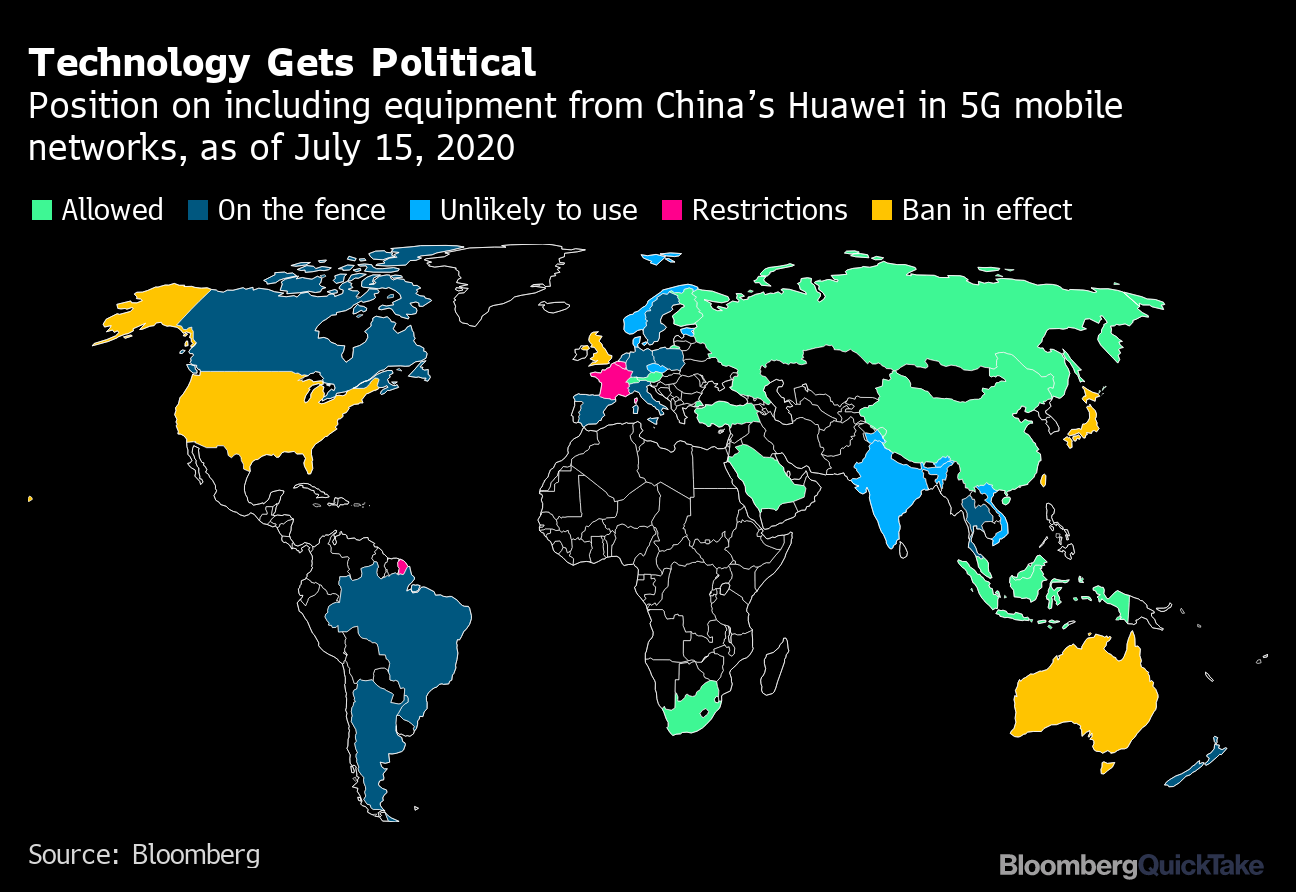

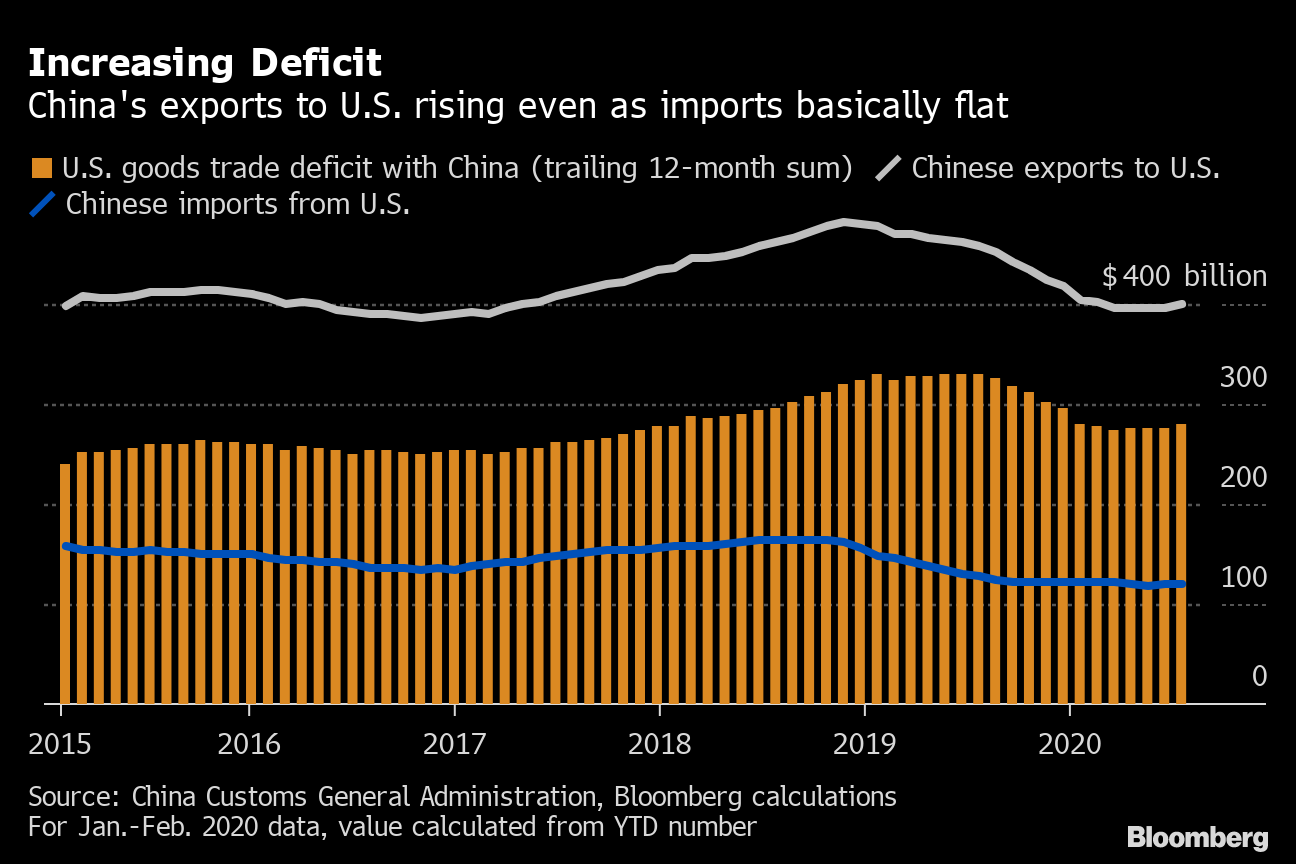

| Life got a lot harder for Huawei this week, and the potential fallout from the U.S.-China tech war substantially more destructive. Washington's assault on the Chinese technology giant has been a multi-year campaign. It has included requesting the arrest of Huawei's chief financial officer, prosecuting the company for racketeering, and lobbying U.S. allies to ban its gear from their telecommunications networks.  The most-damaging prong of the attack, however, has been America closing Huawei's access to semiconductors. And on that front, there's been a substantial escalation. Washington first barred Huawei from buying America technology, including chips, in 2019. It didn't take long for suppliers to find a loophole though. A rule exempting goods that are 75% produced outside the U.S. allowed companies such as Micron Technology to continue selling to Huawei. U.S. authorities, over the protest of American suppliers, ultimately closed that loophole in May of this year by expanding its ban to include chips made using American equipment. With gear from U.S. companies such as Applied Materials and Lam Research ubiquitous across the semiconductor industry, it significantly ratcheted up the pressure on Huawei. But again, there appeared to be a loophole. Washington's restrictions seemed to leave room for Huawei to buy chips made by non-American companies such as Mediatek. Indeed, shares of the Taiwanese chipmaker surged on speculation that a wave of Huawei orders were on the horizon. Until this week, that is. That's when the U.S. expanded its restrictions to include chipmakers based anywhere in the world that use American software or equipment to produce semiconductors. Shares of Mediatek and other Asian chipmakers plunged on the news. In explaining the consequences of this latest action, Jefferies analysts including Edison Lee wrote in a note to clients that closing this loophole "puts Huawei's survival at risk." Such an outcome would have profound implications for Beijing's relationship with Washington. U.S. actions that stunt the growth of one of China's technology champions will inevitably deliver rancor and inflame tensions. American sanctions that put a Chinese technology champion out of business would seem to necessitate a different league of response. Canceled Talks Does President Donald Trump still want the phase-one trade agreement? It's an increasingly difficult question to answer. Trump this week said it was he who cancelled talks between Chinese and American officials to review the first six months of the deal. Addressing whether the U.S. might pull out, he said, "We'll see what happens." On one hand, that sentiment contradicts White House economic adviser Larry Kudlow's comments last week that trade with China was "fine right now," as well as news this week that officials from the two countries are trying to reschedule the talks Trump says he called off. It also seems contrary to China's moves to accelerate purchases of U.S. goods, most recently in the form of American oil. But on the other hand, China's purchases are way behind Beijing's obligations under the phase-one deal and America's trade deficit with China is starting to widen again. Trump of course is also trailing Joe Biden in most polls. The crystal ball is awfully misty at the moment.  Rectification One of the more-notable features of Xi Jinping's tenure leading China has been a continuous series of anti-corruption campaigns. The latest appears to be focused on the country's law enforcement agencies, with this week seeing the third senior police official placed under investigation since the start of 2020. The official Xinhua News Agency reported Tuesday that Gong Daoan, Shanghai's head of public security and a deputy mayor, is suspected of serious violations of party discipline and the law. That follows earlier probes against the police chief of the metropolis of Chongqing and a deputy minister for public security. Gong though was the first senior official investigated since China in July announced an "education and rectification" campaign to remove "tumors" from the country's justice system. He seems unlikely to be the last. Wounded Consumers China's economy is rebounding faster than any other from the shock of the coronavirus. That's the good news. What's worrying is that this recovery has taken place largely without the consumer. China's most-recent economic data, for example, showed that while industrial production increased 4.8% in July from a year earlier, retail sales fell 1.1%. This is partly the result of lingering fears about infection, which has prompted families to avoid eating out, going to the movies or taking a vacation. But it's also a reflection of the belt tightening undertaken by the millions who lost jobs or had their wages cut in the first half. Getting people to spend again has been and will be more challenging than restarting the country's factories. Without it though, it's hard to see how China's recovery can really start to gain momentum. Australian Wine The challenges presented by a more powerful and assertive China extend well beyond Washington. Australia, for example, got a fresh reminder this week of how precarious its situation is when Beijing kicked off an anti-dumping probe into its wine exports. The announcement quickly prompted questions about whether China was using trade to send a message. It wouldn't be unprecedented if it was. China has used commerce to similar effect against South Korea and Japan. And more recently, there's been plenty for Beijing to be upset with Canberra about. Australia has publicly expressed concerns about the national security law in Hong Kong, called for an investigation into the origins of Covid-19 and was among the first countries to ban Huawei from the roll out of its 5G network. But any backtracking by Canberra is also unlikely. That's obviously an unhappy cocktail for Australia's wine industry.  What We're Reading And finally, a few other things that caught our attention: |

Post a Comment