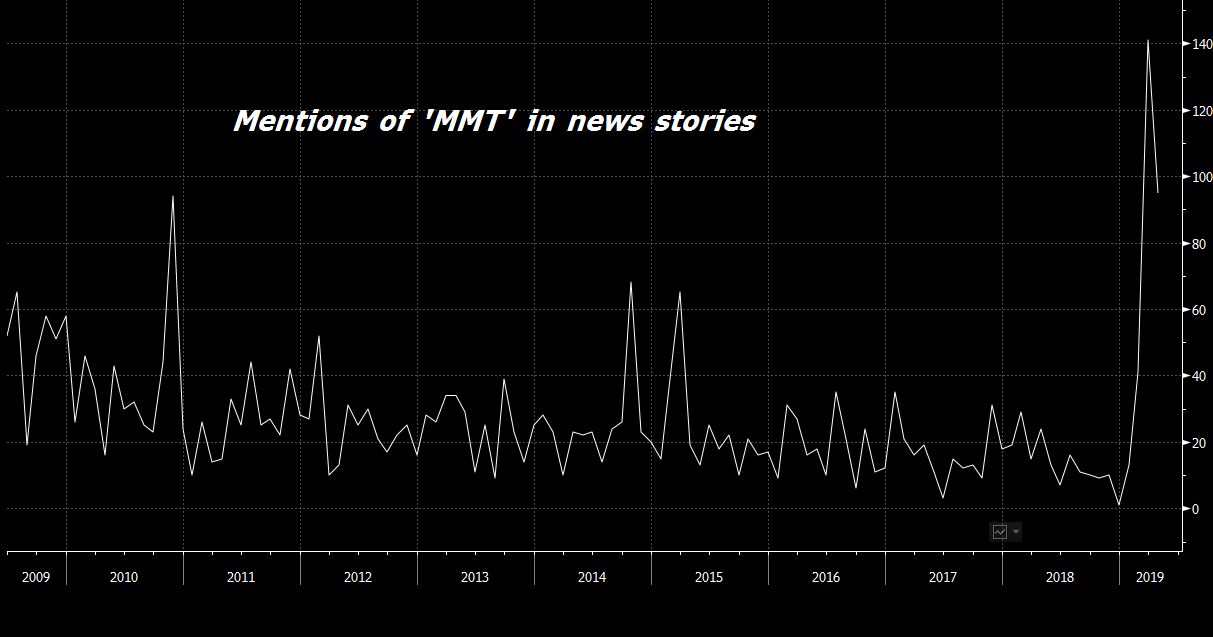

Trade talks are not going well, markets drop, and sabotage near the Strait of Hormuz. Weekend hangoverWhatever hopes existed for a breakthrough on trade between the U.S. and China were dashed over the weekend as both sides seemed to harden their positions. President Donald Trump doubled-down on his claim that Beijing "broke the deal," while Chinese state media blamed him for the impasse and emphasized the Asian nation's economic resilience. Optimism for a solution to the standoff in the near term is disappearing. U.S. officials are expected to announce details of their plans to impose a 25% additional tariff on all remaining imports from China later today, while the Asian nation's response is still awaited. Larry Kudlow, Trump's top economic adviser, said on Sunday that no further talks had been scheduled. Markets fallThe worsening outlook for trade is hitting global equities. There was no sign of the plunge-protection team in China overnight where the Shanghai Composite Index closed 1.2% lower. The region's MSCI Asia Pacific Index dropped 0.7%, while Japan's Topix index closed down 0.5% as yen appreciation added to pressure on exporters. In Europe, the Stoxx 600 Index had declined 0.5% by 5:45 a.m. Eastern Time, while S&P 500 futures pointed to a sharp drop at the open. The 10-year Treasury yield was at 2.426% and the dollar advanced. SabotageSaudi Arabia said two of its oil tankers were attacked as they approached the Strait of Hormuz, the world's most important choke point for crude shipments. The precise nature of the attacks, which also targeted cargo vessels, remains unclear. The incident comes at a time when tensions in the region are rising as relations between Iran and the U.S. continue to worsen in the wake of increased sanctions and military deployments to the Gulf. Brent crude futures rose as much as 1.9% in London this morning. Auto newsUber Technologies Inc.'s second day of trading is likely to be volatile after the company's debut saw shares close well below the IPO price. The weak earnings reported by the company's main rival Lyft Inc. and the wider market selloff mean that the biggest public offering of the year may continue to struggle. Elsewhere in the auto world, Nissan Motor Co. is opposing renewed efforts by Renault SA to merge because the company thinks the proposed structure will not help revive its fortunes. This time lucky?President Trump is developing something of a track record in not seeing his potential nominees to the board of the Federal Reserve make it through the Senate. The latest name on the list of potential picks for one of two vacancies at the central bank is conservative economist Judy Shelton, who has served as an informal adviser to the president. In other Fed news, Boston Fed President Eric Rosengren, Fed Vice Chairman Richard Clarida and Dallas Fed President Robert Kaplan are all speaking today. What we've been readingThis is what's caught our eye over the weekend. Want the lowdown on European markets? Get the European edition of Five Things in your inbox before the open, every day. And finally, here's what Joe's interested in this morningDespite the robust economy, the U.S. budget deficit has exploded under the Trump administration. That hasn't stopped Republicans from attempting to position themselves as the party of fiscal restraint and Democrats as the party of unchecked government spending. Republicans on the House Budget Committee want to hold a hearing on the dangers of Modern Monetary Theory (MMT), the prominence of which has exploded in recent months and which argues for a rethink of deficits. I'm not sure how unusual it is for politicians in DC to hold hearings about an economic theory, but there are two things that come to mind here. One is that at its core, MMT attempts to be a descriptive framework that characterizes the monetary system as it currently stands. There's no such thing as "doing MMT" or "implementing MMT" per se. That being said, MMT adherents do argue that one implication of their work is the government should be more aggressive in its use of fiscal policy, and less reliant on monetary policy, in order to stabilize the economy and achieve full employment. Others have argued for this as well, which gets to the second point: The MMT packaging has been incredibly successful. There are all kinds of criticisms of the theory (of varying validity), but the bottom line is that as a political project to change the way people think about deficits, MMT has made astonishing headway. So much so that the folk in DC feel so defensive that they need to hold hearings about it.  Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment