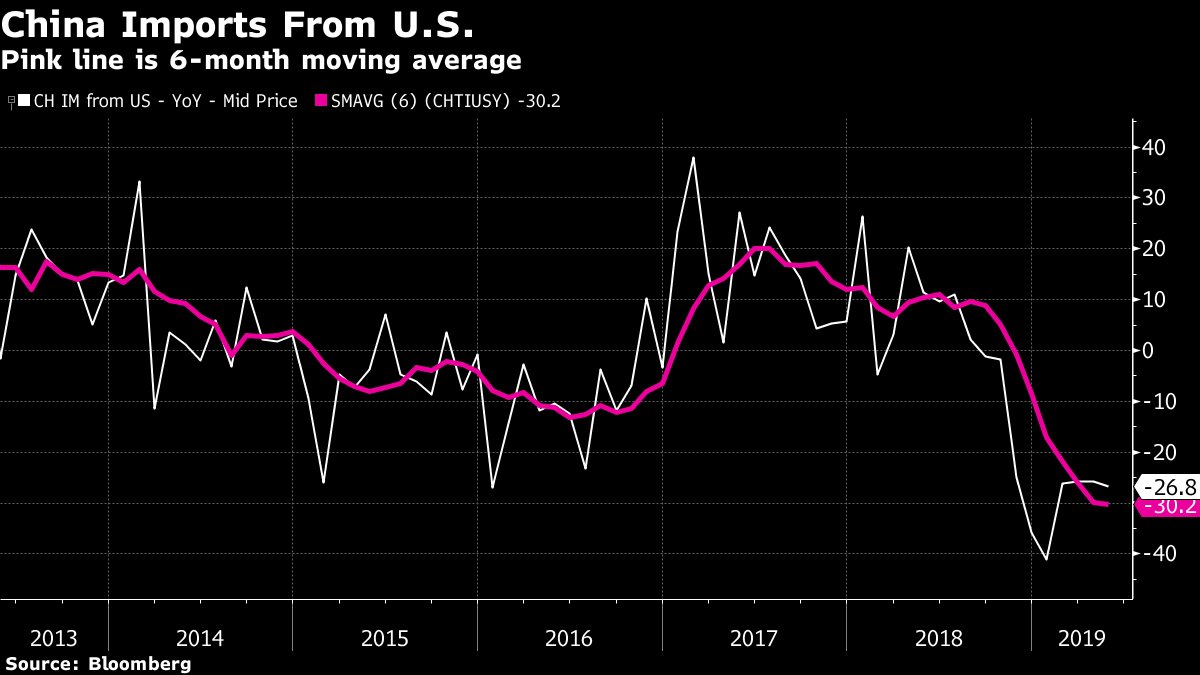

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. European equity futures are suggesting minor gains on Tuesday, Chinese monetary-policy makers took action against the effect of tariffs, there are some important U.K. statistics coming up, and we have a checkup on the oil market. Here's what's moving markets. PBOC Action While U.S. President Donald Trump was threatening new tariffs on China if President Xi Jinping stands him up at the approaching Group of 20 summit, the Asian nation's central bank was defending its currency. It set its reference rate for the yuan higher than forecast and said it plans to sell bills this month after the currency was hit in May as the trade war escalated and the economy slowed. But if you really want to keep up to date with China, you might want to follow this newspaper editor. Re-Open Several European bourses re-open after the Whit Monday holiday, including in Germany, Denmark and Switzerland, with sectors exposed to Mexico, like German automakers, expected to benefit from the weekend news that the U.S. had suspended planned tariffs on Mexican goods. Stocks in Asia mostly gained for a second day on Tuesday, while the pound was steady after some hawkish words from a Bank of England rate-setter, as was the euro amid bets on a cut in interest rates from the European Central Bank by the middle of next year. Shaky Oil Oil's gone slightly under the radar of late, as commentators focus on the trade war's impact on equities. But Brent crude prices are down about 12% over the past month, compared with the the Stoxx Europe 600 index's gain of about 0.3%. As such, hedge funds have also slashed bets on a rally in West Texas Intermediate, according to data released Friday. Futures gained overnight as Saudi Arabia maintains that it will work with Russia and other members of the OPEC+ coalition to prevent a further slump. U.K. Jobs The labor market is the star performer of the British economy, but with gross domestic product now shrinking on a monthly basis, investors may start to question the outlook for jobs. So keep an eye on U.K. unemployment statistics at 9:30 a.m. in London. Meanwhile, there were no real surprises on the long list of candidates to replace Theresa May as Conservative party leader and prime minister. Coming Up... We'll get an update on the U.K. housing sector, when builders Bellway Plc and Crest Nicholson Holdings Plc both update, and FTSE 100 environmental tech firm Halma Plc publishes a full-year report too. Earnings on the continent are light, but several European Central Bank speakers on today's schedule will keep FX traders on their toes. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Mark Cudmore is interested in this morning U.S. companies are losing out on the world's largest export market, by population, and one of the fastest growing in nominal terms. This hasn't yet fed through to earnings estimates, but it will. Never mind whether there's an eventual trade deal later this year, China imports from the U.S. are collapsing at an unprecedented rate. There's been at least a 25% year-on-year decline in each of the past seven months. The knock-on impact of this trade slowdown will hurt multiple economies and negatively hit earnings around the world. Much of this future impact doesn't appear to be factored into stock prices, particularly in the U.S. The recent slump in global yields provides a forgiving macro environment for equities, but it won't be sufficient if growth and earnings are to get slashed in tandem.  Mark Cudmore is a Bloomberg macro strategist and the Managing Editor of the Markets Live blog. Bloomberg Terminal users can follow him there at MLIV <GO> Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment