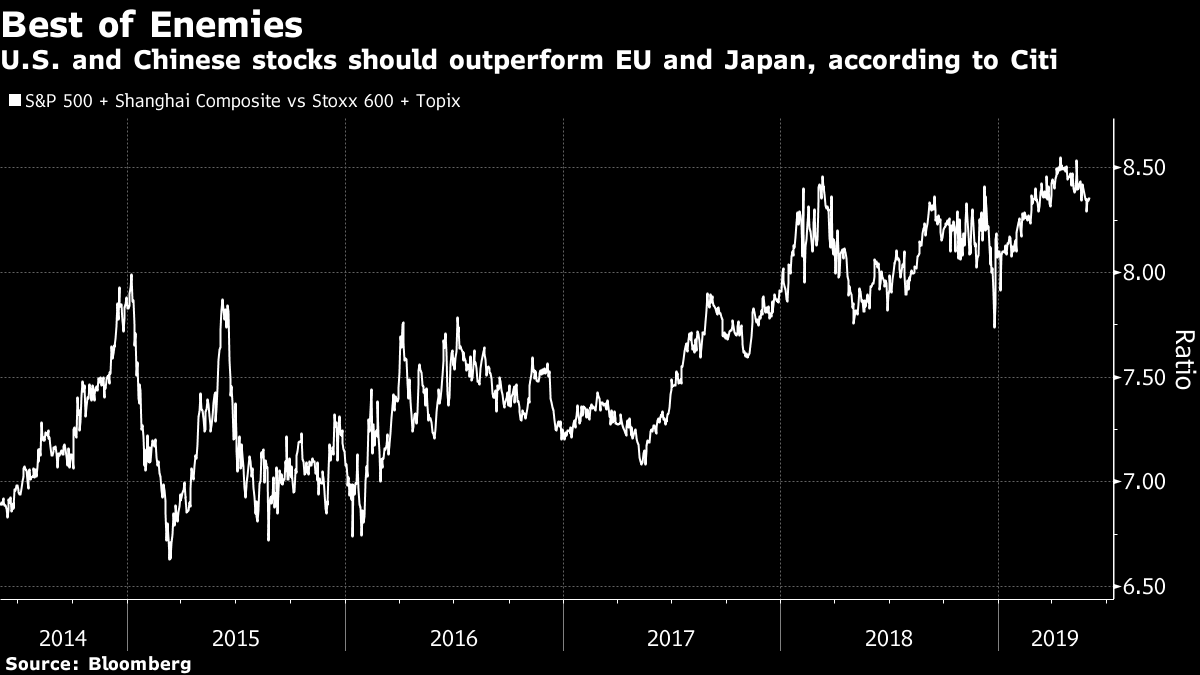

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Stocks fell suddenly as the White House dropped a tariff bombshell, Uber Technologies Inc. reported its first earnings since going public, Italian tensions are as high as ever and China's readying a rare earth retaliation. Here's what's moving markets. Tarifas President Donald Trump vowed to impose a 5% tariff on Mexican goods until that country stops immigrants from entering the U.S. illegally, jeopardizing a new North American trade agreement and sending the Latin American country's currency tumbling the most in months. There's plenty of European companies that will be concerned by the update, such as carmakers and brewers with production plants in Mexico and banks with Mexican exposure. Here's a handy listicle we did last year. Blindsided Asian stocks and U.S. futures tumbled on Trump's Mexico tariff surprise, while reports of Beijing's plan to restrict exports of rare earths to the U.S. if needed added to ongoing trade war angst globally. Data also showed China's manufacturing sector slowed more than expected in May. Elsewhere, keep an eye on the lira today after Turkey's currency surged Thursday on signs that President Recep Tayyip Erdogan is working to break a stand-off with the U.S. over the planned purchase of a Russian missile defense system. Uber Loss It's not every day that a company reports a billion-dollar loss. Even less are such reports welcomed by the market. But Uber shares edged up in after-market trading, as the ride-hailing giant's first update as a public company was deemed better than some had feared ahead of the event. A statement that the tech firm will cut back on customer promotions and that marketing expenses as a proportion of revenue should decline soon was also well received. The stock had been languishing since trading began earlier this month. Mamma Mia Bond yields have been sliding in recent weeks but not so much in Italy, as tensions between Rome and Brussels simmer. Today's the deadline for the southern European nation to explain its rising debt load, but it's set to push back, citing near-zero inflation and global trade tensions for its rising debt-to-GDP ratio. Meanwhile, populist Deputy Prime Minister Matteo Salvini has told his party he's ready to see the coalition collapse if he can't push through tax plans. Coming Up... With much attention on Italy, watch out for its latest inflation numbers and a final reading of first-quarter growth. There's also consumer price index numbers from Germany to look out for, and a confidence reading from the U.K., while central European airline Wizz Air Holdings Plc is looking lonely on today's earnings schedule. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Cormac Mullen is interested in this morning The U.S. and China may be on opposing sides of the recently re-ignited trade war, but Citigroup Inc. still see a combination of the two nation's stocks outperforming those from Europe and Japan. U.S. shares benefit from the so-called Fed and Trump puts, even though they haven't really priced in a deterioration in the trade spat, wrote analysts including Jeremy Hale in a note Thursday. Chinese stocks can benefit from China adding stimulus to buffer its economic vulnerability, they said. Conversely, Euro-zone shares lose points due to the lack of desire for any sort of fiscal loosening in the region, and Japanese stocks are stymied by the lack of monetary policy space in Japan. Structurally both markets remain ``Japanified'' given stagnant financial sectors and zero room for policy maneuver, according to Citi. Both European and Japanese shares have underperformed their U.S. and Chinese counterparts this year, with benchmarks rising around 10% and 2% respectively versus about an 11% and 17% rise for the latter pair.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment