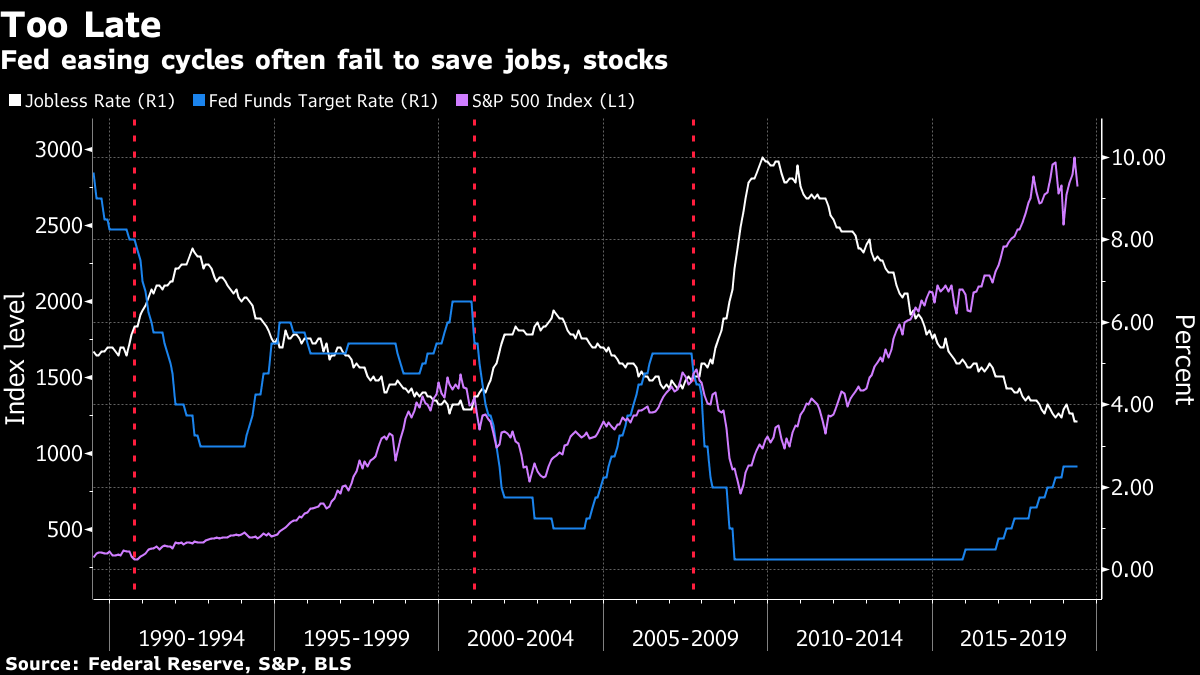

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. European stocks are set for another lower open, U.S.-German relations took a turn for the worse, U.K. prime minister candidates start being whittled down today, European countries are making the most of low bond yields and there was a rare bit of good news for the U.K. housing sector. Here's what's moving markets. Trump vs. Merkel In a further sign of deterioration in U.S.-Germany relations, President Donald Trump upped his criticism of Berlin's support for a new natural-gas pipeline into Europe from Russia, saying he's looking at sanctions to block the Nord Stream 2 project that would leave Germany "captive" to Moscow. (The U.S. also wants to sell gas to Germany.) Trump has also repeatedly rebuked Merkel's government over other policies, like trade and and defense, while Germany has criticized Trump's moves to abandon agreements on climate change and Iran. 17 or Out This summer's second-most-exciting popularity contest really gets going today as the U.K. Conservative party's first leadership ballot commences. Those who receive 16 votes or fewer will be eliminated, before further ballots take place next week, and we're eventually left with a final couple of contestants for the wider party to choose from. Having played down his desire for a no-deal Brexit in a campaign speech on Wednesday, the U.K. premiership remains Boris Johnson's to lose, according to bookmakers. Bond-anza European nations are taking advantage of plunging yields by raising money via low-cost debt sales. There's no shortage of demand either, with investors even lapping up an issuance from the Italian government on Wednesday, just as euro-area finance ministers prepare to meet in Luxembourg today to discuss penalties for Italy over its debt load. Bond traders aren't bothered, and the discounted sales may well continue if the European Central Bank drops further hints of easier policy. Shares Slip Asia stocks mainly fell for a second day with no real trade war conclusion in sight and tensions rife in Hong Kong, while Treasury yields ticked lower after a weak inflation report on Wednesday bolstered the case for Federal Reserve interest-rate cuts. Oil, meanwhile, languished near a five-month low following a surprise increase in American crude inventories. European equity futures are pointed lower but one sector that might get a lift today is U.K. homebuilders, following a rare bit of upbeat pricing data for a sector battered by Brexit uncertainty. Coming Up... U.K. supermarket chain Tesco Plc gives a quarterly update after its shares were hit in May by industry data that pointed to weaker grocery spending. The Swiss central bank announces its rate decision and economic forecasts with the country's currency having rebounded in recent weeks from a two-year low against the dollar. OPEC releases a report on forecasts for oil demand and production, just as some of the industry's top executives attend a climate change meeting with Pope Francis at the Vatican. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Garfield Reynolds is interested in this morning Rate cuts from the Federal Reserve might seem to be the U.S. equity bull market's best hope of extending its decade-long run, but history shows they could instead be the last nail in its coffin. Even as some decry calls for rate cuts with unemployment at a near-50-year low, a look back over the data shows Fed usually only moves after the jobs market has actually started to turn. The last three major easing cycles -- starting in 1989, 2001 and 2007 -- all got going just after the jobless rate turned out to have troughed. Seems jobs are indeed a lagging indicator. Alarmingly enough, the jobless rate usually shoots up as rate cuts get going, and the S&P 500 had a rough time of it during the past two easing cycles.That adds to the case that stocks are cruising for a bruising despite their apparent trade-war resilience.  Garfield Reynolds is the Asia Team Leader for Bloomberg's Markets Live blog. Bloomberg Terminal users can follow him there at MLIV <GO> Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment