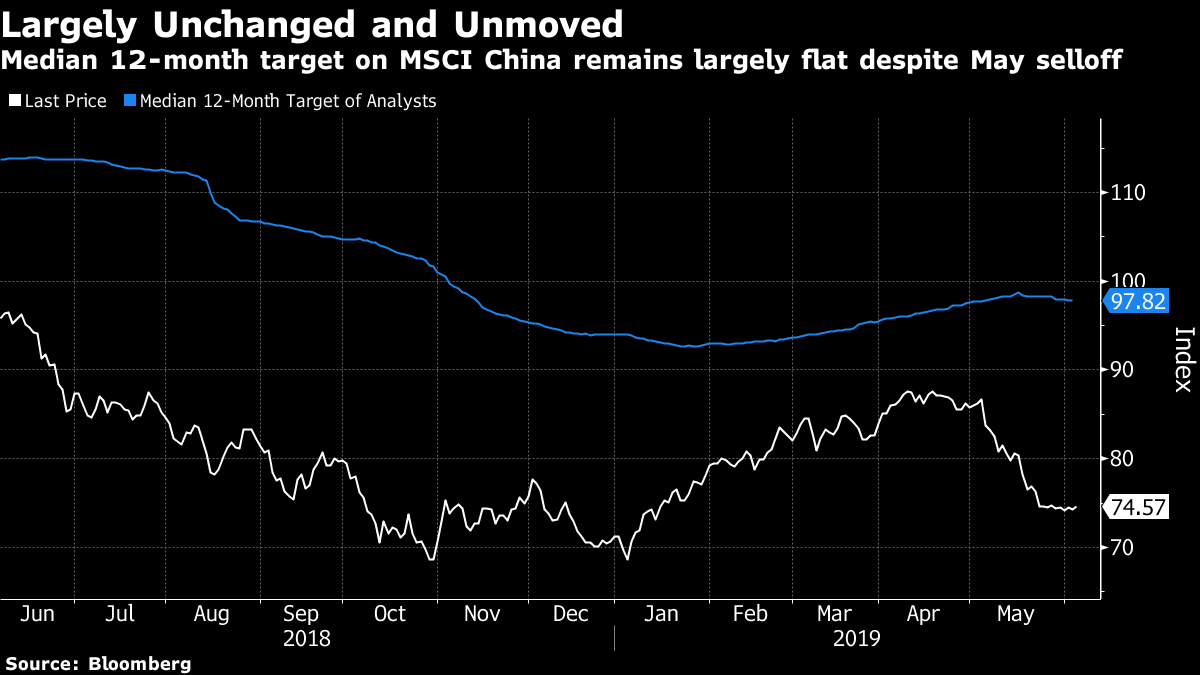

| Boeing is in talks for a megadeal that the trade war could derail. Asia equity futures are mixed after a U.S. stock advance. And the Trump administration readies a $2 billion Taiwan arms package. Here are some of the things people in markets are talking about today. Boeing Megadeal Boeing is negotiating one of its largest-ever orders of wide-body jetliners with Chinese airlines. Talks are for a 100-plane deal—including the 787 Dreamliner and 777X—potentially worth more than $30 billion before the usual discounts, people familiar said. The U.S.-China trade war is a complication for both sides, with the carriers waiting for Beijing's guidance before proceeding. Mixed Markets Asian equity futures may open mixed, with Nikkei futures slightly up, while the Hang Seng may open down. U.S. stocks climbed on optimism Mexican tariffswill be avoided. Treasuries rose as a weak private-jobs report bolstered bets the Fed will ease, outweighing solid service-industries figures. The spread between 2- and 10-year yields reached the widest since November. The dollar rose against all G-10 currencies except the kiwi. Oil entered a bear market after U.S. supplies jumped the most in almost 30 years. Taiwan Arms Sale The U.S. is preparing a $2 billion arms sale to Taiwan that will include the American Army's best tank, the M1A2, a person familiar said. The package also includes anti-aircraft and anti-armor weapons, but not F-16 fighters, which are still under review by the Pentagon and State Department. Beijing opposes all weapons deals with Taipei and will probably issue a public protest. Prayuth Keeps His Job Thai junta leader Prayuth Chan-Ocha won a parliamentary vote to return as prime minister following a disputed election in March, defeating the opposition's Thanathorn Juangroongruangkit. The former army chief was backed by the majority of lawmakers in a joint vote of the elected lower chamber and military-appointed Senate. He'll lead a coalition with a razor-thin majority against a vengeful opposition tired of being silenced. Trump Disputes Execution Report Trump said a North Korea official who was reported to have been executed really wasn't. The president took issue with a Chosun Ilbo report that Pyongyang killed its former top nuclear envoy to the U.S. and four other foreign ministry officials in March after a failed summit between Kim Jong Un and Trump. Kim Hyok Chol, who led working-level negotiations for the February summit in Hanoi between Trump and leader Kim Jong Un, is being investigated for his role in the failure to reach a deal, CNN reported earlier. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what David's interested in this morning The range of projections on the Chinese stock market at the moment is looking pretty wide. Morgan Stanley's new 12-month target for MSCI China is 76, just above current levels. Credit Suisse's year-end target is 79, implying about 6% upside; while HSBC Private Banking's own year-end target is 94, implying a whopping 25% rally by Christmas. The variation shows the complexity equity strategists face right now, with issues from trade-deal-or-no-deal and appropriate discount rates to model portfolios and potential policy responses. It must be difficult to trust that key assumptions will remain relevant beyond just a few months.  What all this probably means is that bond yields will remain depressed and are unlikely to retrace all the way back up near term, despite overbought signs. According to Kirk West of Principal Global Advisors, it would be a bit reckless to start leaning away from defensive assets right now. You can follow Bloomberg TV anchor David Ingles on Twitter at @DavidInglesTV. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment