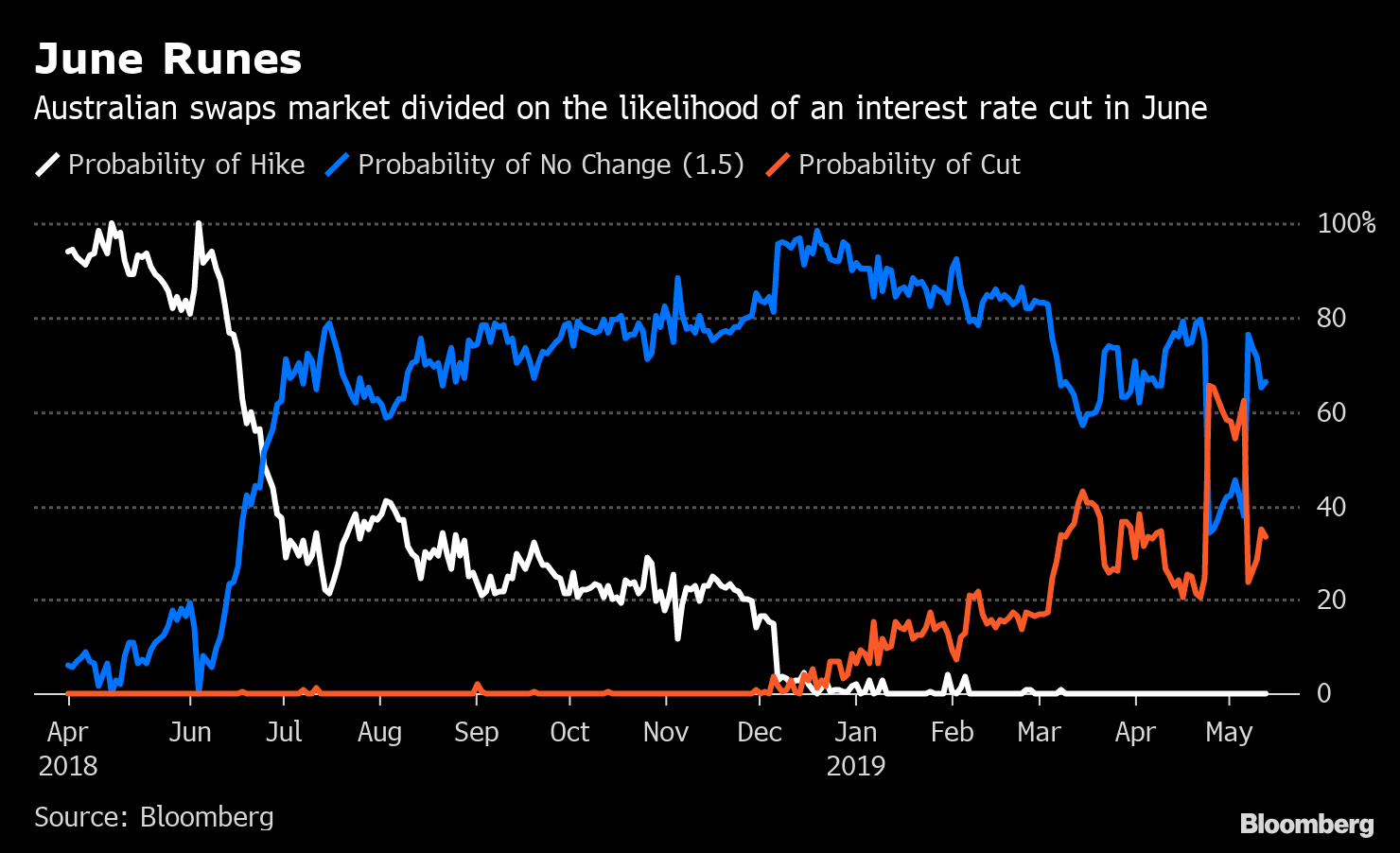

| U.S. stocks plunged after China hit back at Trump, and Asian futures indicate the selloff is far from over. Uber's skid continues and Duterte's allies lead in the Philippine Senate vote. Here are some of the things people in markets are talking about today. Equity Plunge Continues U.S. stocks tanked after China retaliated to increased American tariffs with levies of its own, sending the Dow down 617 points. And the equity selloff looks likely to continue, Asian futures show. Treasuries pared gains a tad after Donald Trump said he'd meet Xi Jinping at the G-20 summit in June, though 10-year yields were still down almost 7 basis points. The dollar rose against most of its major peers, but the yen and franc jumped on haven buying. Oil dropped and gold gained. Targeting The Heartland Trump warned China against "substantial" retaliation. This after Beijing announced plans to raise duties to 25% on 2,493 U.S. goods, defying Trump's warning to resist escalating the trade war. The president predicted China would attempt to target U.S. farmers, a mainstay of the president's political support. Goldman says the spat will lead to inflation and a slowdown in the U.S. economy. Here's what banks think will happen in the U.S.-China negotiations, and here's how we got to this point. Transatlantic Tensions Transatlantic relations aren't too smooth at the moment, either. The EU is finalizing a list of American goods to target with retaliatory levies in the event that Trump imposes tariffs on car imports, trade chief Cecilia Malmstrom said. He's expected to make a decision by May 18. Shares of European automakers have already been hit. Here's our list of other industries doing business with China that could face further pain. Duterte Allies Lead in Philippine Vote Allies of Philippine President Rodrigo Duterte are leading in an early count of the Senate vote, after the country's citizens went to the polls on Monday to vote in elections covering more than 18,000 government positions, including half of the 24-seat Senate. Nine of Duterte's allies are among 12 leading senatorial candidates, based on latest poll body data with 0.4% of the votes counted. The vote was marred by hundreds of malfunctioning machines and dozens of arrests for suspected vote buying, although violence eased compared with the 2016 vote, police chief Oscar Albayalde said. The Rideshare Debacle Uber's skid continued. Shares shed another 11% as investors questioned the size of the ride-hailing market, its ability to execute on food delivery, and its push into autonomous cars, according to Wedbush. Meanwhile, CEO Dara Khosrowshahi reminded employees that Facebook and Amazon also faced difficulties after listing. One place Uber has succeeded? Spawning offshoots. There are 34 companies created by former employees, many more than young Amazon, Google and Facebook produced. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what Cormac's interested in this morning In a week overshadowed by the reignited U.S.-China trade war, Asian traders are still likely to turn their focus Down Under on Thursday, with the release of the latest Australian employment numbers. Jobs are key in determining the next action of the Reserve Bank of Australia, which opted against easing policy May 7 as it waits to see whether the persistent hiring strength of the past two years is maintained.  The probability of a rate cut at the central bank's June meeting has swung wildly in recent weeks, thanks to a combination of commentary from the RBA and mixed economic data. It was about 34% on Monday. Traders should brace for more volatility around the labor data, particularly if the unemployment rate comes in either side of the 5% market expectation. Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment