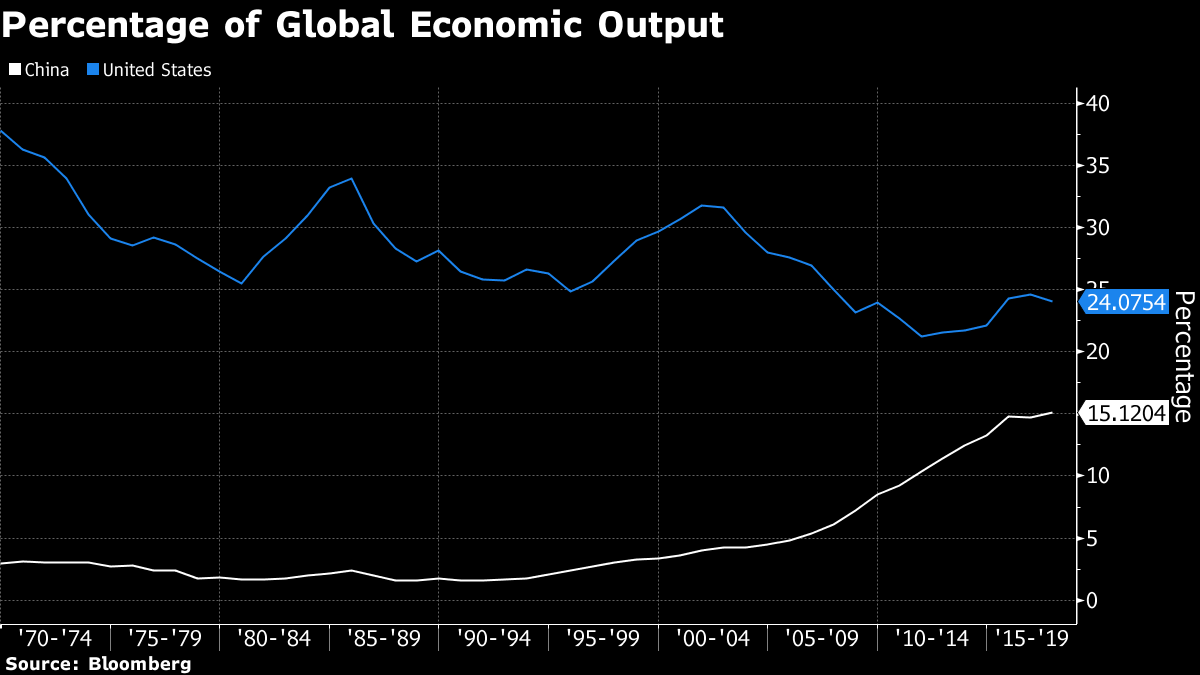

| Modi set to win India election, back to business after Australia's surprise vote, and simmering trade tensions focus for markets. Here are some of the things people in markets are talking about today. India's Modi Set for Return Prime Minister Narendra Modi is likely to triumph in India's general elections and may even win an outright majority. Exit polls released Sunday night show his Bharatiya Janata Party-led National Democratic Alliance will win between 267 and 350 seats in India's 543-seat parliament, likely well above the 272-seat majority mark. He will be returning to power at a time when the world's fastest-growing major economy is facing a jobs crisis and a struggling rural sector. The focus now turns to whether Modi can kick-start consumer spending, alleviate farm distress and create employment opportunities, said Ajay Bodke, the chief executive officer of portfolio management services at Prabhudas Lilladher Pvt. Australia's Election Shock Australia's center-right government is getting straight back to business after its surprise election victory, pledging to pass signature tax cuts to shore up a slowing economy. Just hours after Prime Minister Scott Morrison claimed the biggest come-from-behind win in decades, his Liberal-National coalition said it aimed to deliver tax relief for about half of Australia's 25 million people when parliament reconvenes, perhaps as soon as next month. The Australian dollar jumped as much as 1%. Market Open Asian equity futures were narrowly mixed after U.S. stocks closed lower Friday, marking the second week of declines on the back of China trade pessimism. Treasury yields were little changed and oil fell Friday. The New Zealand and Australian dollars were higher Monday. Coming up this week, the FOMC releases minutes from its latest meeting and Federal Reserve Chairman Jerome Powell speaks at a financial markets gathering. The Reserve Bank of Australia publishes minutes from its latest meeting on Tuesday, the same day Governor Philip Lowe speaks, amid increasing anticipation of an interest-rate cut. The European Central Bank also publishes the account of its April meeting. There's a slew of U.S. data, including home sales and manufacturing. Japan has GDP, trade and CPI. More Headwinds for China's Battered Yuan China's yuan, already battered by the U.S. trade dispute, will soon have a catalyst for further depreciation. Offshore-listed Chinese companies will sell the yuan to buy foreign currencies and fund their $18.8 billion dividend bill due from June to August, according to Bloomberg calculations. While that's less than last year's $19.6 billion, the payments come at a sensitive time: the yuan is at its weakest this year and speculation is mounting it will fall to 7 per dollar, regarded as a key psychological level. Trump's Iran Warning President Donald Trump warned Iran not to threaten the U.S. or it will face ruinous consequences, as tensions mount between Washington and Tehran. The U.S. hastened the deployment of an aircraft carrier to the Persian Gulf and withdrew some diplomatic personnel from Iraq in recent weeks after saying intelligence showed a growing threat toward U.S. forces or commercial shipping by Iran or its proxy forces in the Mideast. Both sides said they are not looking for confrontation. What we've been reading This is what's caught our eye over the last 24 hours. And finally, here's what David's interested in this morning I've been anchoring our shows from our studios here in Beijing from late last week. While we were moving around we managed to drive past some historic spots like the Forbidden City, Mao's Mausoleum, the Summer Palace and the Temple of Heaven. If you've seen them in person, these places are frankly intimidating, especially up close. You get an instant sense of China's mighty, glorious past. One of Beijing's key asks in trade talks (that we know of) is that the text of any future deal ensures the "dignity" of both nations. That's like code for China telling the U.S. "we've arrived." Many inside and outside the party want the country to be seen as a global superpower. Big ticket events and projects, from the Beijing 2008 Olympics and the 2010 World Expo in Shanghai, to today's Made in China 2025 and the Belt and Road initiative, are part of that coming out party (pun intended).  Alongside the current impasse in trade negotiations, some commentators are framing this as Trump's short game versus Xi's long game. The White House is looking to build momentum into the 2020 elections, while Beijing is looking at putting behind it events that date back to the 19th century. If you're not familiar with the concept of the "Century of Humiliation," I highly recommend reading up on it. It gives you a real, big picture perspective to the debate about which side needs this trade deal more. You can follow Bloomberg TV anchor David Ingles on Twitter at @DavidInglesTV. Even before Trump's trade war, China was the world's biggest story. It's reshaping the global economy — but its ascent hasn't come without major problems. Sign up to get Next China, a weekly dispatch on where the country stands now and is headed next. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment