion worth having:  The response suggests, correctly, that the only issue we should have is with the tense he used. There was a Trump Bump. But it is now over. Before the election, the prevailing narrative was that Trump meant risk or uncertainty; whatever he did, he would be unpredictable, and some of his ideas were really bad. The risk of protectionism, in particular, spooked the markets. Once the election result was in, and traders had a moment to confront what it meant, a new narrative took hold: Trump meant growth. Reduced taxes and regulations would be great. For a year, trade disappeared from the agenda, while Trump delivered on a big stimulus. For the last year, it has been the opposite. All of this added up to a Trump bump which is now over. For one clear sign of this, take a look at the S&P 500. Technical analysis can often lead to attempts to impose patterns or rules on the markets that aren't there. But in this case, the upward trend channel in which the market started trading once Barack Obama was elected in 2008 seems very clear. The Trump Bump, once the tax cuts became a reality, brought the S&P above its trend briefly at the end of 2017, and again later in 2018. Then the sell-off that climaxed on Christmas Eve very nearly took the market back down below the bottom line of its trend channel. And now we are back squarely within the remarkably steady upward trend that has been in force ever since Obama was elected.  There was a Trump bump. It is now over. His critics cannot say that he has done anything to mess up the strong market that he inherited. His supporters cannot say that he has done anything to accelerate or improve on his inheritance.

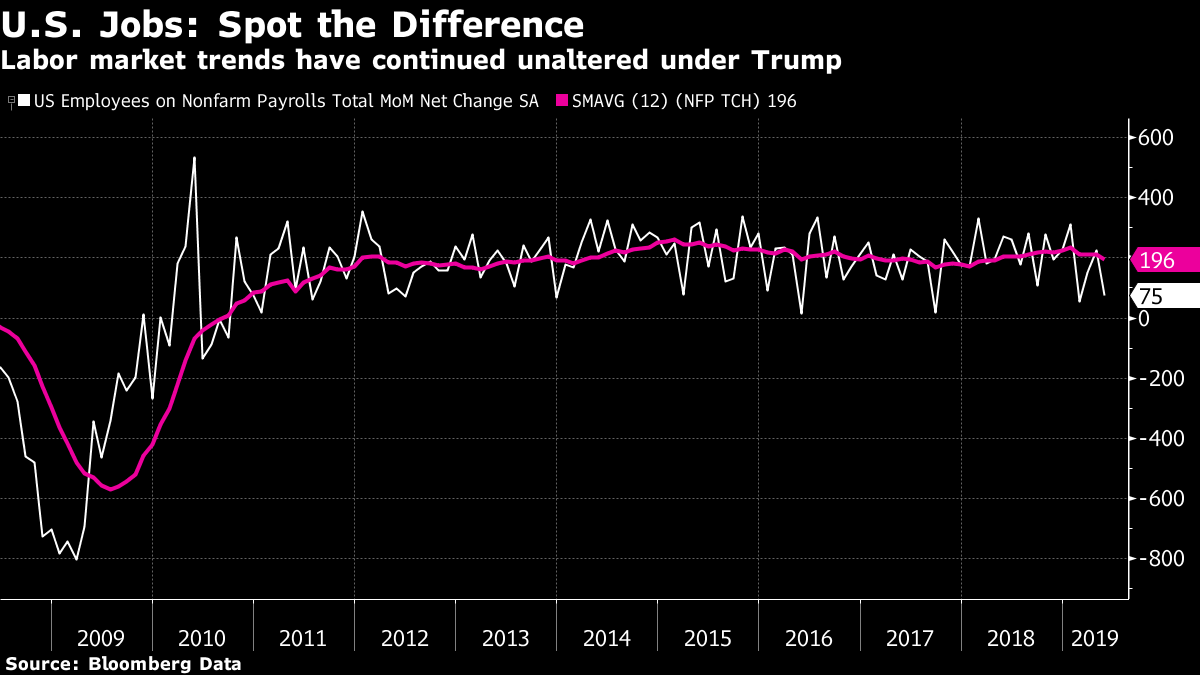

Almost exactly the same is true of the rather more important jobs market. In many ways, the transition from Obama to Trump was an epoch-making one; it meant a total discontinuity in both policy and governing philosophy. And yet there is no sign at all of any shift to a trend of steadily stronger monthly changes in the jobs market:

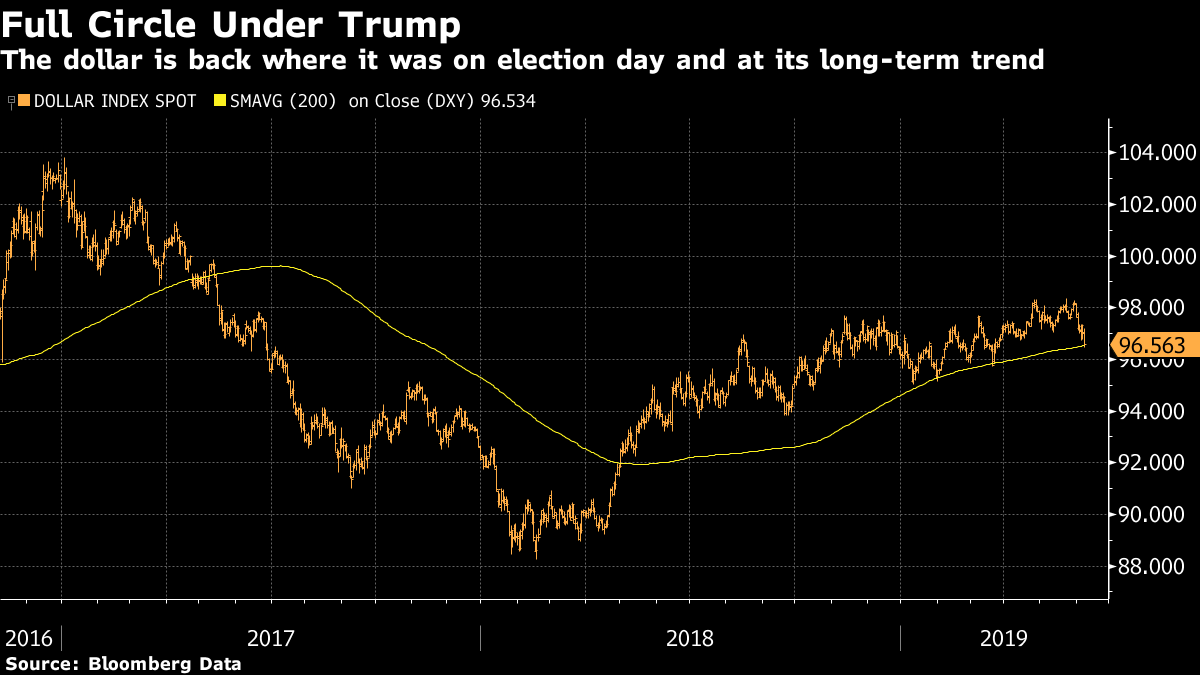

Yes, Friday's job numbers were unambiguously bad and disappointing, but the series is prone to noise and revision. As with the market, Trump's critics cannot say that he has done anything to mess up the employment picture, and his supporters cannot claim that he has done anything to improve it. And yet somehow I fear this will not be the end of it. The number that counts Finally, it is worth looking at this crucial juncture for the single most important monetary indicator of the moment. Worries about the economy, plus the belief that the Fed will be cutting rates, have been enough to bring the dollar down.Now, the trade-weighted dollar index is almost exactly at its 200-day moving average, and it is also exactly where it started on election day in 2016:  Technical indicators such as moving averages matter a lot in the foreign exchange market, where there are few clear indicators of underlying value. The long-term trend line has acted as an effective floor from which the dollar has bounced several times in recent months. So this is an interesting test.

The most recent data suggest that the U.S. economy isn't so great after all. Fed speak, which will now cease ahead of the FOMC meeting later this month, has suggested that rate cuts are more likely. This should increase the chance that the dollar actually drops through the 200-day moving average. That would be great news for Trump, who has complained that the dollar is too strong. It would also make life easier in emerging markets around the world, and particularly for China, which would prefer not to let its currency weaken too much against the dollar.

Against this, there is a move toward a reduction of rates and a return to stimulus across the world, while any concerns about the economy generally boost the dollar as a safe haven. The news about Mexican tariffs may well strengthen the dollar.

So brace for an important test of the dollar to start the week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment