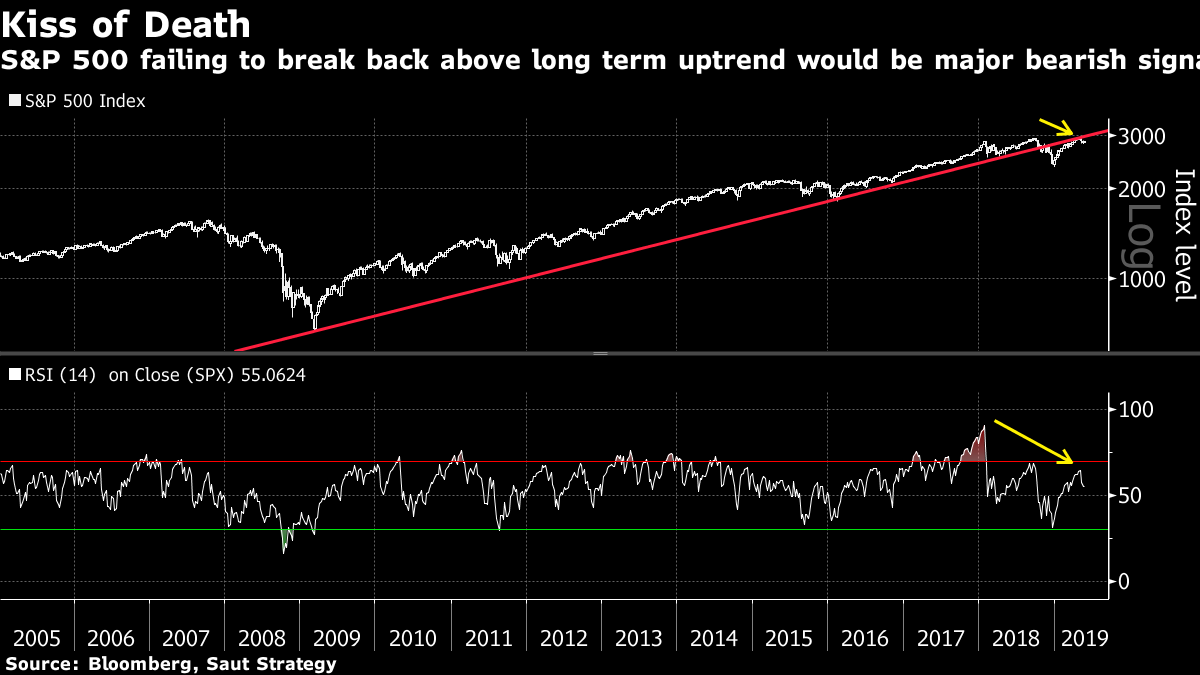

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. Theresa May is hanging on by a thread, the Federal Reserve is being very patient and the world is awaiting a full-blown response from China on trade. Here's what's moving markets. Chaos Speculation was rife that Prime Minister Theresa May could be pushed out of her job by Wednesday but she has remained steadfast even in the face of near certain defeat for her deal. Her job is hanging by a thread and was put under further pressure when Andrea Leadsom, a high-profile pro-Brexit Cabinet minister, resigned. Pound investors are bailing out of the currency as the uncertainty about who will be running the country, and indeed who will handle further negotiations with the European Union, increases exponentially. And it's all happening just as European Parliament elections begin. Be Patient One could have surmised this from the cavalcade of Federal Reserve board members who have spoken over the course of this week, but the central bank's meeting minutes confirmed it intends to stay in wait-and-see mode for some time. Staying patient on the rate path for "some time" is how the bank intends to proceed, resulting in limited impact on markets. New York Fed President John Williams had already said there is no strong argument for moving rates in either direction right now, while central banks are facing calls to hike inflation targets in unison. The Response The week has been dominated by the U.S. ratcheting up tensions with China, putting various companies onto blacklists and hobbling their international appeal. China's response is increasingly the focus as a full-blown trade war becomes the baseline assumption rather than just a risk. Goldman Sachs Inc. thinks the odds of a continued stalemate are high. The EU is also waiting to get into trade talks with the U.S., but isn't sure the latter is ready for that yet. The trade war has, however, put the dollar back on its throne. The State of Autos An auto industry health check is probably in order. At first glance, it's not great. The number of jobs slashed by big carmakers in the past six months has hit around 38,000 and counting, with Daimler's outgoing boss warning deep savings will be needed to gird the industry for the huge upheaval of shifting to electric and automated vehicles. Taking much of the attention in the industry is still Elon Musk's Tesla Inc. It has had a torrid week dominated by bearish analysts who are now branding the electric car firm a "restructuring story." Perhaps not what an investor would want to hear when the industry is mired in this kind of existential crisis. Coming up... Investor concerns about trade tensions increased once more and have sent Asian shares lower. European futures are pointing to a weak open, too, and oil is falling on higher U.S. inventories and those trade jitters. Minutes from the European Central Bank's latest policy meeting are due, along with euro area PMIs, German GDP and a rate decision from South Africa for emerging market watchers to pore over after its inflation missed target and it officially elected its president. Indian election results are also pouring in and have sent local stocks to highs. What We've Been Reading This is what's caught our eye in the past 24 hours. And finally, here's what Cormac Mullen's interested in this morning The rally in U.S. stocks needs to get back on track soon or it risks ending. That was the message from Saut Strategy's Andrew Adams this week, who said a failure to rise back above its long-term trendline soon would be a major bearish signal for the S&P 500 Index, in a note to clients. The technical strategist's warning should have investors across the world eyeballing their charts, as bad news for American shares is bad news for global shares -- regardless of any theories they could decouple. The benchmark U.S. gauge "kissed" the underside of its uptrend earlier this month before retreating, and the weakening upside momentum seen in its relative strength indicator is a negative sign, Adams wrote. These are potentially two major bearish signals and it's important U.S. stocks make new highs again soon, he said. With the S&P 500 about 3% below its all-time high, investors will be hoping there is enough juice left in the rally to push it through the wall of worry raised by the renewed U.S.-China trade war.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment