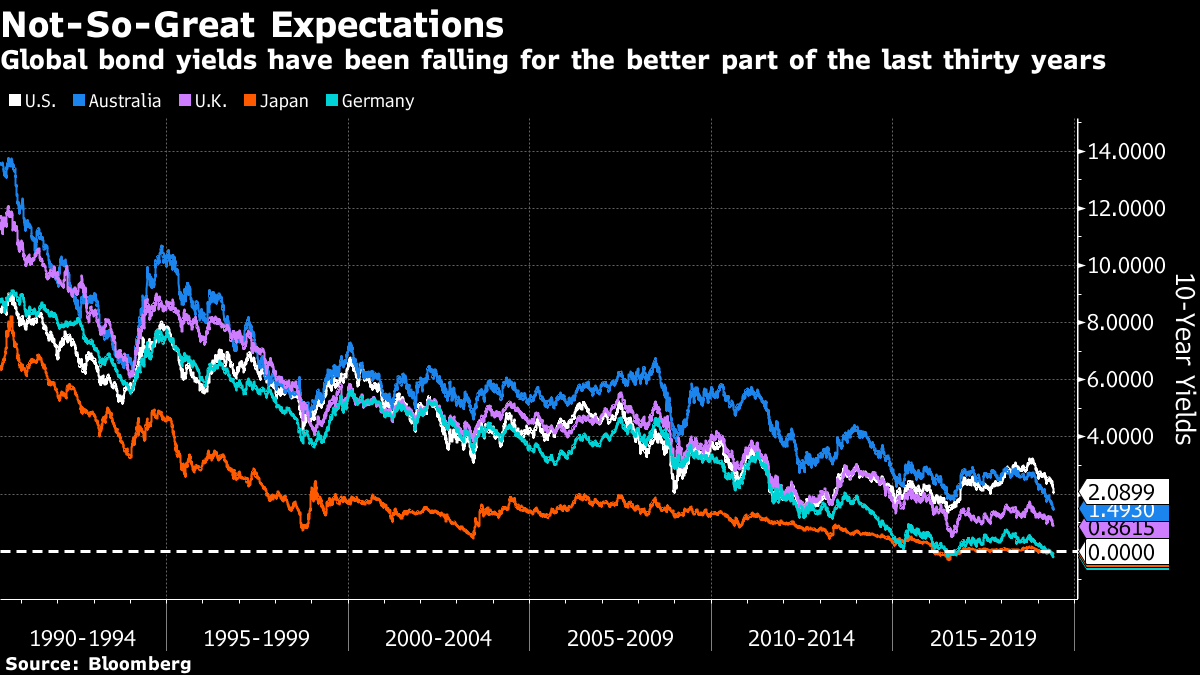

| China warned its citizens against U.S. travel, citing "frequent" shootings. Asia equities are looking up after U.S. stocks jumped the most since January. And the RBA's Lowe put more easing on the agenda. Here are some of the things people in markets are talking about today. Another Trade-War Salvo China issued a travel advisory about the dangers of visiting the U.S., citing frequent shootings, robbery and theft. Also: "Law enforcement agencies have repeatedly harassed Chinese citizens visiting the United States through exit and entry inspections, door-to-door interviews and other means," CCTV reported, citing the foreign ministry. Elsewhere, Tiffany & Co.'s U.S. sales to Chinese tourists fell by more than 25% last quarter, a trend that's worsening as the trade war escalates. Openness to Cut Jerome Powell opened the door to a rate cut. The Fed chief said the central bank is "closely monitoring" the impact of U.S. trade tensions and suggested officials may ease policy if the economy is threatened. "As always, we will act as appropriate to sustain the expansion." Bank of America expects three cuts for a total of 75 basis points over the next year, starting in September. In remarks earlier on Tuesday, Chicago Fed President Charles Evans brushed aside the idea the central bank needed to cut rates in response to market pressure. Stocks Jump Asian equity futures are pointing higher after U.S. stocks jumped the most since January on Powell's comments. Big banks surged as Wells Fargo analyst Mike Mayo said the industry would "party like it's 1995" if rates are cut. Treasury yields rose from multiyear lows as the Fed chairman stopped short of signaling any imminent moves, and the dollar declined. Oil advanced and gold was little changed. Australian Easing RBA Governor Philip Lowe also put more easing on the agenda. "The board has not yet made a decision, but it is not unreasonable to expect a lower cash rate," he said in an evening speech after announcing a cut earlier Tuesday. Australian first-quarter GDP data Wednesday may show growth slowed to 1.8% year-on-year as business investment weakened. Pipeline is a Game Changer China's looming pipeline reform is poised to spur competition in its natural gas industry, lowering prices and supercharging demand from the top importer, Credit Suisse said. The move—likely to happen before year-end—will break a monopoly that the state-owned giants have over downstream users and result in prices falling 10% over 2020 and 2021, the bank added. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what David's interested in this morning When you hear about the inverted yield curve and the recession it portends, one should remember that right now it refers only to the U.S. economy. Some of the commentary seems to overlook this. While a U.S. recession would certainly affect the world (more on that later), nuance is now more important than ever because other economies make up a far larger part of global GDP compared with the last inversion 14 years ago. To underscore this point, Nomura Rate Strategist Andrew Ticehurst, speaking about rate differentials during an interview on Bloomberg TV, emphasized that the Australian and U.S. cycles have to some extent diverged. America's done well enough for the Fed to tighten policy (arguably contributing to the curve inverting) while Australia's almost three-decade run of unimpeded growth has hit a speed bump, prompting the Reserve Bank of Australia to take rates to new lows.  The other angle here is that while the threat of recession is likely just a U.S. Story in the near-term, falling rates are a global one. And as rates drop, so does the bar for governments to borrow and spend. Fiscal policy will likely feature more prominently in the second half of 2019. If the U.S. 10-year yield falls through 2% and approaches 1.5%, the question of whether rate cuts are enough or even the right tool to deal with trade war-induced uncertainty probably becomes less relevant. You can follow Bloomberg TV anchor David Ingles on Twitter at @DavidInglesTV. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment