|

Greetings, I'm Andy Browne, Editorial Director of the Bloomberg New Economy. To handicap the outcome of U.S.-China trade negotiations, economists and market-watchers have turned to game theory. Which economy relies more on trade? (China, a key vulnerability.) Which political system can best withstand a protracted standoff? (Here, China's authoritarian structure may confer an advantage.) Will U.S. President Donald Trump blink if the stock market sinks? (He's been relatively unmoved by price swings so far.) And on and on. These calculations, however, obscure a much larger question: What is the game?

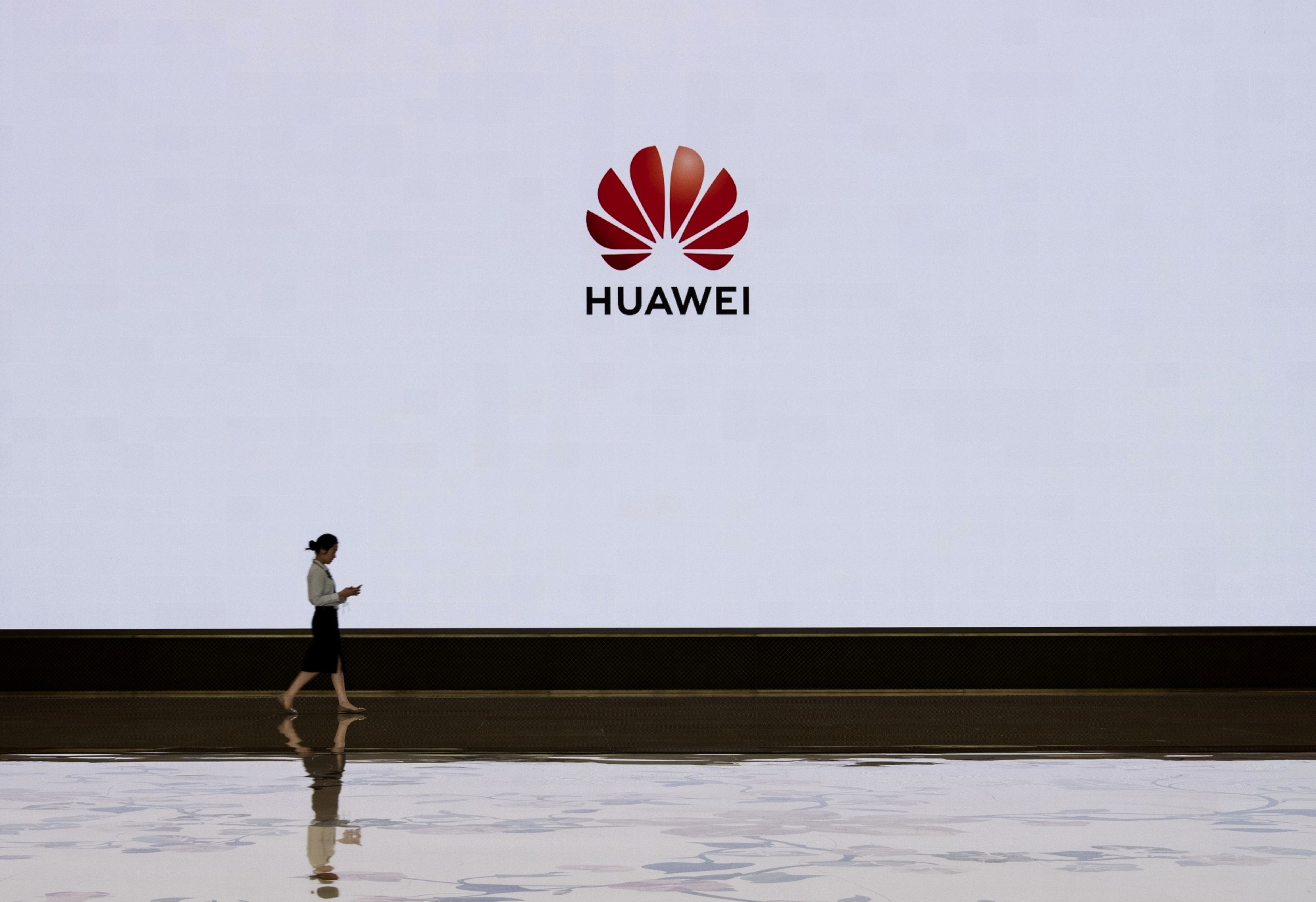

Nobody seems to know. Certainly not Trump, who upped the ante this week by starting to choke off the supply of U.S. components to Huawei Technologies Co., the avatar of China's high-tech ambitions. That uncertainty could sink any remaining prospects for a trade agreement and, if it continues, could provoke a broader crisis in U.S.-China relations. Tensions are rising again in the South China Sea, where the U.S. Navy has been conducting "freedom of navigation" exercise around disputed reefs.

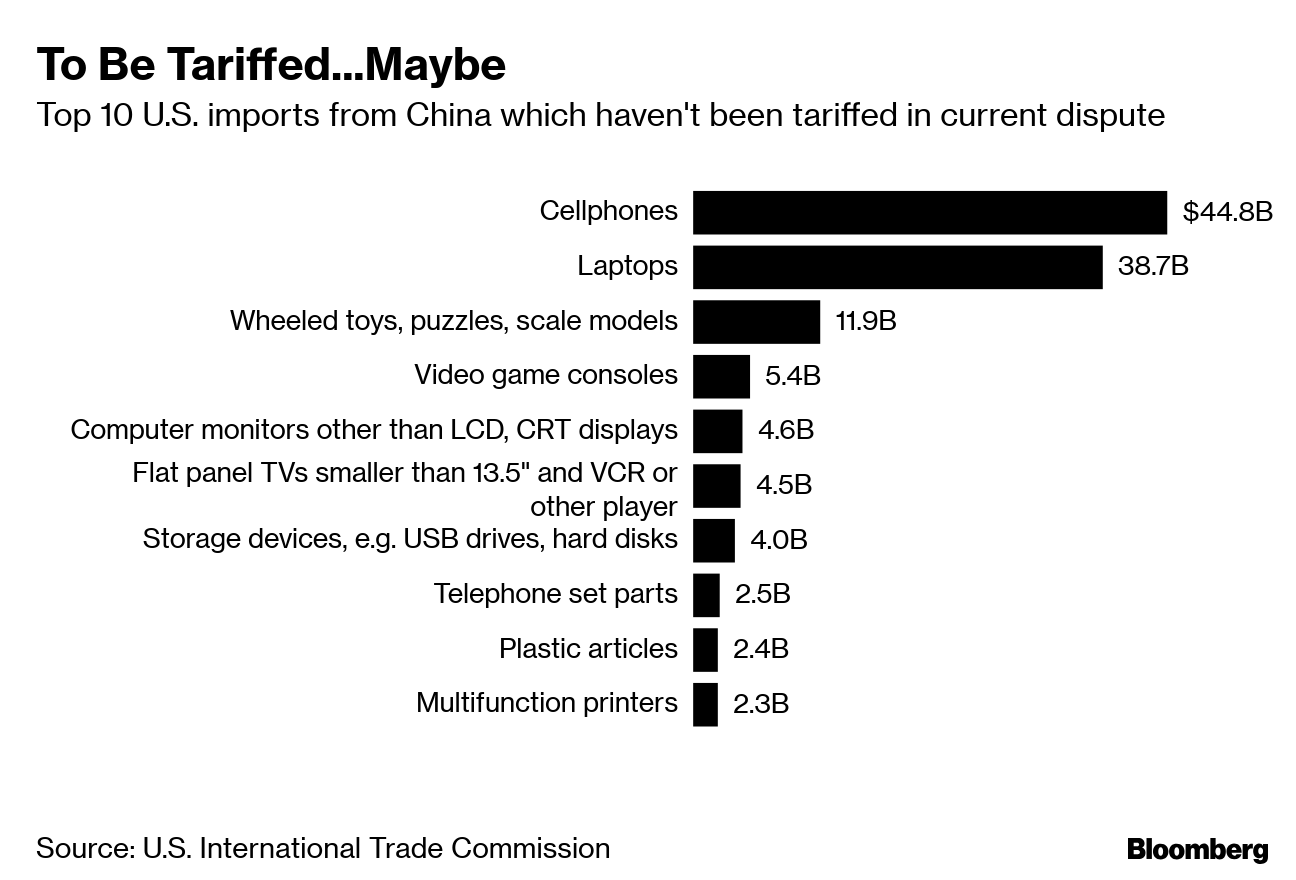

At the outset of his administration, Trump's goals for resetting the U.S.-China relationship seemed relatively contained: to narrow the trade deficit, bring manufacturing jobs back to America and fight for better market access for U.S. businesses in China while protecting their intellectual property. Over time, the mission has expanded. After Trump's first National Security Strategy branded China a revisionist power bent on using technology, propaganda, and coercion "to shape a world antithetical to U.S. values and interests," the State Department's Director of Policy Planning, Kiron Skinner, essentially proclaimed a few weeks ago that the U.S. and China were engaged in a clash of civilizations. It's now becoming clear that the trade talks are merely one component of a bigger game of superpower rivalry, with technology at the heart of it.  Game theory experts might well ask themselves why China would ever sign a trade deal with Trump if they sense that his demands are essentially limitless -- with the ultimate goal of preventing China's rise as a technology peer. The Chinese have good reason to worry that Trump would pocket any concessions and come back for more. Already, China is drawing level in key areas of technology, which is even more reason for Beijing to be concerned about Trump's intentions. Huawei threatens to become a high-quality, low-cost supplier of the 5G networks that will power smart cities, autonomous driving, advanced manufacturing and much more. Unless Trump puts Huawei out of business -- maybe he'll push the button on this nuclear option, maybe he won't -- China will get a jump in all these areas, setting standards, rules and norms around the world.  Decoupling To discuss the implications of what seems to be an open-ended conflict between the world's two largest economies, I hosted a Bloomberg New Economy dinner in San Francisco this week, inviting a mix of venture capitalists, entrepreneurs, former government policymakers, scholars and journalists. A key takeaway: The decoupling of the U.S. and Chinese economies is underway, and it's breaking apart the digital kingdom of "Chinafornia" -- the name that Matt Sheehan, a non-resident fellow with the Paulson Institute, gives to the technology ecosystem that fuses Silicon Valley with Chinese tech hubs.  