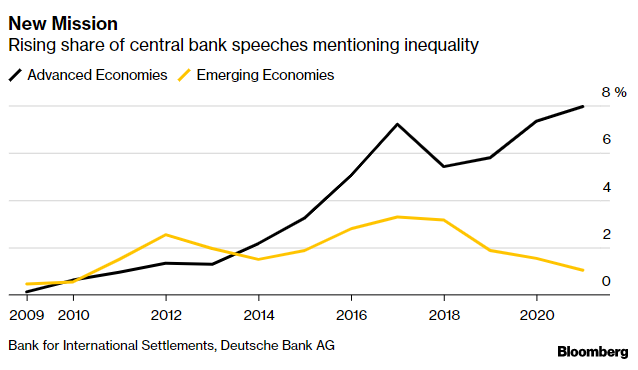

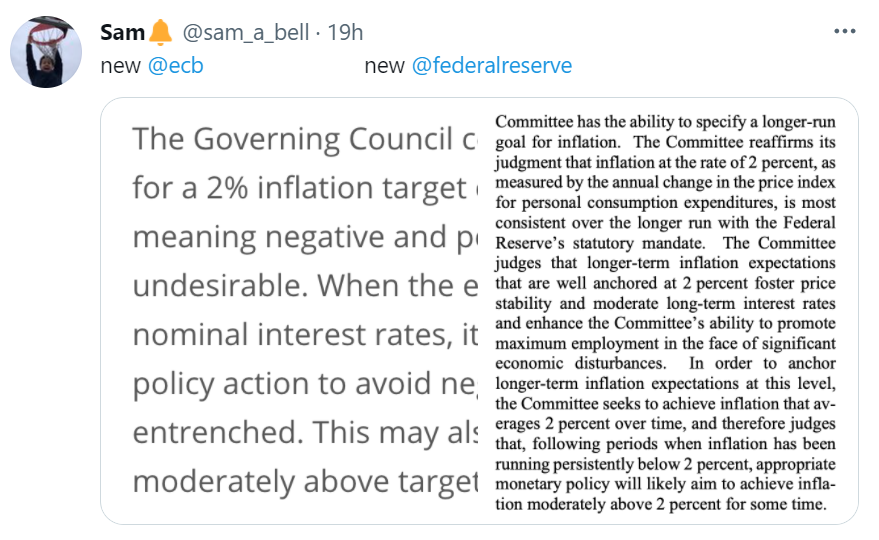

| Hello. Today we look at the broadening scope of central banks, Hong Kong's unequal recovery and food prices. As for tomorrow, Andrew Browne is on vacation this week, so New Economy Saturday will return July 17. Mission CreepThe expansion in the scale and scope of action by central banks to prop up major economies during the pandemic — unprecedented in the modern era — has proved so successful it's contributing to the most sweeping rethink of their role in decades. As the crisis recedes, many policy makers favor keeping their expanded role in shaping economies and even broadening it further to incorporate social goals such as climate change and curbing inequality, Craig Torres and Michelle Jamrisko write.  The sustained low inflation seen across the globe since the turn of the century has allowed central banks to abandon the austere technocracy of the 1990s, when central bankers stood apart from governments and often leaned against them with inflation-fighting policies. The Federal Reserve has incorporated a more expansive definition of full employment, helping to address higher unemployment among minority groups. The Fed also last year joined the Bank of Japan in allowing for an overshooting of its 2% inflation target, with the European Central Bank following suit this week. The ECB has additionally incorporated climate change into its policy framework. The BOJ next week is set to unveil a climate-focused lending initiative. And all three, along with counterparts around the world, are continuing to snap up major shares of government debt issuance as fiscal policy makers expand safety nets. Benefits from more active central banks could include higher sustained employment over time, along with greater progress on nurturing green finance. But some caution that a greater political role could make it harder for monetary policy makers to tighten their stance in the face of escalating inflation or asset-bubble risks. Says Taimur Baig, the Singapore-based chief economist at DBS Bank Ltd. who previously worked at the IMF: As central banks move "deeper into the fiscal sphere," there's the risk that they become "paralyzed if they fear market and political repercussions from selling bonds."

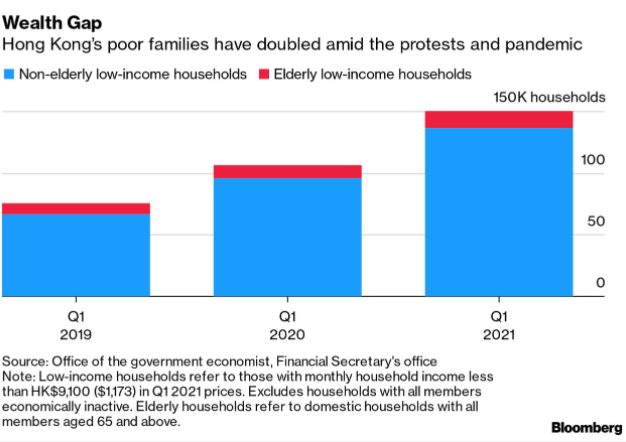

—Chris Anstey The Economic Scene Hong Kong's emerging recovery from recession fueled by the pandemic and political protests is throwing into stark relief the deepening wealth imbalances between the city's working class and elite. The economy's return to growth in the first half of the year has been led by a combination of resurgent trade, property prices back to near record-highs in the world's most expensive housing market, and a resilient financial services industry backed by a surge in initial public offerings. Yet the city's tourism, consumer and services industries, the biggest employers of many of Hong Kong's working class, remain constrained by pandemic restrictions, and have likely suffered permanent damage waiting for borders to reopen. Today's Must Reads - China cuts | China's central bank cut the amount of cash most banks must hold in reserve in order to boost lending in the economy as growth starts to wane.

- More cautious | The ECB took a step in the Fed's direction with its new inflation target of 2%, while stopping short of a similar commitment to let the economy run hot after a recovery.

- Recovery roadblock | India's risk-averse lenders are emerging as one of the biggest hurdles to the nation's recovery as they hold back credit when the economy needs it the most.

- Prices peak | China's factory inflation peaked and started to ease in June as a stronger dollar and government measures helped to cool commodity prices. That relieves a pressure on global prices too.

- Latin America | Peru's central bank signaled monetary tightening may be closer, echoing a theme elsewhere in the region as inflation accelerates.

- Beefing up | The International Monetary Fund neared final approval to create a record $650 billion of new reserves in a move that'll boost its ability to help poorer nations.

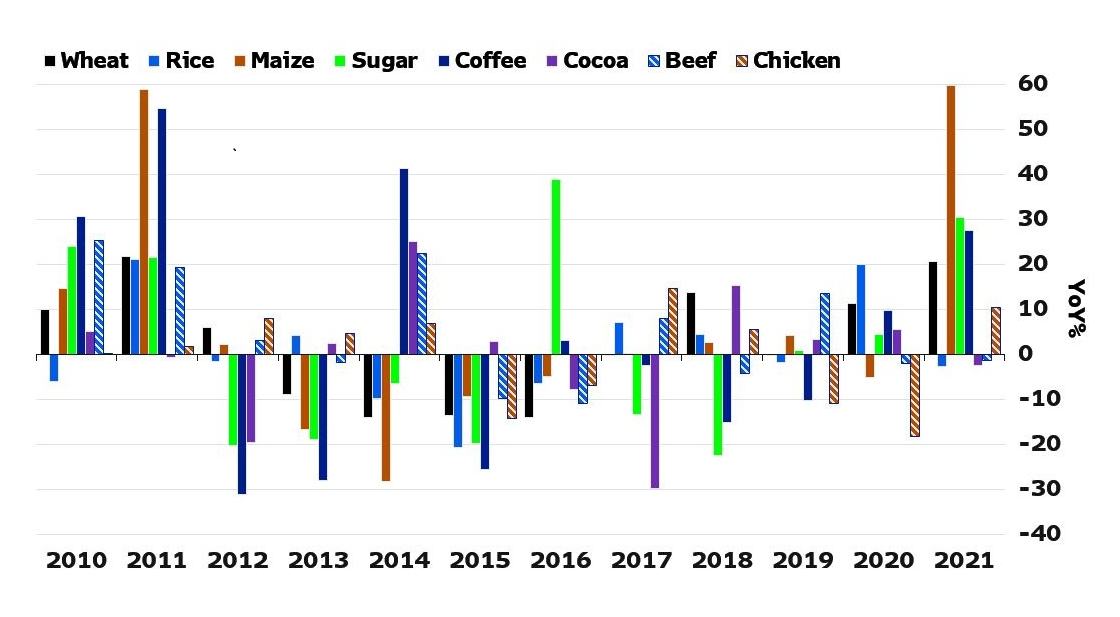

Need-to-Know Research International food prices have risen close to their 2011 peak. Ten years ago, they triggered waves of protests, especially in the Middle East. The region is still exposed today, but its weakest links are Sudan and Lebanon instead of Egypt and Tunisia. Large economies (Brazil, China and Russia) and wealthy hydrocarbon producers (Qatar, Saudi Arabia and the UAE) are the least exposed to higher food prices. Read the full research on the Bloomberg Terminal by clicking here On #EconTwitterA tale of two central banks…  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment