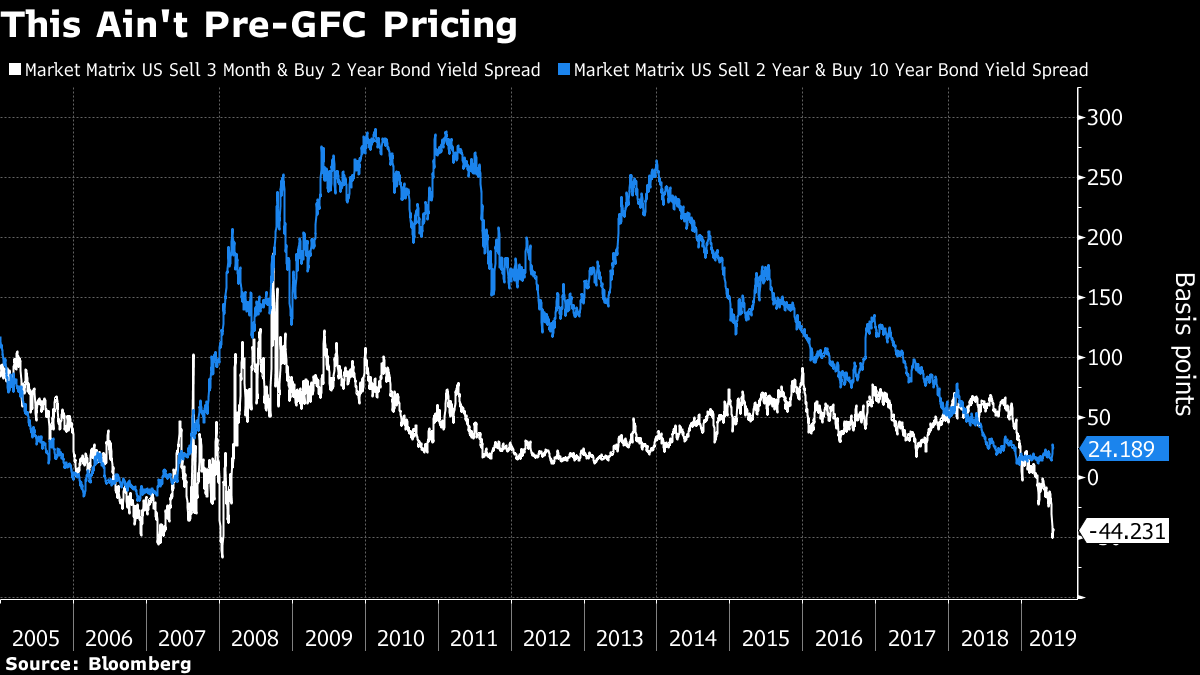

It's jobs day, no breakthrough on Mexico and China prepared for worsening trade war. PayrollsToday's employment numbers are hotly anticipated after the surprisingly bad ADP data released on Wednesday showed May was the worst month for private companies adding workers since 2010. Economists are forecasting 175,000 new positions filled in the month, but there seems to be little agreement on what a large miss in either direction would mean for markets. The unemployment rate is projected to remain at a 49-year low of 3.6% while annual wage gains hold for a third month at 3.2% when the numbers are released at 8:30 a.m. Eastern Time. In Pence negotiations Talks between the U.S. and Mexico are set to continue into a third day in a bid to reach an agreement that would stop the imposition of 5% tariffs on American imports from its southern neighbor on Monday. Mexican Foreign Minister Marcelo Ebrard confirmed that his government has offered to send about 6,000 national guard troops to Mexico's southern border with Guatemala to help stem migration, while Vice President Mike Pence said it is still the U.S. plan to go ahead with the tariffs. He said he would talk to President Donald Trump over the weekend to update him on developments ahead of the deadline. Tremendous roomPeople's Bank of China Governor Yi Gang said his country has "tremendous" monetary and fiscal policy space to make adjustments to the economy should the trade war worsen. He also said that his meeting this weekend with U.S. Treasury Secretary Steven Mnuchin would probably be a "productive talk, as always." China's markets are closed for a holiday today, but the offshore yuan fell the most in three weeks to trade at the weakest level since November, in the wake of the governor's comments. Markets riseOvernight, the MSCI Asia Pacific Index climbed 0.1% while Japan's Topix index closed 0.5% higher to cap the gauge's best weekly advance in two months. In Europe, the Stoxx 600 Index had gained 0.8% by 5:45 a.m. as investors in the region remain positive in the wake of the latest ECB decision, while oil companies got a boost from rising crude prices. S&P 500 futures are pointing to a positive open ahead of jobs data, the 10-year Treasury yield was at 2.122% and gold held its recent gains. Crude reboundA barrel of West Texas Intermediate for July delivery was trading at $53.20 at 5:45 a.m., bringing its two-day advance to more than 3% after Saudi Arabia and Russia reiterated their commitment to work together to keep the global market balanced. The kingdom's top oil official said he was sure that OPEC and its allies would agree to extend production cuts into the second half of the year after holding talks in St. Petersburg. In non-OPEC oil news, the weekly Baker Hughes U.S. rigcount is due at 1:00 p.m. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Luke's interested in this morningThe 10-year yield may have moved less than one basis point this week through Thursday, but the bond market has been anything but boring. It's minute, but there's been a change in the nature of the bond rally to bull steepening: the short-end falling faster than the long-end after four straight weeks of flattening. Last week saw the biggest shrinkage in the three-month, 10-year spread since the middle of 2017. The Powell connection: an openness to cutting sooner may somewhat mitigate the need to cut more later. This dynamic, along with the combination of an inverted 3m10y curve and a positive 2y10y slope, hints at the enduring belief that any Fed easing cycle will be sufficiently shallow and proactive so as to avert a material downturn in the economy. We're closing in on the longest streak on record in which 3m10y is inverted while 2y10y remains positive. By the time 3m2y was this inverted in 2006, 2s10s was also subzero, pointing to expectations for a period of prolonged accommodation. For PIMCO's Mark Wiseman and Vanguard's Gemma Wright-Casparius, the steepening trend is due to continue as the case for rate cuts crystallizes. But consider a scenario in which the past is prologue. Namely, U.S. data is non-recessionary and risk assets stay resilient. That would likely involve traders pushing back expectations for any start of a rate-cutting cycle from the Fed, supportive of flattening in cash curves. Today's non-farm payrolls report will be the first test case. In other words, the bond market is saying that the Fed has enough ammo for this episode. "It feels like the bond market message is that the Fed can cut a few times, the economy stabilizes around 2-ish percent, and recession is avoided," writes Renaissance Macro's Neil Dutta.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment