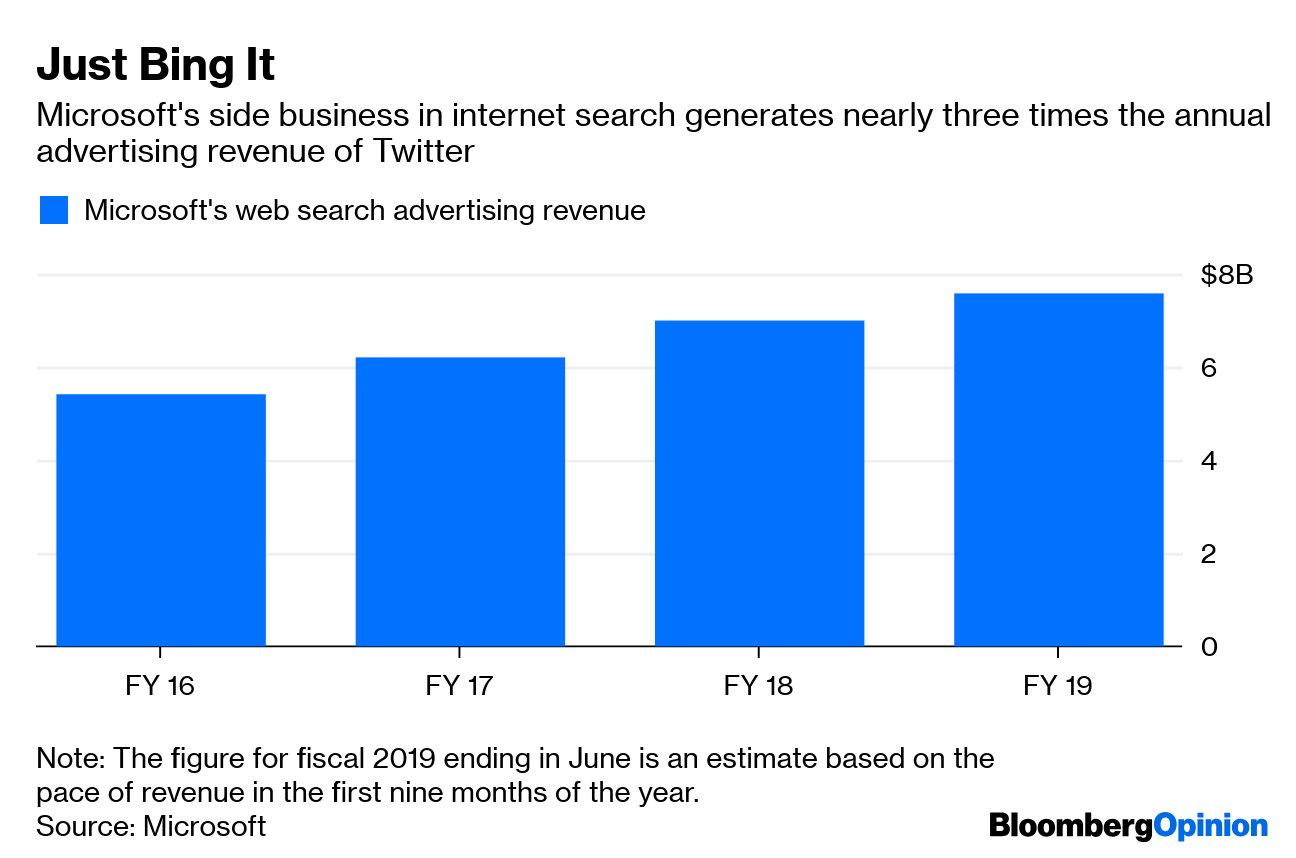

Today's Agenda  The Economy Can Cut Both Ways No matter how low his approval rating has fallen, no matter how many different people are investigating him, President Donald Trump has always had a strong economy on his side. But that security blanket may be shrinking. As pundits have noted recently, forecasting models based on economic growth point to a Trump re-election in 2020. These models were almost alone in predicting Trump's election in 2016, writes Karl Smith. But he also notes some of the same economic trends that helped doom Hillary Clinton are setting up to worry Trump in 2020. The economy needn't be in full-on recession to hurt the White House incumbent, Karl writes; it wasn't quite there in 2016. If it's just moving in the wrong direction, then voters may look for other options. One theme that arguably elevated Trump in 2016 was the unfairness of the Great Recession's recovery. A vote for Trump was a vote against elites and for the common man, or some such. But after two years with Trump in charge, data on financial-stress levels show the recovery is still uneven, writes Barry Ritholtz: Its benefits flow more to the wealthy than to the less-well-off, who are still saddled by debt and vulnerable to another downturn. Sounds like easy pickings for, say, Elizabeth Warren. Trump could also ease up on the trade war, which doesn't improve the economic outlook. An epiphany on immigration would also help; Matthew Winkler writes that states with high concentrations of immigrants (legal or otherwise) have done better economically under Trump. Two of the biggest such states are Florida and New York, Matt notes; stomping grounds of one notable employer of immigrants: the Trump Organization. Further Economic Reading: Here's why economists are so bad at forecasting recessions. – David Blanchflower Talkin' About Your Generation The miserable economic recovery was particularly hard on millennials, notes Ramesh Ponnuru. We told this generation college was the ticket to wealth, so they took our advice, loaded up on student-loan debt and hit the job market … just in time for a mini-depression. And then we mocked them for eating avocado toast and killing malls or whatever. We also criticize them for living in expensive cities, but Ramesh points out we keep cramming all the good jobs in those cities while not building new housing in them. No wonder millennials aren't having babies. This may not comfort the millennials much, but falling birth rates mean Generation Z, at least, will have an easier time getting into college, writes Justin Fox. Elite colleges will still be in high demand, but maybe other colleges won't keep skyrocketing in price. Battlefield Rare Earth Yesterday, many patriots were in an uproar over news China might squeeze exports of rare-earth minerals to strike back at America in the trade war. You'll pry my lanthanum from my cold, dead hands, China! But David Fickling suggests this threat is not exactly a nuclear option; the U.S. has other rare-earth sources, including right here at home. China's last attempt at weaponizing rare earths, against Japan in 2010, backfired when China lost market share it never fully regained. Further Trade War Reading: Time to Rethink This Whole T-Mobile-Sprint Thing Mid-sized wireless providers T-Mobile US Inc. and Sprint Corp. are trying to merge into a behemoth to rival Verizon Communications Inc. and AT&T Inc. This would hurt consumers, Tara Lachapelle has written, and the Justice Department apparently agrees. It wants the two to shed some assets and mash them together into a new competitor, named like T-Mobisn't or Leftovers Wireless or something. Somewhat unbelievably, the companies are apparently considering this. In a new column, Tara writes that letting a new competitor into the game would not only defeat the whole purpose of the merger, it would leave T-Mobile and Sprint worse-off than they were before. Telltale Charts On its 10th birthday, the oft-mocked Bing is not only still around but has turned into a decent little business for Microsoft Corp., Shira Ovide writes.  Energy is now a smaller part of the S&P 500 than it's been in at least 30 years; and oil companies have only themselves to blame, Liam Denning writes.  Further Reading A second referendum won't end the Brexit deadlock. Instead, two parties must take opposing sides and have another general election, giving one a mandate and a parliamentary majority to carry it out. – Mervyn King Robert Mueller's statement is a warning to protect our electoral system against further foreign interference. – Bloomberg's editorial board Despite pouring on the charm, Abe couldn't get Trump to see his way on North Korea, boding ill for Japanese trade talks and America's standing in the region. – James Stavridis Israel's political upheaval makes Trump's Palestinian investment conference even more of a dud. – Hussein Ibish Spain is vying to take Italy's place among the leading nations of Europe. – Ferdinando Giugliano Ben Shapiro is wrong: The West has no monopoly on science. In fact, the U.S. is now turning away from it. – Noah Smith ICYMI China pulls its punches in the trade war. But it's also stopped importing soybeans from America. Relive the moment Angela Merkel realized she couldn't trust Trump. Kickers Forget about work-life balance. Cellphones may have made America's crime rate collapse. Here's a map of every American city's most-Wikipedia-ed resident. Drake is the true villain of the NBA finals. Note: Please send soybeans and complaints to Mark Gongloff at mgongloff1@bloomberg.net. New to Bloomberg Opinion Today? Sign up here and follow us on Twitter and Facebook. |

Post a Comment