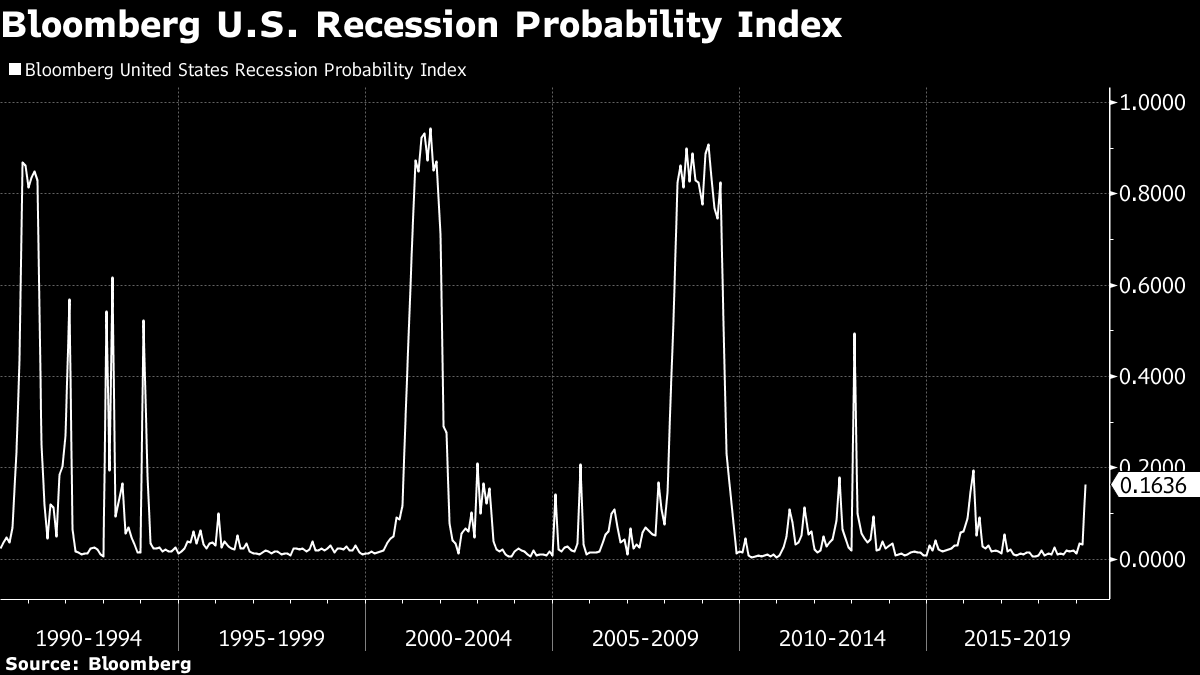

| Trump signed an order that could block Huawei and ZTE from selling their equipment in the U.S. He also geared down the trade war with Japan and the EU, giving U.S. stocks a welcome boost. And Alibaba posted a 33% jump in sales. Here are some of the things people in markets are talking about today. A National Emergency Trump signed an executive order to declare a national emergency relating to threats against information and communications technology and services. The move, which was expected, could restrict Chinese firms Huawei and ZTE from selling their equipment in the U.S. Shortly afterward, the Department of Commerce said it had put Huawei on a blacklist that could forbid it from doing business with American companies. The pair of actions risk aggravating Beijing as the president seeks to pressure China's leaders into agreeing to a wide-ranging trade deal Pumping The Brakes Donald Trump may de-escalate trade friction with the EU and Japan by delaying on auto tariffs by up to six months, people familiar said. He may change his mind, however, as aides including Wilbur Ross and Peter Navarro are in favor of the new import duties. Meanwhile, U.S. Treasury Secretary Steve Mnuchin expressed caution about China, saying he has "no plans yet" to go to Beijing and that while he's "hopeful" for a deal, "I wouldn't say I'm confident." Good Day For Stocks U.S. stocks rose on optimism trade tensions may wane, with the S&P 500 posting its biggest two-day gain in more than six weeks. The index remains 3% lower than before the trade-war escalation. Treasuries climbed, with 10-year yields down more than three basis points. Hang Seng and Nikkei futures are mixed. China's Treasuries Dump China's holdings of Treasuries fell in March for the first time in four months, dropping by $10.4 billion from February to $1.12 trillion. The country remained the top holder of U.S. sovereign debt, ahead of Japan. The data preceded the recent deepening of the trade war, which has prompted renewed speculation that Beijing could sell American assets to put pressure on Washington. Slowdown? What Slowdown? Cisco gave a bullish sales and profit forecast for the current period, a sign that corporations are continuing to spend on their computer networks. The company expects as much as $13.5 billion in revenue in the current quarter and adjusted profit of up to 82 cents per share, in line with projections. Alibaba defied China's slowdown; Tencent wasn't so lucky. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what David's interested in this morning Here's my attempt to pull two of this week's big stories together — I'd really like to see what everyone thinks. The first is talk, once again, of a looming U.S. recession. Jeffrey Gundlach is one of the latest to chime in: he thinks it's 50-50 whether one happens within the next year. The second is Uber's far-from-ideal trading debut, a result of misgivings over valuation.  So here's what I'm thinking. If the U.S. does fall into a recession, it will be the first one of the current gig-and-sharing economy. One of the major problems during a downturn is job losses and the consequent impact on consumption, confidence, spending and investment. Assuming someone gets laid off, would moonlighting for Uber, renting out a spare room over AirBnB, exploring personal financing over Upstart, starting a cooking channel over YouTube, pursuing a popstar career via Musical.ly, or even just finding happiness over Tinder help take the sting out of a recession? In other words, does the free flow of information and labor give people more options to deal with adverse financial situations? In Uber's case, the fact that drivers can shift between apps, or even leave any time, casts uncertainty over how the business model can be profitable. But it's a microcosm of this added layer of labor market resiliency that the gig economy's inadvertently created. I'm guessing it'll help if and when a recession hits but probably won't be enough, especially if aggregate demand is really depressed. Thoughts? You can follow Bloomberg TV anchor David Ingles on Twitter at @DavidInglesTV. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment