| Fiscal Fizzle The on-again/off-again stimulus deal has reached a new level of urgency. Earlier this week, after President Trump tweeted that the talks were off, it looked like the next U.S. government aid package was penciled in for sometime after Infrastructure Week on the calendar in Godot's waiting room. (We know there's no waiting room. But give us a break, it's been a long year.) Now, who knows. Clearly at least some investors had assumed a deal was still possible before the election. On the president's surprise announcement Tuesday, the S&P 500 slumped and the dollar rallied. But the equity index has more than recovered that loss, and the 10-year Treasury yield dipped only temporarily. The gradual climb in long-end yields this month could be a trifling side-effect of supply, as the market's absorbed more 10- and 30-year auctions. But it seems to have legs: These yields are hovering around four-month highs, and the gap between five- and 30-year yields stretched to 125 basis points Monday, marking its widest close since December 2016. Moreover, BMO's strategists pointed out that Thursday's sale of 30-year bonds tailed -- meaning it came cheaper than the prevailing market rate -- for the sixth time in the last eight offerings.  The rebound in yields and equities also seems backed by a conviction that more fiscal help is on the way (if we set aside the solid point that the stock market index is a heavily distorted reflection of what's going on in the real economy). Investors may be taking heart from the president's more-recent assurances of piecemeal stimulus, and the prospect of restarted talks between Treasury Secretary Steven Mnuchin and Nancy Pelosi. Alternatively, or perhaps additionally, they're banking on a more-generous package after the election. That view is tied, somewhat brazenly, to polls showing rising odds of a Democratic sweep -- a scenario that Credit Suisse's Jonathan Cohn is calling, at least for now, the "more dominant narrative." If this expectation of a delayed spending surge is the driver, it's a pretty big punt. First, it's unclear how long that delay might be, but it's not hard to imagine circumstances in which it could drag into the new year. In the meantime, large employers from the airlines, to cinemas, to hotel chains have already flagged that they're facing significant layoffs. "If there's an election result where there's a standoff and you can't get an agreement through, or it's just too little too late, that's the pain trade," said Charles Schwab's Kathy Jones. That would mean a flatter yield curve and a shakeout in the high-yield credit sector and other riskier segments of the market: "They'd have to lean more heavily on the Fed and frankly the Fed's used a lot of its bullets." Central (B)Angst And indeed, central bankers are publicly wringing their hands -- not a good sign. Boston Fed President Eric Rosengren put it plainly on Bloomberg TV Thursday: "There's a limit to how far we can push the 10-year Treasury rate or the mortgage-backed rate down.... That's not to say we shouldn't do it. It just says the magnitude of the impact, when rates are already so low, is probably much less than what we want, which is why I think you're hearing Federal Reserve speakers call out for more fiscal policy." The minutes from September's Fed meeting, released this week, showed that the relatively sanguine tone and economic projections were based on some assumptions of fiscal help. Many participants noted that "if future fiscal support was significantly smaller or arrived significantly later than they expected, the pace of the recovery could be slower than anticipated." So this is an uncomfortable juncture for the Fed, as the minutes also showed divisions on balancing the need to preserve flexibility in their next steps with providing more detail on what would change their stance, including on asset purchases. Kansas City Fed President Esther George went on record Thursday with her view that policy makers ought to be more transparent with their intentions for the bond-buying program.

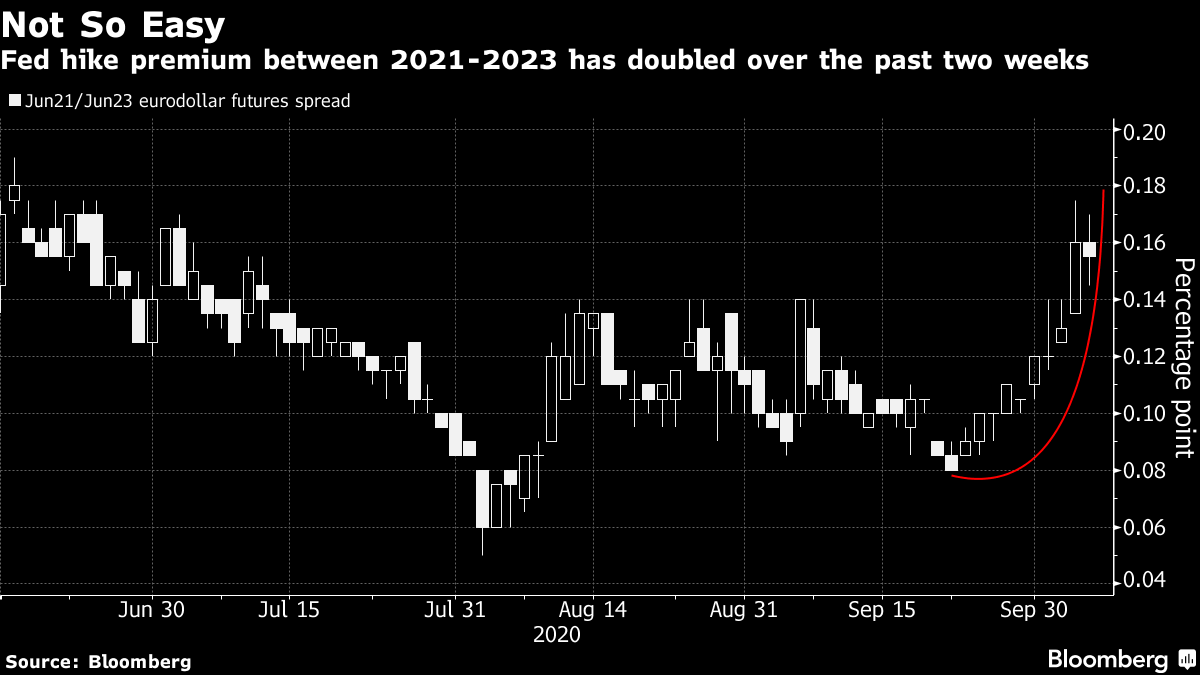

If the Fed is left holding the stimulus bag for a while longer, pressure will mount for further action in November's meeting, which starts the day after the election, running Nov. 4-5. The widely anticipated step is for the Fed to announce a shift in the composition of its purchases to favor longer-dated issues, which would weigh on those rates further out the curve. And if that is next month's decision, members might also have to steel themselves to elaborate on how long their policy rate will stay at the zero bound. Last month, the Fed said that would be until the labor market reached maximum employment, and inflation reached 2% -- and was on track to moderately exceed that goal for some time. There's a lot of wiggle room in that statement, particularly since the Fed's just jettisoned its former yardstick for full employment. Coordination of rates- and asset purchase policies is crucial, says former Fed official Roberto Perli. He tweeted this week that "rate hike expectations rose sharply" after the first and second iterations of quantitative easing starting in 2008 and 2010, respectively, because forward guidance wasn't strong enough. He contrasted that with a steadier fed funds outlook post-QE3. That program was accompanied by a commitment to keep rates on hold until "well past the time that the unemployment rate declines below 6.5%, especially if projected inflation continues to run below the Committee's 2% longer-run goal." That guidance may be more necessary than it seemed only a few weeks ago. Our rates reporter Edward Bolingbroke has seen more bets springing up in Eurodollar markets for an earlier-than-anticipated Fed "lift-off." Since late September, the rate-hike premium priced between 2021 and 2023 -- expressed by the Jun21/Jun23 eurodollar futures spread -- has more than doubled to around 19 basis points (three-quarters of a 25 basis point rate hike) from roughly 8.  Whither Credit? Meanwhile, those companies that can access the U.S. markets in the weeks remaining before the election are milking it for all they've got. As our credit reporter Caleb Mutua points out, sales of both investment-grade and high-yield corporate debt hit full-year records in the third quarter in the race to capitalize on unprecedented Fed support. But the central bank's limitations aren't lost on bond giant Pimco (at least not with the likes of former Fed Chair Ben Bernanke and more recently the Bank of England's Mark Carney among their advisors), our Tasos Vossos reported this week. Global economic advisor Joachim Fels said investors should know that policymakers can't shield them from losses if a pandemic-fueled corporate borrowing spree spurs a surge in defaults. He pointed out in Pimco's October secular outlook that the transition to renewable resources could help accelerate attrition across the credit spectrum. "With corporate debt much higher now and the transition from physical to digital and from brown to green creating many losers, we may be heading into a default cycle," Fels said. "Central banks cannot protect investors from defaults and capital impairment." After all, despite investors' enthusiasm for the Fed backstop, which has helped drive spreads sharply tighter over recent months, the Fed hasn't proven as ready as some might have hoped to leap into the fray at the first signs of a shakeout. The central bank kept to the sidelines as spreads widened at the end of last month. "Despite being a major milestone when it was first announced, the corporate credit facility has not had to do too much heavy lifting in terms of actually purchasing bonds," wrote Jefferies economists Aneta Markowska and Thomas Simons.  This isn't news for the many investors whose appetite for corporate credit appears to have soured over the past month. Investors pulled cash out of exchange-traded funds tracking corporate bonds in September for the first time since the pandemic first upended markets in late February. Bonus Points Real yields are negative for $31 trillion of bonds This may change your mind about Modern Monetary Theory While we're on myth busters: Why are yields not rising as the U.S. debt pile mounts? Matt Levine is the story Stop eating octopuses. |

Post a Comment