There's a conceit in some parts of Washington, D.C. that China can't survive without U.S. technology, and that this gives the U.S. leverage in its trade fight with Beijing. That's true in discrete areas -- semiconductors, for one. But this kind of thinking ignores an important trend. According to Sheehan, a one-way flow of ideas -- from the U.S. to China -- has over the past four or five years started to go both ways. Silicon Valley is learning as much from China as the other way around. Talent is flowing backwards and forwards, too. Don't assume that stapling a U.S. resident visa into the passports of Chinese Ph.D. graduates will automatically persuade them to stay, says Sheehan. We used to think that America invented and China copied. Alibaba Group Holding Ltd. was a clone of eBay Inc.; Baidu Inc. a version of Google. But the recent runaway success of TikTok, the video-sharing site owned by Beijing ByteDance Technology Co., has caught many in Silicon Valley by surprise. Facebook and YouTube have a global Chinese competitor for the first time.  The dinner group hadn't yet felt much direct impact from Trump's moves to curtail U.S. technology exports to China and block Chinese investments in U.S. tech companies. But they report a shift in attitudes and behaviors. Chinese students, branded by U.S. politicians as potential spies, are opting not to come to the U.S. for graduate studies; researchers from the mainland are deciding they'd rather not work for U.S. companies and be treated as potential security risks. Amy Gu, the Silicon Valley Managing Partner of Hemi Ventures LLC, which invests in early-stage startups, says she runs into young entrepreneurs these days who won't take Chinese money even if they badly need it. "They're so scared," she says. Of course, let's not forget how all this started. Elizabeth Economy, the director for Asia Studies at the Council on Foreign Relations, points out that decoupling has become Chinese policy. President Xi Jinping's signature domestic industrial policy, Made in China 2025, explicitly aims to shut foreign players out of advanced industries such as robots and new energy vehicles. In Silicon Valley, the consequences will be measured in opportunities lost: The brightest minds in China and America will no longer collaborate as freely as before to solve the world's big problems, whether that's climate change or disease or gridlocked cities. The "Chinafornia" dream is over.  Like Turning Points? Subscribe to Bloomberg All Access. You'll get our unmatched global news coverage and two premium daily newsletters, The Bloomberg Open and The Bloomberg Close, and much, much more. See our limited-time introductory offer. Want more news about China? Sign up for our new Next China newsletter, a weekly dispatch on where China stands now and where it's going next. Download the Bloomberg app: It's available for iOS and Android. |

Post a Comment