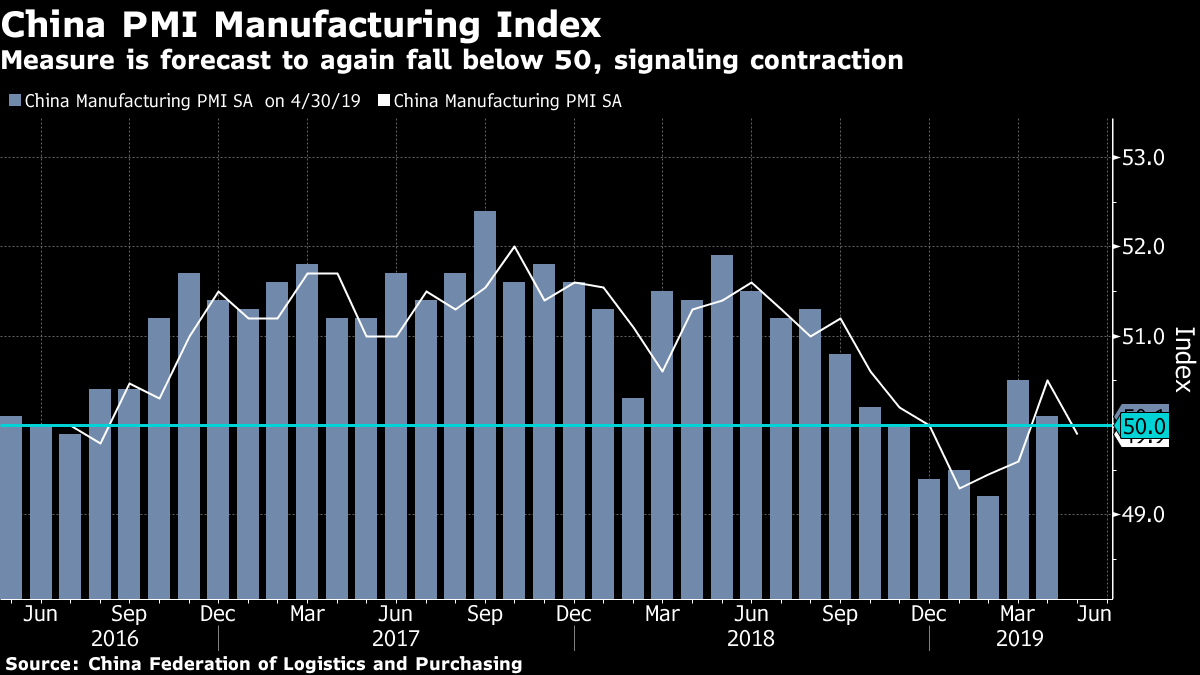

| China tosses the trade ball back to Trump. A Canadian telecom calls Huawei too big a threat. And Uber beats in its first post-IPO report. Here are some of the things people in markets are talking about today. America's 'Economic Terrorism' It's your move, America. That was the message from China's Ministry of Commerce spokesman, who said trade talks hinge on the U.S.'s "attitude and sincerity," and that the country's "various tricks" have escalated tensions. Another official accused the U.S. of "economic terrorism." Threats from Trump and his unpredictability coupled with a slowing economy have left the Chinese looking for a way to "fight without severing relations," and have left at least one of the country's major companies rethinking U.S. deals. Too Big a Threat Huawei poses too big of a threat to Canada and should be banned from its 5G network, according to Rogers Communications. The Canadian government is still mulling whether to ban Huawei from its 5G telecommunications system due to potential security challenges. Trump and Theresa May plan to discuss the Chinese telecom giant, which the U.S. has blacklisted, during his state visit to London next week, a U.K. official said. HSBC Job Cuts HSBC plans to eliminate hundreds of investment banking jobs in a drive to cut costs, people familiar said. At least 500 roles could go within global banking and markets starting as soon as mid-June. It's the latest stage in the bank's "Project Oak" revamp, which includes a centralized cost budget that should encourage managers to make aggressive reductions. Rate Cut Coming? The U.S. economy is solid but the Fed is watching for signs of further slowdown, said Vice Chairman Richard Clarida, signaling a possible rate cut. U.S. GDP was revised down to an annualized 3.1%, consumer spending grew the slowest in a year, and initial jobless claims rose by 3,000. Asian equity futures are up after U.S. stocks meandered before closing slightly positive. Uber Beats In First Report Uber beat sales estimates in its first report since going public. First-quarter sales came to $2.76 billion, near the high end of preliminary results and just above the consensus forecast. Its $1.01 billion loss in the period, also in line with previous numbers, was larger than that of rival Lyft for all of 2018. The ride-hailing company didn't issue a forecast. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what David's interested in this morning Just two months ago, a China Beige Book report concluded that China's economic recovery in the first quarter was unmistakable. Well, they were right. The recovery just didn't last beyond Q1. To be clear, I'm not calling out the guys at CBB, nor am I sounding out the many other economists who thought the same way. It did feel like China had bottomed. In hindsight, perhaps the lessons here are not to confuse stability with recovery and that sovereign bond markets were correct to assume a sustained recovery was a low probability event. Yields have pretty much gone in one direction since November: Down. Anyway, here we are.  The earliest of early indicators signaled that May was worse than April, which was in turn worse than March, and today's Purchasing Manager's Index is forecast to show a return to contraction territory. On markets, unless global stocks rally an improbable 5.5% these next 24 hours, we'll will clock the first monthly loss of 2019. Happy Friday. You can follow Bloomberg TV anchor David Ingles on Twitter at @DavidInglesTV. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment